We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

My comment below on youth crime prompted a lot of good comments. My thanks for Civitas, the think tank, for commenting about this admirable venture to encourage youngsters to learn discipline, pride and have a lot of fun at the same time.

It is not all bad news out there, thank goodness.

… this guy needs to buy a cat and take some well deserved ‘chill time’ for, oh, the rest of his life maybe?

“So I got down with my back to the grenade and used my body as a shield. It was a case of either having four of us as fatalities or badly wounded – or one. I brought my legs up to my chest in the brace position and waited for the explosion.”

The short version: he set off a booby-trap (the old tripwire/grenade shtick) in the middle of his patrol, jumped on the grenade and his body armour and the stuff in his backpack took the brunt of the explosion. Other than getting blown through the air, this Royal Marine walked away pretty much in one piece. Fortitude and insane luck are a very cool combination.

Let me offer the Lance Corporal a career suggestion: head back to civilian life and get a job doing endorsements for a certain backpack manufacturer.

I do not always follow politics. When things are going well for politicians I do not like I prefer not to think about it. But now, I am thinking quite a lot about Gordon Brown, the British Prime Minister.

Two labels have been attached to Gordon Brown, in succession. First, there was the big clunking fist metaphor. But now, this picture of a grim but determined, horrid by decisive individual, has been replaced by a quite different clutch of descriptions, most of which involve the word “dither”. This transformation was famously described by Lib Dem wrinkly Vince Cable as from Stalin to Mr Bean. So, which is true?

The answer is: both. If all that Gordon Brown was was Mr Bean, we could all relax, except those of us in the immediate vicinity of the man, such as his wife, secretaries, immediate subordinates, children, and anybody unfortunate enough personally to encounter him in the course of his staggerings around. But Gordon Brown is Mr Bean with the powers of a Prime Minister – Mr Bean a hundred feet high, able to ruin thousands with one ill-judged swipe of his arm, one petulant kick. This is not somebody who dithers only about whether to have one lump or two or perhaps three, although the telly-comedy sketchers are surely at work on that very notion as I write. This is a man who can, as and when he feels inclined, shut down this entire industry, or that one, or that one, depending on what he finally decides, or on what he merely hears himself saying or finds himself doing. He could rescue that whole area of the nation’s life from ruin, if he could only make up his mind about it, and he may do that or he may not, which actually, if you think about it, means that he will not. It is the combination of his vast powers to wreck (mostly to wreck) with his inability to decide on a “vision” – that is to say, on a recognisable and single path of wreckage which most of us could feel safe about not being in the way of – that makes this man so particularly scary, even by the standards of your average Prime Minister.

Blair at least seemed at least to have arrived in office with some idea of the limits of government power, and to have various notions about relying on it a bit less (along with others that involved relying on it far more). During the Blair years, Mr Blair would announce policies, some of which were sensible, and Mr Brown – the brooding, glowering dragon-in-a-cave Wagnerian bass Mr Brown – would either pay for them and mess them up or else just mess them up by not paying for them, depending on his mood. As methods of government go this one could have been a lot worse, although, as we are now discovering to our cost, it could have been a lot better. But now, our ruler is a fussy and insomniac incompetent, Mime with the powers of Wotan, but without Wotan’s hard-won wisdom. As somebody said over the weekend, what you want is somebody intelligent but lazy. What we have is an industrious fool.

The final touches to the story of the Brown moment are been inked in by the political commentators, and I do not believe that Mr Brown is going to be able, ever, to shake loose from these judgments. He is out of touch. He is terminally (Janet Daley makes much of the Terminal 5 fiasco) incompetent, and his followers are in disarray.

What follows? Will Mr Brown’s party sack him? Soon, I mean. It seems unlikely, but maybe. Will Mr Cameron be any better when he eventually takes over, as he surely now must? Ditto.

Blogger Clive Davis, who is well known to us at Samizdata, has this distressing report about an attack by youths on his teenage son. He’s not been impressed by the response by the police. It will not ease Clive’s anger one jot to hear that I had exactly the same experience when I was mugged in Clapham nine years ago. The police jotted down some comments, took a statement from me, including a description of the attackers (I managed to hit one of the bastards quite hard, I am glad to say). About a week or so later I was contacted by Victim Support, offering counselling, which I politely refused, although I was grateful for at least some followup. I had bad headaches for about a week and had to take several days off work. It is, as Clive and the rest of us Londoners know only too well, a regular occurence.

What to do about it? That is the big question, perhaps one of the biggest questions of public policy in Britain. Sure, the economic worries arguably are taking a greater share of the chattering classes’ time right now, but the long-running issue in Britain, at least since I have been interested in public affairs, is the continued uptrend of yobbery and violence in British society. It has been blamed on many things, with varying levels of plausibility: the lack of authority figures that can inspire and instill respect in youngsters, mostly boys; the breakdown of the family and the rising levels of single-parenthood, which in turn is encouraged by perverse incentives, such as the Welfare State. Throw in a culture that celebrates, or at least does not condemn, yobbery and violence plus the decline of manual labour and lack of outlets for youngsters who are not academically gifted, and you have quite a toxic mix. As for the last point – the decline of manual labour – I certainly do not think that could or should be reversed, given all the gains we have enjoyed from the move to a more service-based economy. But it is a problem that has to be thought about. I personally think one step would be to cut the school-leaving age and hack away labour market restrictions so that apprenticeships can be viable. What so many kids lack is a chance to learn a skill and quickly experience the pride of earning a proper wage. It would be a start.

Time magazine has already caused a stir with this front cover. Good. Sometimes it takes a foreign news publication to tell it like it is about what is happening. Not very “Cool Britannia”, is it?

Anyway, my best wishes to Clive and his family.

London and the Database State

A mayoral hustings organised by NO2ID

Londoners are among the most watched people on earth. As well as housing Whitehall, Parliament and the other self-protecting security apparatus, London has many information and identity management systems of its own. How do candidates feel about the civil liberties and privacy implications of, among other things, the Oyster Card, congestion charging, telephone parking? Would they support or oppose national ID schemes as mayor? What is their attitude to the database state?

Invitations have been issued to every party with London representation at Westminster, in Strasbourg or in the GLA. Gerrard Batten (UKIP), Sian Berry (Green), Lindsay German (Respect/Left List), Boris Johnson (Conservative), and Brian Paddick (LibDem) are currently expected to participate, and written responses from other invitees will be read from the chair.

Chaired by Christina Zaba, journalist and NO2ID’s Union Liason Officer.

Time: 7pm Tuesday 8th April 2008

Place: Friends House, 173 Euston Road NW1 2BJ

Free and open to all.

[I’d like to take this opportunity to remind EU and commonwealth citizens resident in London, they have a vote in this too.]

Now this is something I look forward to seeing, at least virtually:

The Mile High Tower will be double the height of its nearest rival, and will be almost seven times the height of the Canary Wharf tower in London. Visitors will be able to see Africa from the top of the tower, the Sunday Times newspaper reports […] The project will push architecture and engineering to new limits, as the tower must be robust enough to withstand the extremes of temperature and strong desert winds in the region.

What a pity it is going to be in Jeddah as much as I would like to see it up close, not even that marvel could induce me to set foot in that theocratic hell hole.

Over on The Line is Here, they are hosting the Carnival of the Libertarians, where various folks sound off about, surprise surprise, issues to do with liberty.

Check it out.

There is a great little article in Slashdot about a well known German hacker group, Chaos Computer Club, publishing the fingerprints of German Secretary of the Interior as part of their protest against state use of biometric ID.

The club published 4,000 copies of their magazine Die Datenschleuder including a plastic foil reproducing the minister’s fingerprint – ready to glue to someone else’s finger to provide a false biometric reading. The CCC has a page on their site detailing how to make such a fake fingerprint

Sweet. I suppose that is a ‘hardware hack’ of sorts!

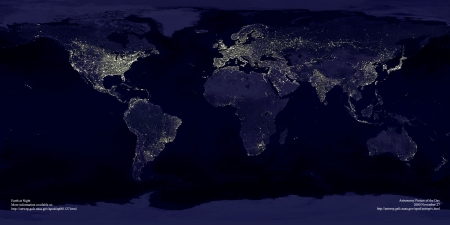

I never get tired of looking at this photograph. It never fails to fill me with wonder and awe at the ingenuity of my species who, against all the odds, have carved these glorious man-made islands of light out of the primordial blackness. Whenever I am heavy of heart, I open up this photograph and stare at it to remind me that, somewhere, there is light and life.

And there is. For now.

Towns and cities around the world are turning out the lights for an hour to highlight the threat of climate change.

Sydney was the first major city to begin “Earth Hour”, when at 2000 (0900 GMT), lights went out on landmarks like the Opera House and Harbour Bridge.

Bangkok, Toronto, Chicago and Dublin are among 27 other cities officially due to follow suit at 2000 local time.

With each passing day I become more convinced that the ‘green’ movement is actually a millenarian psychosis; a mental and spiritual sickness borne, perhaps, from some degree of civilisational exhaustion. Not just a belief that the end of the world is nigh, but an active desire to bring it about. And soon. Ours is not the first age to witness such pandemics of madness but, in the Middle Ages at least, there was the excuse of a near-universal poverty. In such a state of interminable plight, despair may not be the wisest response but it is at least an understandable one.

But now we live in an age of near-universal prosperity and progress. Never before has our species enjoyed such security and such freedom from want. Yet this is clearly no defence against a recurrance of this psychological plague.

Some pubs are spending the evening without the lights on while many Australians are marking the occasion quietly in the darkness at home.

Life, laughter, love, food, drink, warmth, travel, communication, progress, a world full of unprecedented wonders and it’s all too much for them. Better to sit in the darkness and curse the lighting of even a single candle.

‘Stop the world, I want to get off’ was the plaintive refrain of some Broadway comedy show I think. It could also be the motto for the greens, except that they want everybody off. Is that what they aspire to as they sit at home quietly in that seductive, undemanding cloak of blackness? To switch off civilisation and shuffle away into the perpetual tenebrosity dragging everyone else behind them?

The conditions are ripe for the spread of this insanity. Indeed, it is spreading now. How long will it be, I wonder, before some official body somewhere floats the idea of mandatory blackouts and curfews? “The voluntary approach” they will proclaim, “has not worked”.

And what do we do in response? Laugh at them? Ignore them? Rage against them? What would work to inoculate the rest of our species? What combination or words or phrases could we use to dissipate and lay low a viral madness? I am, of course, familiar with the customary rebuttals. “We will win because we have MTV and Coca-Cola”. But without the light there is no MTV, there is no Coca-Cola. What do we have then?

The lights are not yet going out all over the world. But I fear that I will see them do so in our lifetime.

Has the Prime Minister got lost?

– The Queen during the Windsor Castle banquet for Sarkozy

Laird Minor, one of our commentariat who has spent a lifetime in this sector of the financial industry felt the first article on the subprime financial crisis gave an incomplete picture. He proceeded to fill in the rest of the story in such fine form that I am re-posting his comment here on the front page so that it will, in conjunction with the first article, give our readers a much better idea of what is going on and what to expect.

Having been a participant in one way or another in the subprime mortgage industry for over 20 years, this is a topic in which I possess a fairly substantial degree of expertise. The first article is reasonably accurate as far as it goes, but there is a lot more to the story. I could probably write a book on this, but I will try to keep this post as brief as I can.

The CRA only applies to banks, and while banks are the originators of a large number of mortgage loans, non-bank lenders have come to comprise a substantial portion of the mortgage industry. This is especially true in the subprime sector. Thus while the CRA was a typically bad Washington idea, propounded by “poverty lobby” zealots with no conception of how the market works, it isn’t really the principal source of the problem. That honor goes to Wall Street.

Subprime loans are not “agency-eligible”, which means that they can not be sold to Fannie Mae or Freddie Mac, the two huge quasi-governmental agencies that dominate the mortgage world. For this reason subprime lending remained a fairly small segment of the market, much like “payday lenders” are in a different market, until Wall Street figured out how to securitize the loans. Securitization is an extremely valuable financial tool, as it allows loans, which in essence are nothing more than streams of cash flows, to be combined into giant pools and carved up into separate “tranches” having different characteristics as to timing, default risk, etc. By separating these cash flow streams the tranches can be sold to different investors with different investment criteria (insurance companies, for example, have clear actuarially-determined timing needs for cash) which results in better pricing. Overall, securitization created a more efficient market for mortgages, which benefited everybody. Unfortunately, it got out of hand, primarily because of the rating agencies and, to a lesser extent, the monoline bond insurers.

Mortgage-backed securities are rated by Moody’s, Standard & Poors, and Fitch, to determine their investment grade. This affects both price and the appropriate universe of investors. As more and more subprime mortgages and especially unusual ones like “pay-option ARM” loans began to be placed into securitization pools, the rating agencies failed miserably in analyzing them and forecasting their performance characteristics. Monoline insurers, who provide bond insurance for the highest-grade bonds, similarly failed to adequately model these loans’ performance, and thus imposed inadequate credit enhancements (loss reserves, subordination levels, etc.) on the deals. Lenders found that they could sell all the loans they booked, with no meaningful penalty for weak credit quality, so of course they expanded their guidelines. They were merely reacting rationally to signals the market was sending, and do not deserve all the blame for the ultimate melt-down.

So the mortgage pools got riskier and riskier, but no one really appreciated that fact until delinquency levels began to surge last summer: there is a fairly long lag time between mortgage origination and delinquency. Once investors realized how bad the pools had gotten they stopped buying the bonds. The market for mortgage-backed securities ground to a halt almost overnight; pricing for existing securities went into free-fall, and new deals simply couldn’t be completed. And since banks and other financial institutions which own most of those securities are required to write them down to current market values, their paper (unrealized) losses ballooned. This is the reason for such events as the Bear Stearns failure; it had pledged those securities for its borrowings, and when the bond values plummeted and the loans were called they could not come up with the cash.

It is a typical Wall Street “bi-polar” overreaction, but the pain is very real. Property values, which had been driven up by speculative excesses and cheap money (as noted in the first article), are falling rapidly, especially in the areas where they had risen the most (Florida, southern California, Arizona, etc.), and until they bottom out the liquidity crunch will continue. Eventually that will happen, though, and when it does things will return more or less to normal. Hopefully the participants in this market will have learned something from the experience, but I am not sanguine about long-term wisdom; Wall Street has a short memory, and the next generation of traders will probably repeat at least some of these mistakes.

So there is blame to go around: foolish laws and regulations; inadequate understanding of the effects of weakened credit standards; a few, but very few, truly predatory lenders taking advantage of unsophisticated borrowers; and greedy borrowers who were speculating in real estate values or who simply wanted to extract all of the equity in their homes for current consumption. In my opinion this last group is getting far too little of the blame. It was a market failure of monumental proportions, but as long as the politicians will stay out of the way the market will correct itself; it always does. Unfortunately, it now appears that politicians, who always want to be seen as “doing something”, whether it makes sense or not, will muck around in matters which they don’t understand and make things worse.

The Law of Unintended Consequences will come back to bite us. It always does.

I suspected this much would happen but perhaps not quite so quickly.

In the post below, I provided a link to ‘Live Leak’, the only internet video site that was willing to host the movie. Apparently, YouTube and Google were approached but their joint and several response was to hastily gather up their skirts and run away screaming like a pair of Victorian maiden aunts.

The owners of Live Leak are clearly made of stronger stuff but they can hardly be blamed for pulling the plug once their lives had been threatened. The film has been removed from their server. Their official statement says:

Following threats to our staff of a very serious nature, and some ill informed reports from certain corners of the British media that could directly lead to the harm of some of our staff, Liveleak.com has been left with no other choice but to remove Fitna from our servers.

[Emphasis mine].

I cannot say that I am entirely surprised by this development but what I do find discomforting is the reference to ‘certain corners of the British media’. Which ‘corners’ are they talking about? I think we ought to know. Does anybody have any details here?

Anyway, it seems that the film is now being spread virally on all manner of mirror sites so, if you are interested, you will still be able to find it, albeit that you may have to dig a little deeper.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|