As originally reported by Janet Burns of Forbes, the New York City Council has denied city residents access to additional ride-sharing services. In a 39-6 vote, the bill caps the current supply of New York City Uber and Lyft drivers for the next 12 months and implements a minimum wage of 17 dollars per hour. In what City Council Speaker Corey Johnson referred to as reforming an industry “without any appropriate check or [government] regulation,” Councilman Eric Ulrich argued, “This is like putting a cap on Netflix subscriptions because Blockbusters are closing.”

|

|||||

|

“As for those “bad ideas” the Kochs have, they’re the reason for whatever governing success Mr. Trump has had so far. Pro-growth cuts in tax rates, deregulation and originalist judges have been the most successful parts of the Trump agenda. And they were Koch beliefs when Mr. Trump was still donating to Bill and Hillary Clinton. The President gets credit for winning the election and making the policies happen, but the Kochs also gave his agenda major support over the last two years. Contrast that success to Mr. Trump’s immigration agenda, which has gone nowhere in Congress; his ill-thought border enforcement that ended up in the debacle of family separation; and the tariff assault that has so far raised costs for U.S. consumers and producers without any compensating trade opening. Whose ideas are the “bad” ones?” There is a lot to admire about Elon Musk. I thought the space car was glorious. The whimsicality of it, which so many objected to, delighted me. It is sad that Mr Musk has now shown that his whims can take a nastier turn.

Apparently it started when Mr Unsworth was rude about Mr Musk’s offer of his mini-submarine to help in the rescue:

If nothing else had been said, my sympathies would have been with Mr Musk. Even if it was something of PR stunt, I am sure Musk did genuinely want to help save lives. Still, I dare say tempers often flare in these high pressure situations. One man’s praiseworthy offer of aid can be another’s dangerous distraction from an urgent task. However then Mr Musk went on to call Mr Unsworth a “pedo”, not just once – in which case it might have been written off as a random zero-content insult like calling someone a “bastard” when you neither know nor care whether their parents were legally married – but repeatedly. Mr Musk’s “evidence” for this allegation out a blue sky was that Mr Unsworth is a white guy living in Thailand. Musk said that that in itself was “sus”, meaning suspicious. Angry comments are coming thick and fast to the Times article “Thai boys’ rescuer Vern Unsworth could sue Elon Musk over paedophile smear”. If even a fraction of those commenting on the Times website and those of other British newspapers who have said that they are about to cancel their Tesla order follow through with it, Musk’s UK operation could be in real trouble. That comes on top of the doubts already raised about the company by Tesla’s failure to live up to some of Musk’s earlier extravagant promises. For all the fame of the brand, the number of Tesla electric cars in the UK is still only in the low thousands, and Times subscribers are exactly the sort of people who would be most likely to buy them. Charismatic individuals can push forward scientific innovation. They can also screw up big time. Congratulations Mr. Brokenshire, you’ve just killed every buy-to-let mortgage. of which there were 1.8 million even back in 2015. It’s a standard clause in every single one of those mortgages that they be rented out on a six or 12-month shorthold assured tenancy. The reason being that in the event of default the bank or building society understandably wants to be able to sell the place without having to deal with an immovable sitting tenant. No one has any problem with increasing the choices available in terms of types and terms of tenancies. But imposing new terms on all landlords and tenants either means that 1.8 million rental dwellings are off the market, or we’ve got to persuade every bank and building society in the country to alter their existing contracts. For a price, of course. We might, then, politely suggest that this hasn’t been properly thought through. Although of course we’d never compare James Brokenshire to Tony Blair, I’m not too clear who that would be unfair to. The last part of Ludwig Von Mises great work Socialism is entitled “Destructionism” and is not, formally, about socialism at all. In the main body of “Socialism” Ludwig Von Mises proves that it is impossible (yes impossible) for socialism to equal capitalism economically, let alone to exceed capitalist economic performance (as socialists had been promising for over a hundred years) socialism must always produce inferior results. Now the language of Ludwig Von Mises may sometimes suggest that he believes that socialism can not function AT ALL (i.e. that it can produce nothing – no goods and services), but that is a misinterpretation of the position of Mises (which is partly the fault of Mises himself – who sometimes lets elegant language get in the way of fully stating the correct position, as I detest such things as “grammar” I do not make this mistake). By copying the prices of the capital goods in “capitalist countries” socialist countries can make a crude approximation of “capitalist” economic activity – never very good, but certainly not no economic activity at all. However, in the last part of his work “Socialism” Ludwig Von Mises turns to “Interventionism” government spending, taxes and regulations which (supposedly) improve on the work of voluntary cooperation. “Market forces”, of supply and demand, are as my friend Mr Ed often points out – partly a matter of physical reality (weather and so on), but mostly a matter of human choices (voluntary interaction). Government intervention (by spending, taxes and regulation) far from improving economic and social outcomes can (as Herbert Spencer pointed out in “Man Versus The State” in 1883) only make things worse than they otherwise would be. Ludwig Von Mises takes great pains in “Destructionism” to show that the fashionable polices of his time (and our own time) of government spending, taxes and regulations make things worse, not better, than they otherwise would be. And that the supposedly new idea of interventionism – is, in fact, a return to the absurd fallacies of past centuries that the Classical Economists of the had exposed. Has the penny dropped, do politicians (and the public) yet understand that government spending, taxes and regulations make things worse (not better) than they otherwise would be? Sadly no – most politicians and most of the public do not understand. → Continue reading: Destructionism – with a few British examples A few weeks ago in central London, I watched a group of protestors holding aloft anarchist signs as they demanded greater government spending. They seemed almost as confused as the fellow who tweeted me his denunciations of globalisation the other day – using a mobile device made in Korea and software written in California. – Douglas Carswell, Rebel, page 295. According to Lucian Armasu of Tom’s Hardware, in one week’s time I might no longer be able to link to Lucian Armasu of Tom’s Hardware and quote him like I’m about to do. Or have I misunderstood? I hope I have, because this sounds serious:

…

…

…

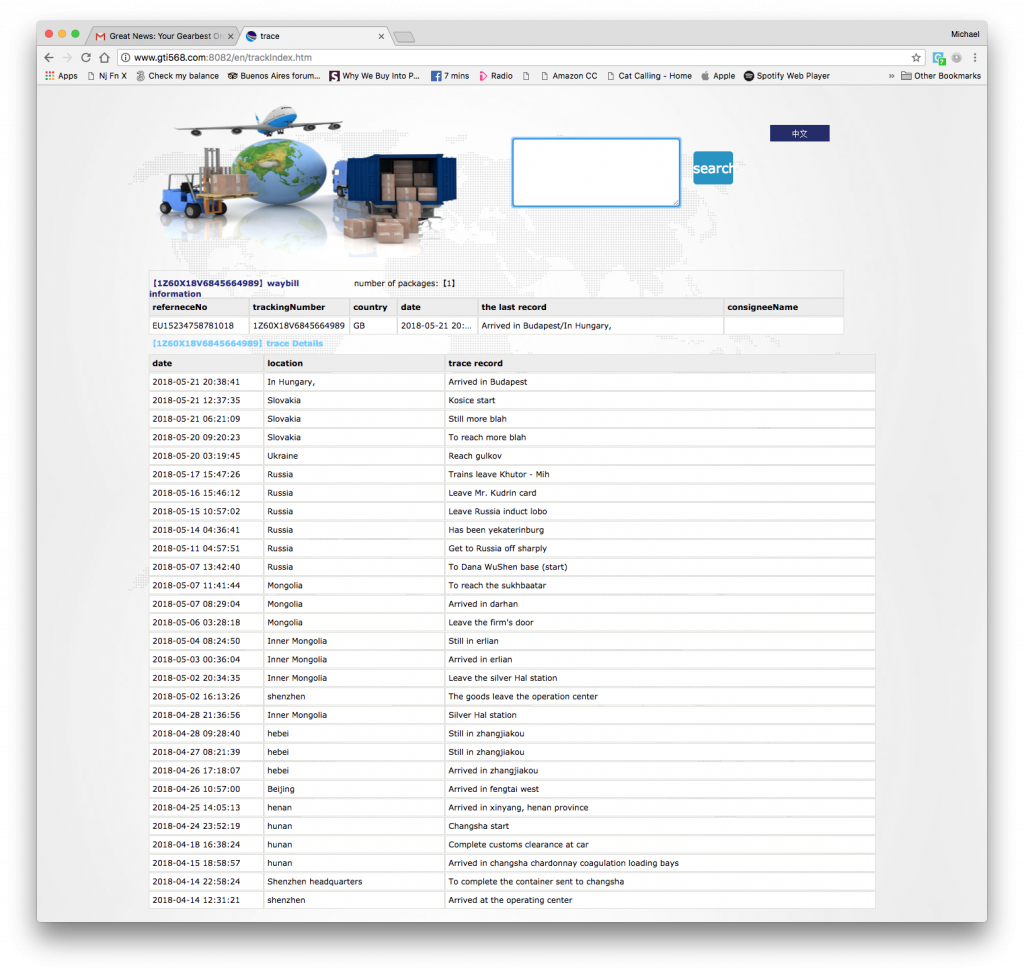

I have heard of Julia Reda MEP before. She sits with the Greens in the EU Parliament but don’t hold that against her; she is actually a member of the Pirate Party. She is fighting the good fight. Thanks to Brexit fruit is going to be left to rot in the fields. How can we cope without a reliable supply of cheap foreign labour and zero-hours contracts to cover the seasonal summer work? All this will push the cost onto society in the form of more expensive grocery bills. Meanwhile, those evil Capitalists at Amazon are exploiting cheap labour and forcing people to work zero-hours contracts to cover the seasonal winter work, pushing the cost onto society in the form of tax credits. The Turkish cab drivers aren’t opposing Uber because it is bent. But because it is honest. – ‘Chester Draws’ commenting on the Continental Telegraph. I clicked on a link to an article about food marketing failures and came upon a notice that due to GDPR, the publisher just could not be bothered dealing with people from Europe for now. It turns out the even the Los Angeles Times thinks people from Europe are too much of a pain in the ass to talk to. If they can not cope, what chance does a small US-based pizza restaurant with an online ordering system have, having been told that they have to comply with GDPR in case any customers from the EU visit? Things look set to get even worse for the Internet within the EU. But it is not just the EU. Amazon will stop shipping things to Australia because of a global sales tax. Trump seems very keen on tariffs. The UK does not appear to be in any hurry to turn into a small-state unilateral-free-trading nation after Brexit. In fact we are likely to have to choose between outright full-steam-ahead socialism and slowly-boiled-frog socialism at the next election. Governments really do like their borders. As Guy Herbert says: The nation state is still our biggest problem. Recently (by which I mean about six weeks ago), I ordered a 3D printer kit to be sent to me from China. It was much cheaper to order it directly from a seller in Shenzhen than via an intermediary like Amazon. Because I was in no real hurry to get it – and because I am cheap – I selected the cheapest shipping option – Europe Railway Priority Mail. My printer has clearly been coming via the Trans-Mongolian Railway, which joins the Trans-Siberian railway north of Mongolia. Given that it has taken over a month to get to Budapest, it has clearly not made the journey on a single train, even on the sections where this is theoretically possible, such as Beijing to Moscow. I give you my wonderful tracking information. I particularly like “Arrived in changsha chardonnay coagulation loading bays”. Also, let’s face it. “Get to Russia off sharply” is good advice for anyone. (Click to make the image larger). |

|||||

All content on this website (including text, photographs, audio files, and any other original works), unless otherwise noted, is licensed under a Creative Commons License. |

|||||