We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

“Dublin’s landlords would rather put their properties on Airbnb than rent to local families,” wails the strapline to an article by John Harris in the Guardian called “30,000 empty homes and nowhere to live: inside Dublin’s housing crisis”.

To give him credit John Harris has never been one to do all his reporting from a swivel chair in Kings Cross. He was one of the few Guardian writers to foresee a Leave victory in the EU referendum, having co-authored with John Domokos a well-regarded series of video and written reports from some of the most depressed parts of the UK. Now he is talking to people struggling to find somewhere to live in Dublin. Here is how he describes the situation:

For want of a flat with a secure tenancy, the two of them have lived here for almost two years, in what the Irish government calls a “hub”…

*

I pay £95 for a single night’s stay (including a £43 “cleaning fee”), which highlights why whoever owns it has decided to rent it out in this way. The same move has been made by scores of other landlords: in August 2018, there were reckoned to be 3,165 entire properties listed on Airbnb in Dublin, compared with only 1,329 available for long-term rent.

*

The city is smattered with key boxes for Airbnb apartments. A stock line among activists demanding action from the government gets to the heart of all this: in 21st-century Dublin, they say, homeless families stay in hotels, and tourists stay in houses.

*

To make things even more difficult, her landlord then decided to sell up, which forced her to suddenly confront a private-rented housing market in which the monthly rent for anything similar was well over €1,500 (£1,300).

*

I am sure this is all honestly reported. But I think Mr Harris might be failing to see what is in front of his nose. All else being equal, most landlords prefer long term tenants to short term ones. A nice steady sum arriving in the bank every month makes for an easy life – and for a relationship of mutual trust to grow between landlord and tenant. In contrast, short term lets carry many risks: that the tenants will not look after the place, having little incentive to do so; that they will get into arrears with the rent or skip without paying it, and, most obviously, that the property will sometimes be vacant and earning you no money.

When most of the landlords in a place are seen to flee the predictability of the long term market for the uncertainty of short term lets, or even more perversely for the sheer unrelenting work involved in “turning over” a property every few days for each new AirBnB customer, there is usually a two word explanation. I did not see those two words anywhere in Mr Harris’s article, though this sentence came close:

Central Dublin – along with 20 other areas of the country – is now classified as a “rent pressure zone”, which caps annual rent increases at 4%, but politicians and activists claim this gets nowhere near tackling the causes of skyrocketing housing costs.

The missing two words were, of course, “rent control”. I don’t know Dublin. I don’t know its housing laws. But as soon as I saw that line “For want of a flat with a secure tenancy” I knew that rent control was at the bottom of this story. And so it proved. It took me only a few keystrokes to find this report by Fiona Reddan in the Irish Times:

Will rent controls start to work in 2018?

That was written in January. It is now December. Judging from Mr Harris’s description, it looks like rent controls in Dublin “worked” exactly as rent controls usually do. If he had happened to read Ms Reddan’s prescient article from eleven months ago (I suppose it would be asking too much for him to have read Henry Hazlitt’s even more prescient words on rent control, written with reference to New York in 1961 but eerily applicable to Dublin in 2018), he might have had a somewhat better idea as to why the 4% cap on rent increases fails to tackle the causes of the crisis, as he sees it. Answer: it is one of the causes. Ms Reddan writes,

If you’re wondering why the much-vaunted rent controls, first introduced this time last year, are having so little impact on stalling price growth, consider this investor’s tale.

He had a house rented out close to Dublin that was bringing in €1,300 a month – far below the market rates, which were more than €1,800. Stymied by the rent controls, which limit rent increases to 4 per cent a year (and 2 per cent a year for tenancies in place before the end of 2016), when his tenants left he was looking only at marginal increases in his rent.

So what did he do? Sold this property and bought the one next door. Previously owner occupied, it wasn’t subject to rent controls, which meant that he could slap a new, higher rate of €1,900 on it. The difference in rent quickly covered his legal and stamp duty costs.

Public Eye was made from 1965 to 1975 and contains adult themes, outdated attitudes and language which some viewers may find offensive.

– Warning message put up by Talking Pictures TV prior to its re-runs of the series. For those unfamiliar with Public Eye, think Colombo meets The Rockford Files in the English suburbs.

“What’s wrong with UK financial markets? The global economy is recovering, but British stocks and shares are not keeping pace. The pound has failed to recover from the slide it experienced in the wake of the EU referendum. This is frequently blamed on investors being spooked by Brexit, even more so by the possibility of a no deal. But has anyone actually asked the markets what is spooking them? Look closer and it becomes clear that while Brexit is a problem for some investors, most are much more worried about a far bigger risk, even if they rarely speak about it in public. It is the possibility of a Corbyn government.”

– Ross Clark, in the Spectator (£).

As there is a paywall and it is annoying for those who cannot get through it, here are more paragraphs:

Since last year’s election, when the Labour leader came within a stone’s throw of No. 10, it has been impossible to write off the idea of a Corbyn victory. And we’re about to enter a time when anything can happen. Theresa May looks doomed to lose the Commons vote on her Brexit deal on 11 December; the DUP has said it may well withdraw its support from the Tories, leaving the Prime Minister without a majority. Whatever the Commons result, turmoil is more or less guaranteed — and one possible outcome is a general election as early as January.

A no-deal Brexit would unquestionably cause short-term ructions in the UK economy, as well as affect the pound and the FTSE — for what economic forecasts are worth (which is not very much, to judge by recent history). Oxford Economics recently claimed that GDP would be 2 per cent smaller than expected, pushing the UK into a mild recession. But even if that were to happen (and it has to be remembered just how far Treasury forecasts were out when they claimed the economy would shrink by 3.6 and 6 per cent in the event of a Brexit vote), growth would then rekindle, trade would continue, companies would re-route imports and exports, and an inflationary spike would die down. But if Corbyn were to be elected on a ‘radical socialist’ platform, investors can only guess as to what might happen.

It is the threat of a wealth tax that is scaring wealthy individuals. It is a theme to which shadow chancellor John McDonnell has returned several times. In 2012 he gave his endorsement to a proposal by University of Glasgow academic Greg Philo (sometimes mistakenly called an ‘economist’ but actually a professor in sociology) to subject wealthy individuals to a one-off wealth tax of 20 per cent in the hope of using it to pay off the government’s debts.

`The wealthiest 10 per cent own £4,000 billion,’ said McDonnell. ‘If you took 20 per cent of that you would then have £800 billion and we could tackle our deficit — we could tackle our debt — four-fifths of our debt would then be wiped out. So we’re saying just collect the money and make those who created the crisis pay for the crisis and that way you overcome it.’

The idea that wealthy individuals are as a group responsible for the 2008/09 crisis is absurd — what role, he might like to explain, did the Rolling Stones play in the crash? — as is the suggestion that such a tax would pay off the government’s debts: how McDonnell would manage to capture his £800 billion when, of course, highly mobile wealthy individuals have the option of fleeing the country. There is little appetite around the world for international socialist revolution, the only thing which could stop capital flight in its tracks.

On the contrary, many governments are going in the opposite direction and making every effort to attract wealthy residents. Donald Trump’s tax cuts have set out a big welcome mat for the world’s rich (if not so much for those of liberal opinion). Israel has introduced a ten-year tax holiday on the global wealth of new residents — they will pay tax only on money they bring into the country. Emmanuel Macron has reversed François Hollande’s war on the rich and offered special inducements to attract wealthy residents. Monaco recently held a presentation in London in an effort to attract wealthy individuals. Argentina and Greece, countries from which the wealthy were fleeing in recent times, are now much more settled.

The author is correct; in my own discussions with people in the financial markets, there is a real fear of what these reheated Marxists will do. Anyone who owns land, for example, unless they are politically connected to Labour, will be targeted. And as usual, it will not just be “the rich” who get it in the neck (not that isn’t bad in its own right), but the broad mass of the middle class who will not have the ease of being able to go abroad on a second passport.

The tragedy of the current situation is that Prime Minister Theresa May uses the genuine fear of a Corbyn-led government to scare us into accepting her plans to turn the UK into a European Customs Union vassal state, indefinitely, hoping no doubt that we all become so bored by the Brexit process that we accept that as the least-worst, if still crap, outcome. This situation, however, cannot last and I predict that there will be a significant political party realignment in the next few years, a view that several folk I know share. This current choice menu of Marxist anti-semite Left vs managerialist and hopeless Tory Party is simply shameful for a country of the UK’s standing in the world.

The Sage of Kettering and I have been on another day trip, this time to Lincoln. We have also visited a mystery town I shall leave you to guess below, and also at Stow-by-Lindsey, a tiny village west of Lincoln, with a now incongruously large Minster, Anglo-Saxon in origin, having been added to over the years.

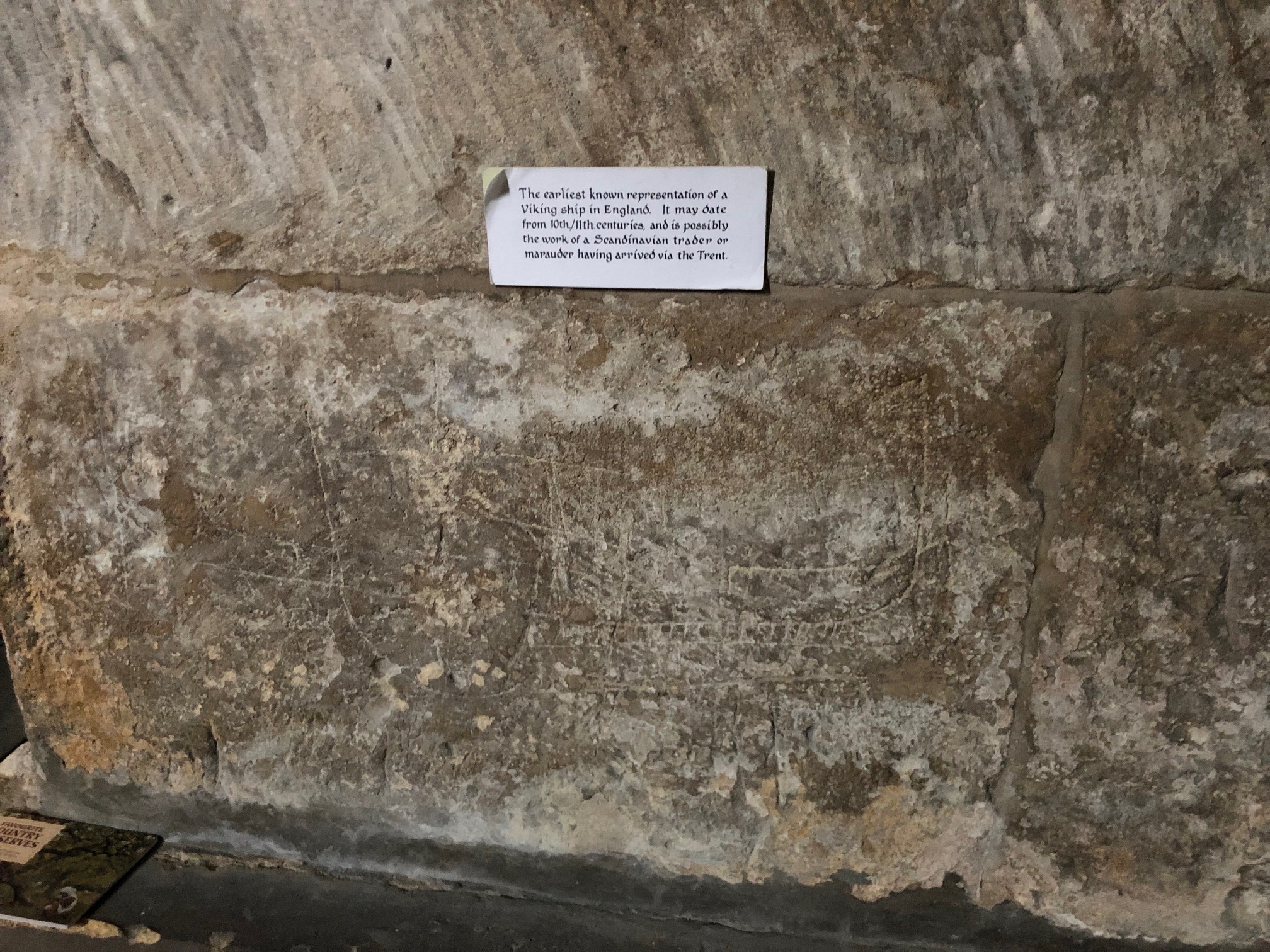

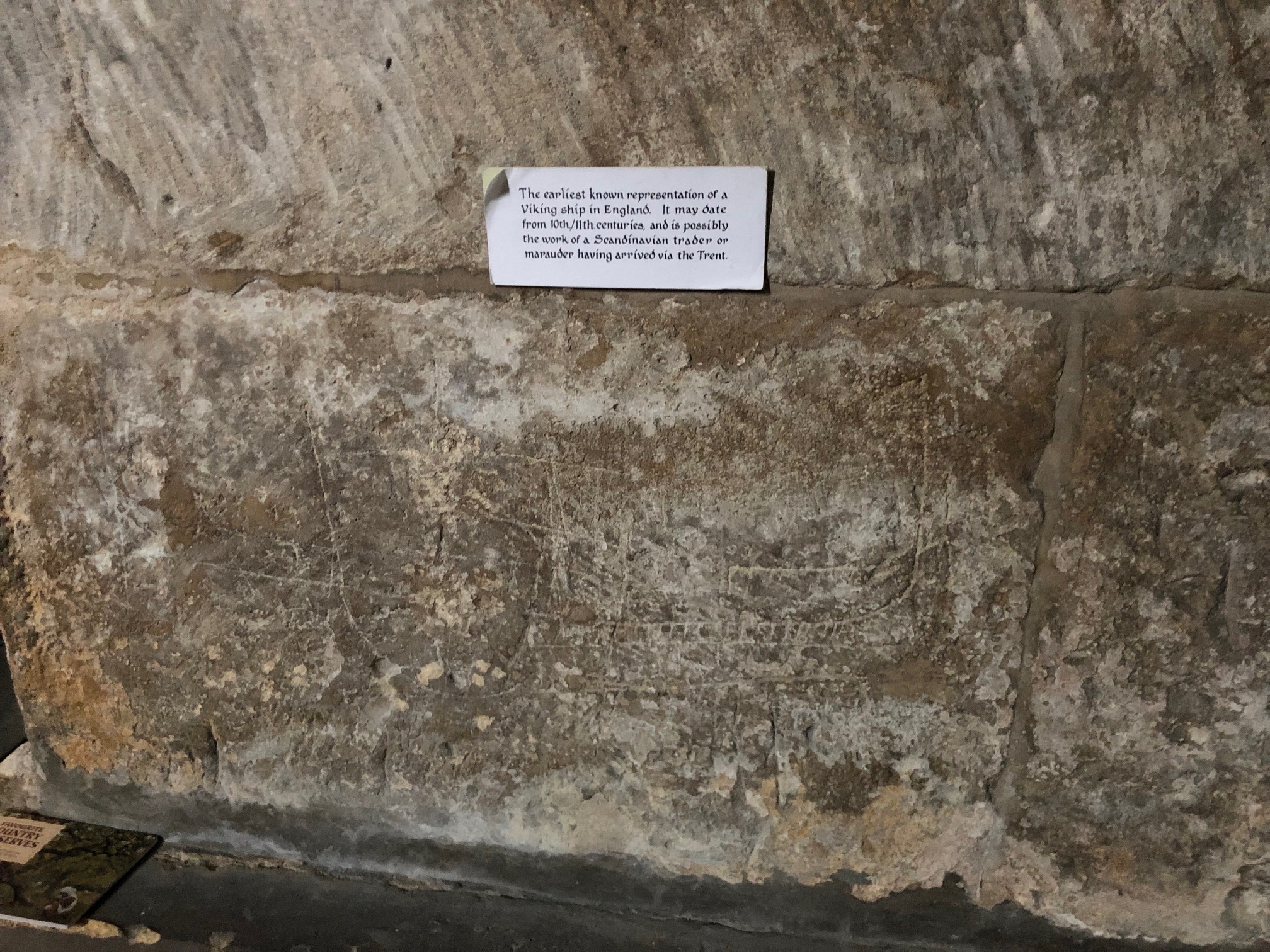

It also claims to have the earliest known Viking graffito in England, a carving of a long ship. It is not clear if this was a marauder or a merchant, but he presumably came up river to here, the Humber is not far away.

It also has a curious face on the font.

And an austere interior, perhaps barer than in its glory.

→ Continue reading: A Lincoln Lark

I recently went along to a financial markets briefing in the City (as part of my job; I do these things so you don’t have to, dear reader), and we got onto the subject of the eye-watering amounts of public debt in the West.In the US alone, the total debt is around $22 trillion (we must hope that if the economy is as robust as Donald Trump claims, that some of this gets repaid). And the economist in the room, when asked about this, and about how future generations are being asked to pay for our current profligacy, liked to refer to the following quote, from one Abba P Lerner, quoted in 1948. (Lerner was a Russian-born British economist). The quote goes: “Very few economists need to be reminded that if our children or grandchildren repay some of the national debt these payments will be made to our grandchildren and to nobody else.”

All very clever, and people in the room (apart from yours truly) nodded their heads at such profundity. So the UK/Western debt is terrifyingly big? Heh, no bother, because our kids/grand-kids will repay it, to er, each other, or something.

But wait a minute. If the UK racks up, say, £5 trillion of debt, and the interest charges to service that debt are still, say, the equivalent of several government departments (such as defence, health, etc) then that is money that has to be found, and yes, the payments of some of those will be paid to other, very much alive Britons, but would those people rather not have to repay it in the first place, but instead use savings to finance investment in productive goods and services? In other words, the inter-generational wealth transfer issue doesn’t become less of a horror. If the present generation racks up a bloody great debt, then the following one is left with a collective bill that it would, other things being equal, prefer not to pay. And there comes a point, of course, when the cost of financing the debt repayments can be so big that current economic growth and revenues cannot fund it, so you end up in a Latin American crunch, a sort of liquidity nightmare. So the question is at what point does the stock of public debt go from being this sort of seemingly benign shuffling of paper from A to B to something out of a disaster movie?

One thing that ought to give people pause about the blithe statements of economists about debt is that some debt down the years has been financed by debasing money – in other words, inflation. The robbery of savers and encouragement of financial speculation and finagling is, paradoxically, a reason why we have seen relatively slack productivity growth and hence stagnant real wage growth in the West in recent years. (Ultimately, real wage growth requires more productivity, and that needs to be financed by real savings, not central bank fairy dust.)

I commend readers to the studies and writings of a friend of mine, Scottsdale, Arizona based investment figure Keith Weiner, who has noted the link between very low, or even negative interest rates, capital destruction, and crap wage and income growth. Far too many on the free market side are in denial that we have suffered from poor wage growth, but we have. It is one of the reasons for why charlatans and thugs such as Jeremy Corbyn and all the rest have been successful, because some of their critiques about living standards are true. Their diagnosis, of course, isn’t.

Today, it was announced that a Chinese research institution had edited the genomes of human embryos that had subsequently been implanted and led to healthy births.

By wondrous coincidence, Ilya Somin of the Volokh Conspiracy posted a great essay defending such gene editing only two weeks ago, and it makes good reading at this time.

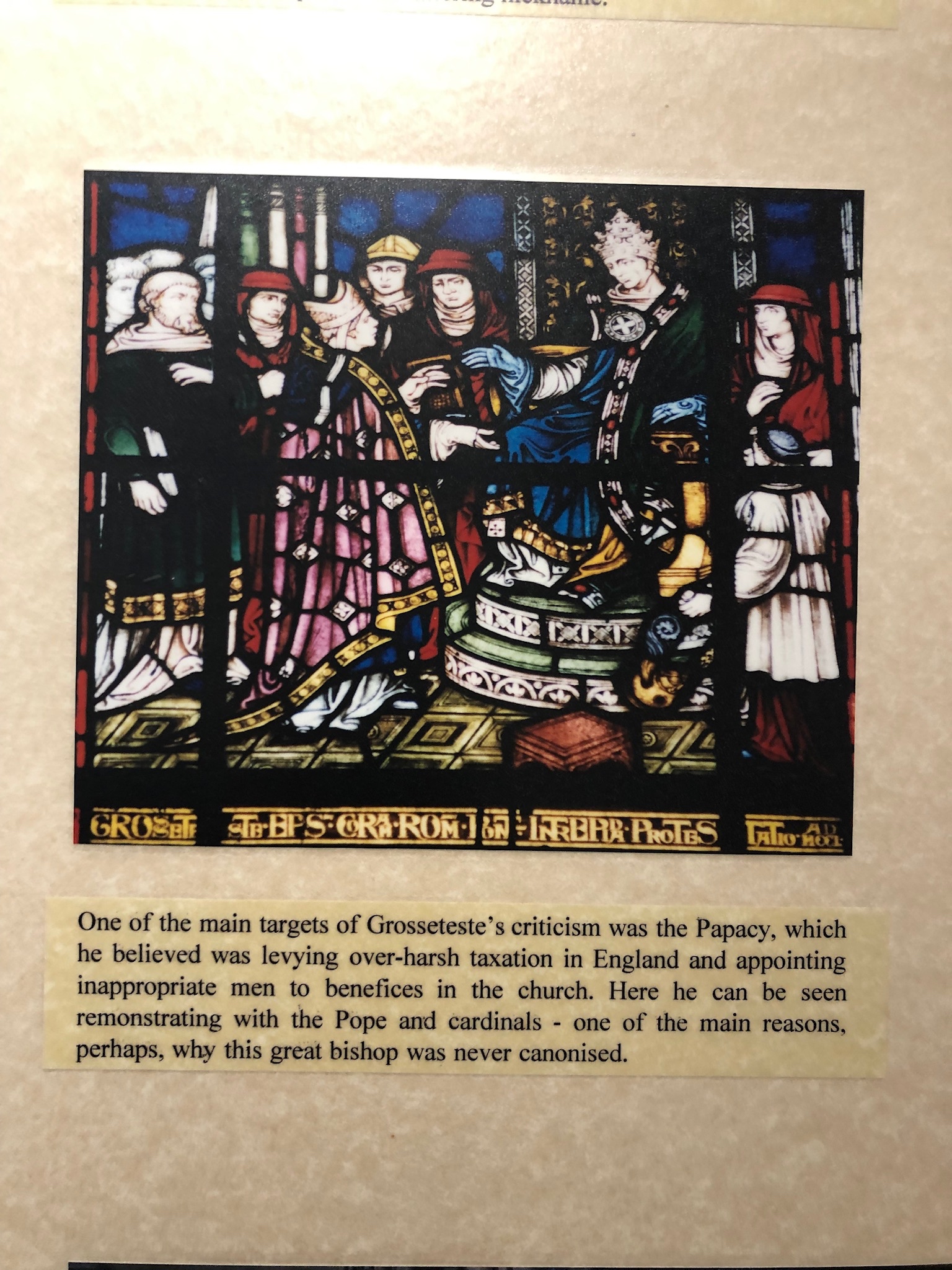

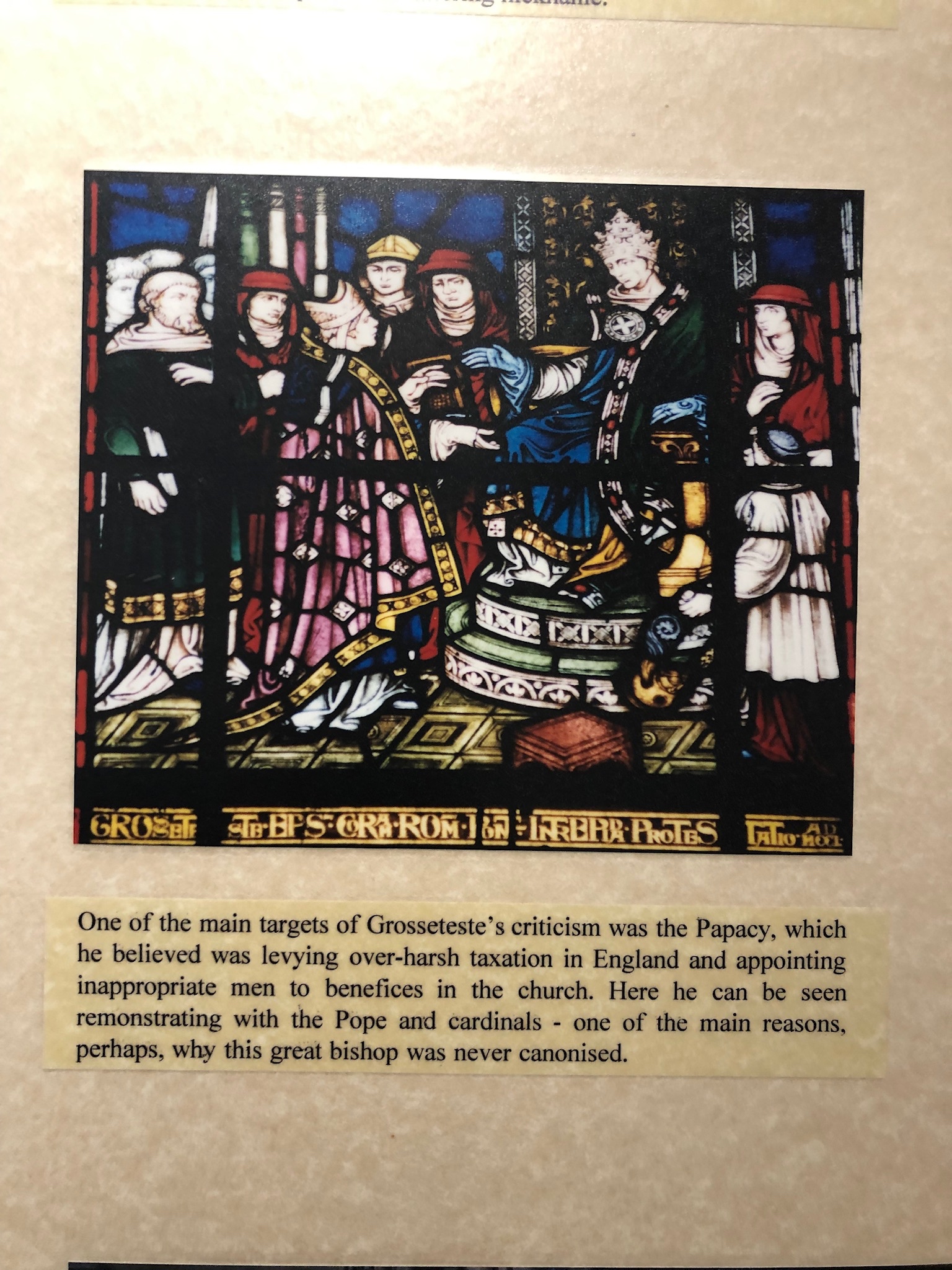

“One of the main targets of (Bishop of Lincoln) Robert Grosseteste‘s (c. 1175 – 9 October 1253) criticism was the Papacy, which he believed was levying over-harsh taxation in England and appointing inappropriate men to benefices in the Church.”

Another quote:

“Those rascal Romans….. he hated like the poison of a serpent. He was wont to say that if he should commit the charge of souls to them, he should be acting like Satan. Wherefore he often threw down with contempt the letters sealed with the papal bulls and openly refused to listen to such commands.”

Thus say English Heritage of Bishop Grossteste (Big Head) of Lincoln, in a display in the former Bishop’s Palace in Lincoln. The Bishop was never canonised, perhaps because he was too holy. He was no fan of Rome, as English Heritage note, in their exhibition in his former palace.

A Protestant before the term was coined, and surely a model for our current political class in the light of current ‘difficulties’ from over the water.

“The idea that it is not possible to leave the EU seems to be the most dangerous affront to democracy. They are saying not only that it was wrong for the public to vote to leave, but also that it cannot be done and therefore the democratic vote was meaningless.”

– Richard Tombs, historian, University of Cambridge.

“Haters are not going to hate here,” asserts a young lady speaking for Scotland in this Scottish government video called “Your hate is not welcome here, Yours Scotland”. “That’s why if we see anything we’re calling the police,” says another virtuously. The philosophy of the whole is explained by the young man at 0:46: “We believe in acceptance.”

Ever since Gove messed up the election of a leave leader, my confidence that the Tories would nevertheless deliver Brexit rested less on the belief that the parliamentary party contained more leavers than full-blown remoaners than on the conviction that it contained many who just wanted to win the next election. Cameron’s referendum to deal with the internal and external (UKIP) threat to Tory electoral prospects ended not as he intended, but it offered such MPs a very obvious path forward. Likewise, when May demonstrated her ability to reduce a poll-lead healthily exceeding 20% to a result just exceeding 2% (over Corbyn, of all people), my belief that the Tories would not risk another election under her leadership rested solidly on my faith in how many Tory MPs wanted first and foremost to win.

For now, it is all still to play for. Firstly, if there are as many letters written as rumoured, yet such as David Davis are still thinking about it, then Mogg’s “this week or next” remains on the table – and I quite see that the rule ensuring May a challenge-free year if she survives a vote is a very good reason for caution in the run-up to launching one. Secondly, when May’s incompetence made her dependent on the DUP for her majority, I thought it good for one reason; I now also think it good for another. Thirdly, if all else fails, reality could still prove wiser than parliament and deliver us a no-deal Brexit through their sheer inability to agree anything decisive in a timely fashion.

All that said, I am beginning to question my faith in the “focus on winning” cynicism of a sufficient majority of Tory MPs. It is one thing to think that enough Tory MPs to keep May as leader could betray their voters, their party, their principles and the most emphatic statements of their 2017 manifesto (and her leadership campaign), but it shakes me to the core to find myself wondering if they could choose the electoral death ride of May campaigning on this deal rather than follow a leaver. I’m glad that a majority of back-bench MPs seem to be interested in retaining the votes of the ‘swivel-eyed loons’ so derided by Cameron, Osborne, and now May, but just how many others would rather lose than be unfriended in SWI ?

Natalie once stated she would endure a Corbyn government rather than stay in the EU. I have always felt much sympathy for the wretched situation of Slavs who found themselves fighting for Stalin against Hitler as the only alternative to Hitler’s winning, and it is with similar feelings that I do see her point (if, that is, we could even rely on their being alternatives). However we should be able to do better than that.

I was always taught that the Maginot Line was a military white elephant – colossally expensive and easily by-passed. But this guy begs to differ – kinda sorta. Short version: it would have worked if it hadn’t been for those flibbertygibbet Belgians! Even so he doesn’t address the question of how Germany would have been brought to heel by means of an entirely defensive strategy.

I love this sort of challenge to the narrative and I understand that Samizdata’s own Bertrand Maginot will be joining me. For once.

“The unwarranted gloom about the UK and the exaggerated respect for the EU are not new. Many of those who now say that Britain must stay as closely aligned to the EU as possible predicted disaster when the pound left the exchange rate mechanism in 1992; prophesied a decade later that Britain would rue the day that Gordon Brown gave the single currency a wide berth; and said with the utmost confidence in 2016 that a vote for Brexit would lead to an immediate and deep recession and a massive increase in unemployment. None of these things happened.”

– Larry Elliott, writing in – yes – the Guardian. Even if you don’t share his left-leaning, Keynesian economics, much of what he says he about the EU debate is spot-on. He is right, for example, to remind folk of just how lousy the forecasts of various EU pushers down the years have been, and continue to be. The shamelessness is, well, shameful.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|