We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

Just over a decade ago, the US and the EU conspired to conduct what has proved to be a very successful war against low-tax jurisdictions and banking secrecy. Under a fig-leaf of a campaign to eradicate ‘drug-dealing’ and ‘terrorism’ (but truthfully to maintain the integrity of their various state-welfare arranagements) they employed a combination of legislation, diplomacy and outright bullying to effectively hobble (and, in some cases, shut down) the Western offshore-investment industry.

As expected, the EU went further in this war than the US where the ‘anti-money laundering’ regime metastasised into a ludicrous campaign against what they called ‘unfair tax competition’.

Well, now the chicks are coming home to roost. Or, more accurately, they are flying the nest:

The world’s major private banks are beefing up operations in Singapore, anticipating that up to a trillion US dollars worth of offshore assets in Europe may be looking for a new home in the next couple of years.

Changes in banking secrecy and tax laws due to take effect in the European Union from 2005 are expected to encourage offshore investors in traditional havens like Switzerland and Luxembourg to start moving their money to other centres.

Singapore, with its stable political system and excellent infrastructure, is seen getting a big share of this money.

“We have estimated that from Europe about a trillion plus could be highly movable without too much difficulty,” said Roman Scott, vice-president at the Boston Consulting Group (BCG). “Some of those guys are going to say; ‘I need an offshore centre that’s not going to be squeezed down’.

All the European places are being squeezed. You can’t go into the US, so you suddenly start to look at Asia as attractive,” he said.

Western political elites are rather like heroin-addicts. No amount of argument, persuasion or reason will do anything to deter them from their narcotic fix.

Lessons generally have to be learned the hard way.

[My thanks to Dr.Chris Tame who posted this article to the Libertarian Alliance Forum.]

Here’s an interesting titbit of news, which I just got from following a trackback to something else to this guy (and his blog).

The Guardian is starting a blog devoted to the single issue of abolishing agricultural subsidies.

Today (Monday, August 18, 2003) with only a few weeks to go before the World Trade Organisation meets in Cancun the Guardian is launching a new website with a single aim:

Help the poorest countries by kicking into oblivion All Agricultural Subsidies

(kickAAS)

This is, you might say, lefties giving leftism a libertarian hook, to refashion one of Perry de Havilland’s most favoured memes. I say, good for them.

I’ve always felt that in the long run (okay, the very long run), if libertarianism (okay, the Samizdata meta-context) were ever to triumph in the UK, it would be via the Guardian and by outflanking the traditional right, which has always had a lively sense of the revolutionary and hence to them regrettable nature of the free market. Guardianistas are trouble-makers first and only socialist centralists second and because this makes trouble for smug establishmentarians. If there’s libertarian (Samizdata meta … etc.) trouble to be made, they’ll make that too.

The message is bound to get spread around in some very unlikely places, many of them very angry and hostile places for such a message, that state spending doesn’t work at achieving its publicly stated goals and most especially doesn’t work at making poor people richer.

I expect a lot of regular Guardian readers to be angry about this. Good.

The Financial Times in an editorial chastises the U.S. Federal Reserve bank chairman Alan Greenspan for encouraging speculators, such as those mysterious bodies called hedge funds, to snaffle up bonds recently by cutting interest rates to ward off deflation, only to find that bond prices dropped sharply once it appeared the economic situation in the U.S. was improving. (It is too early to say for sure that things are getting better in the world economy though. Certainly not in Continental Europe).

I do not really have a quick way of picking through the rights and wrongs of the FT’s position. I think it is plainly daft that Greenspan, who remains one of the sharpest economic brains around, would have deliberately set out to con investors. What I do think this episode does, however, is reinforce in my mind the enormous risks of entrusting great economic powers to folk like Dr. Greenspan. In fact, the more highly regarded such men and women are, the more lethal the consequences when they slip up.

Even many folk who consider themselves to be ardent free marketeers can get caught up in near religious reverence for the great central banker. Financial speculators hang on every word. The most bland of statements are parsed for some deeper meaning. I have spent too many hours than I care to remember trying to work out if the statement of X or Y actually suggests that inflation is likely to up, down, or whatever.

The cult of the central banker is one of those belief systems of surprisingly short duration, by historical standards. Maybe in decades to come, we will look back on the era of Alan Greenspan and his ilk rather as we would that of the Medieval Popes. And we will be even more struck when we recall that Greenspan, when a young economics student and friend of Ayn Rand, urged a return to old-style private banking and the unfairly maligned Gold Standard.

Communist leaders plan to amend China’s constitution to formally enshrine the ideology of Jiang Zemin, the recently retired leader who invited capitalists to join the Communist Party. Despite sweeping economic and social changes, the political status of China’s entrepreneurs is still ambiguous.

There have been no details of the possible changes although foreign analysts say they include the communist era’s first guarantee of property rights. Certain amendments are still needed to promote economic and social development, said the party newspaper People’s Daily. It said the changes were meant to cope with accelerating globalization and advances in science and technology.

Jiang’s theory, the awkwardly named “Three Represents,” calls for the 67 million-member party to embrace capitalists, updating its traditional role as a “vanguard of the working class” and for the constitution to formally uphold property rights and the rights of entrepreneurs.

As someone who has more than passing acquaintance with communism, I see this is as a big change indeed. Even under most dire oppression you cannot entirely stop people exchanging goods and services. And so it was in the countries of the former Communist bloc, although the private sector was not officially recognised, there were shades of grey in the ‘socialist worker economy’. Former Yugoslavia, for example, ventured furthest in its recognition of private enterprise and some semblance of property rights and in return relatively prospered. Also in practice, Poland and Hungary were kinder to their small landowners and tradesmen than the communist ideologues allowed.

Nevertheless, there was no question of formally acknowledging property rights and any form of private enterprise by governments whose grasp of economics was based entirely on Marxism. It was one thing to tolerate existence of non-state markets and even benefit from them, but changing their opposition to individual’s property rights, so firmly embedded in political systems that were barely surviving, would have been a political, ideological and social suicide. (As a matter of fact, not changing it amounted to the same, just by other means: No, no, no, comrade, let’s not play with this (freedom of the press, speech, travel, association, trade, property rights etc) it has sharp edges and will cut your wrists, let’s just circle round the drain together, holding hands and singing the Internationale…)

China’s development has been very different to that of Eastern Europe, politically and economically, although both were waving the Red Flag. The proposed change to the China’s constitution may amount to a symbolic amendment given that China’s entrepreneurs have driven its two-decade-old economic boom. But then, symbols can be very powerful.

One of the more annoying things about modern large bookshops is that they divide the non-fiction books into a vast number of over-defined categories. This is not a huge difficulty if you are looking for a cookbook, or a book about trains, or a travel guidebook, as it is pretty clear what sections those books belong in. However, when we get to the social sciences things get hazy. If I am looking for (say) one of Ian Buruma‘s books on Asia (which are all worth a read, by the way), it is impossible to know whether the book in question will be on the shelves in “Asian History”, “Eastern culture”, “Travel writing”, “Sociology”, “Chinese History”, or one several other categories, even though if you look at all his books together they are clearly all have a very similar theme. It just does not fit into bookshop categorisation.

This is fine if you are looking for a particular book. You just ask at the information counter, they look it up in the computer and they tell you where it is and whether they have any copies. However, if you are trying to find it without help it can be close to impossible.

In any event, when I was wandering through my local branch of Books etc the other day, I found myself walking past a section I hadn’t noticed before, labelled “anti-globalisation”. That’s right, they had a section devoted to the works of Michael Moore, Noam Chomksy and the like. People who wanted to read such books can go straight to that section without having to be exposed to anything else. I’m sure they find this very convenient.

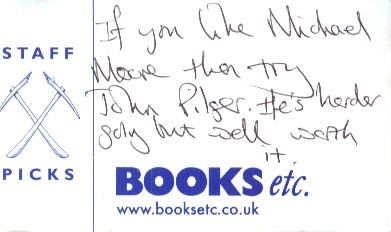

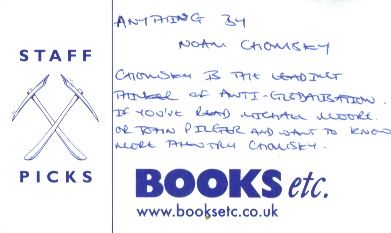

Even better, the bookshop encourages its staff to recommend books to customers. They even go to the trouble of giving their staff members little cards on which they can write down their recommendations and attach them to the shelves in the store. This is a good practice, as it may help readers find books and it also makes it clear that the booksellers are people who like to read themselves. But, even so, I had personal issues with the anti-globalisation recommendations.

Ugh.

Save me.

Seriously, I suspect that the number of people who have read Michael Moore and are not already aware of the existence of John Pilger and Noam Chomsky already is small (or perhaps I overestimate them). I think recommendations like this are better when they refer people who have read something well known to something that is both rather more obscure and also good. And Pilger and Chomsky are not especially obscure, however much I might wish it were so.

However, in the chance that there might be anyone walking through the bookshop who might have discovered Michael Moore but not Pilger or Chomsky, I thought I had a duty to save them from this (and also there was a Samizdata post in it). Therefore, although it was a bit naughty of me I removed the little cards from the shelf and walked out with them. (Yes, okay, technically I stole them. However, sometimes the ends do justify the means).

As I was walking out of the shop, it struck me that it would be kind of cool to get a few of the blank cards, write out a few book recommendations of my own, and then attach them to the shelves. However, when I thought about it some more, I realised I didn’t need anyone to supply me with a stock of blank cards. For I have the miracles of modern technology at my disposal, and I could produce some of my own. I could go back into the bookshop and leave something like this.

Or perhaps this.

The fun could be never ending. → Continue reading: Globalisation, bookshops, and the Anglosphere

Aristocracy [Late Latin aristocratia, government by the best, from Greek aristokrati : aristos, best; see ar- in Indo-European Roots + kratos, power; see -cracy.]. An aristocracy is a form of government in which rulership is in the hands of an “upper class” known as aristocrats. (The Greek origins of the word aristocracy imply the meaning of “rule by the best”.)

People like David Attenborough or almost anyone connected with Population Connection (a group which used to be rather more directly called ‘Zero Population Growth’), are technocrats at heart. Problems are identified, analyzed by experts and their solutions to those problems are imposed via political interaction. It is simply ‘rule by expert’ and there is quite literally no limit to the areas of life which is beyond the overarching gaze of the men and woman with letters after their names. When such people are given access to political power, no limits to what they can make you do or not do. The experts are, after all, the best and thus know best, and if people will not be swayed by their words spoken from the position of superior knowledge, then they must be forced to comply via the political system. They are the new would-be aristocracy in the literal Greek sense of the word.

In today’s Times of London (we do not link directly to The Times), David Attenborough, speaking for the Optimum Population Trust, demanded that the British state work to halve Britain’s population by establishing a ‘population policy’.

He said: “The human population can no longer be allowed to grow in the same old uncontrolled way. If we do not take charge of our population size, then nature will do it for us and it is the poor people of the world who will suffer most.”

[…]

[the Optimum Population Trust] believes that Britain should seek to reduce its population from its present 59m to about 30m by 2130 — about the same as the population in 1870. It wants economic incentives for women to stay childless, free contraception, a balanced approach to immigration and a government population reduction policy.

Indira Gandhi and Deng Xiaoping shared such views and enacted policies based on the realization that gentle prods will not stop people having children. Their views were based on crude pragmatism married with an honest understanding of the efficacy of coercive violence.

People like David Attenborough however take a rather more lyrical utopian view of nature and ‘sustainable economics’ (which in fact has nothing whatsoever to do with economics) and thus are rather more grandiose in their objectives. They seek to limit people’s right to have children or to travel the world or engage in ‘wasteful’ or ‘harmful’ economic activity generally that is not approved of by…well, them, of course. They wish to restore balance and harmony. This sort of idealized view of nature and man’s place in it (or lack thereof) was something that would have gained approving nods not just from idyllic ruralist 18th and 19th century poets but also Heinrich Himmler.

For these people there are no ‘market’ solutions caused by the social interaction of free people, because that would allow the possibility that free people may simply ignore the ‘wise words’ of The Best. In a political system, rather than a social system, there are only a few people who must be convinced and manipulated, and thus it through coercive collectivist politics that the new technocratic aristocracy seek to apply their ‘wisdom’.

At least the Voluntary Human Extinction Movement are not trying to use the violence of state to make people comply. The same cannot be said of Sir David Attenborough and his collectivist ilk.

A debate is currently raging in libertarian as well as in less refined political circles about whether the USA should allow ‘reimportation’ of prescription drugs. Basically, the problem is that patented drugs in the US are sold at prices much higher than they are available overseas. Patented drugs are the newer drugs for which no generic equivalents are available, giving the patent-holder a monopoly on that drug while the patent endures.

The drugs are available more cheaply in other countries for a variety of reasons, but in large part because the governments of those other countries have intervened in the drug markets to set prices. Canada, in particular, has ‘negotiated’ some sweet deals for high-demand drugs, and Americans have flocked across the border to get some of that cheap drug action. With prescription drug prices soaring in the USA, legislation has surfaced to allow drugs to be ‘reimported’ from these socialist havens at the prices that prevail.

On the one side, many libertarians see lifting the ban on reimporting as a simple case of freeing up the market to let it do its magic. Probably the best case that I have seen for this side of the ledger is Conservative Drug Split at National Review Online.

However, it seems to me that this approach overlooks some pretty major issues. Leaving aside the safety issue, which my clients in the drug industry assure me is no straw argument, I do not believe that the cause of free markets is well-served by allowing reimportation.

To cut a long and sordid story short, prices are so cheap in other countries because the governments of those countries demand that the drugs be sold at slightly above their production cost. They can do this because (a) in many countries the government is a monopsonist via the national health system and/or (b) the government simply threatens to break the patent and start manufacturing the drug itself (or allowing someone else to manufacture the drug).

To claim that the sale or reimportation of drugs that are priced under this system has anything to do with the free market strikes me as delusional. First, of course, the prices now obtaining in these markets are not market prices, but are monopsonist prices extracted by threatening to break the patent. Keeping these drugs out of the relatively free US market is no more of a barrier to free trade than keeping the local fence from selling stolen TVs out of the back of a truck.

Proponents of reimportation seem to assume that, when reimportation is allowed, the drug companies will go to these nations and threaten to either cut them off or raise their prices, and the governments will meekly go along. This in turn assumes that these governments will not simply break the patents, as they have repeatedly threatened to do and in fact have occasionally done in the past. Nor am I convinced that breaking the patents will result in any real consequences for the nations that do so. The only hammer over these nations would be the WTO or other treaties, and I do not believe that the government of the US would go to the mattresses to protect Big Pharma’s patents. It never has in the past, and there is no reason to believe that it would in the future. With reimportation allowed, in fact, the US government would have to be crazy to do so, as protecting the patents overseas would dry up sources of cheap drugs that reimportation allows back into the US.

Sadly, the lure of cheap drugs is too much for your average politico to resist, so I think we can look forward to the corruption of the US drug market by overseas socialism.

On his culture blog, Brian Micklethwait provides a reference to a preview of an American television program about the reactions of the muslim world to a perceived onslaught of American television and movies, and how they are perceived by many as “overt propaganda created to undermine their religious and cultural identity”, and yet that at the same time, people love to watch them.

Brian has some has some wise thoughts on the subject himself, and concludes by observing that inevitably the culture must move in two directions.

But all will eventually be well. They’ll make their own shows, that satisfy their young, but deflect the complaints of the complainers.

And then we’ll watch their shows too.

This all invites questions about just how cultural programming – television and movies – propagates around the modern globalised world, which is ultimately much more interesting than simply “America is trying to dominate the world with its propaganda”. It’s both simpler and much more complex. For one thing, American programs are not meant as overt propaganda, and they are certainly not aimed at the Muslim world. Hollywood is trying to make money, and that is all. The Muslim world is such a small market that Hollywood is essentially not paying attention at all, and this is even more so in the case of television than in the case of movies.

For there is a huge difference in the overseas reception of American television and American movies. American movies dominate the box office everywhere pretty much without exception. Local movies have a much smaller market share than American movies virtually everywhere, and Hollywood is selling the same movies to the entire world. Hollywood movies today make more money outside the US than they do inside the US (almost all of which comes from Europe and East Asia), so Hollywood is very conscious of what foreign audiences will want to see when making movies. Often this leads to what may be described as “lowest common denominator” film-making. Movies containing lots of explosions are popular everywhere. (Comedies travel far less well, which is why Hollywood makes fewer of them than it used to, and is why they have smaller budgets). However, rather than turning movies into “overt propaganda”, this tends to make movies bland. American film production does interact with the rest of the world, but in a slightly less direct way. Hollywood has a ferocious appetite for talent. Anything good that is done by filmmakers in the rest of the world tends to get co-opted by Hollywood. If audiences like Hong Kong style action sequences, then these will find their way into American film. The people making the films in America will often be the same people who made the ones in Hong Kong, working in Los Angeles and being paid far more (and working shorter hours) than was ever the case on the other side of the Pacific. When a film financed by a Hollywood studio but made by a Hong Kong filmmaker and filmed in Canada is shown in Spain, it’s a bit hard to tell just whose culture is being influenced by what. (I will be intrigued to see what happens when Iran becomes less oppressive, and some of the country’s many talented film-makers get the opportunity to make films in Hollywood. The thing stopping this is the political situation in Iran and certainly not that in Hollywood.)

The propagation of American television is totally different, although the final conclusion is perhaps the same. → Continue reading: Movies, Television, and Globalisation

Phil Bradley observes a nasty combination: voodoo science allied to voodoo economics

The European Parliament’s adoption last week, of ‘the world’s first Kyoto Protocol mandated multi-national emissions trading scheme (ETS) covering greenhouse gases’ gives me an opportunity to rail against the biggest government instigated boondoggle in the history of the world – namely the Kyoto Climate Change Protocol. Yes, it still rumbles along, destroying prodigious amounts of wealth without producing any measurable benefit. 117 countries are now signatories, although it has no material effect on most of them, except to funnel some money from rich countries into projects of dubious value. The latest signatory is Switzerland, who, reading between the lines, did so under pressure from the EU.

No one really knows how much Kyoto is costing, or how much it would cost were it to be fully implemented, which it never will be. All we do know is that it both reduces growth and diverts resources into economically pointless activities. This link estimates that by 2010, Kyoto will cost the UK around US$35 billion a year, and result in the permanent loss of half a million jobs. Reams of left-wing econo-babble has been written on how Kyoto will actually increase investment in windmills or whatever and stimulate economies. The simple fact remains that any increase in resources to produce the same result necessarily makes us poorer.

The Kyoto Protocol is an object lesson in what happens when you combine agenda-driven leftists with some dodgy science, a media that is mostly ignorant about most things, and politicians who want to be moral and righteous irrespective of the cost to the taxpayer. Bring them together in a UN sponsored framework that is not accountable to anyone, and you have the right formula for this madness.

Climate change is something I have been interested in for long time. In part, it probably stemmed from spending my childhood playing in the woods and fields situated on a glacial terminal moraine that marked the southern limit of last great ice advance across England. I recall being suitably awestruck when someone explained to me that 10,000 years earlier, where I was standing was the edge of a great ice sheet that stretched all the way to the North Pole.

Climate changes, has always changed and will always change. While we have an imperfect understanding of the mechanisms underlying the changes, we do have accurate data on the climate cycles themselves. These cycles vary from a few years to many thousands of years, and perhaps millions of years. To take England as an example, since the Norman Conquest, the climate has varied from about as warm as the south of France, to about as cold as south central Sweden. The last century has been more or less in the middle of the range for the last thousand years.

The weather is something people can relate to. It is immediate – they can see and feel it, and it affects their lives. In particular, extreme weather can be very disruptive to people’s lives. The Left is always on the lookout for anti-capitalist issues. When some scientists started to suggest that man-made increases in carbon dioxide levels in the atmosphere were causing a warming trend in the climate, then it did not take long for the media to start publishing alarmist stories of super-hurricanes, floods and droughts of biblical proportions, rising sea levels flooding whole countries, and wholesale extinctions of animal and bird species. It made great copy on a subject people were interested in, and was written by self-styled environmental correspondents. Most of whom graduated in media studies or similar and could not pass a basic high school science exam.

A number of unusually hot summers in North America have now given way to a number of unusually cold winters, in line with a well-understood short-term climate cycle. It also appears that much of the widely publicized increase in global temperatures over the 20th century was a measuring artifact due to most measurement points being in urban areas that are getting warmer for reasons that have nothing to do with global warming. Anyone interested can find more information here.

In the mean time, global warming was ‘clearly’ a problem for the whole world and of course that well-known fixer of the world’s problems, the United Nations, got into the act, resulting in Kyoto. Even if the world were facing a global catastrophe (and don’t imagine for a moment that it is), Kyoto doesn’t fix the problem. All it does, in line with left-wing agendas, is hobble developed countries with huge costs, it does nothing to limit the fastest growing carbon emitters – the developing world, and picks a ludicrously arbitrary target of some percentage of carbon emissions in a particular year for a country, and for which there has never been any scientific justification. If atmospheric CO2 really were a problem, then probably the only way to fix it would be to build a massive infrastructure to scrub CO2 from the atmosphere. Of course, it is not a real problem and Kyoto is not a real solution.

Of the countries that are affected by the Kyoto Protocols (and most are not), the USA has, as usual, taken the most rational approach, and rejected it outright. Japan has decided that compliance will be voluntary – what ever that means. In both Canada and Australia, Kyoto remains deeply controversial. Australia has yet to ratify it, and while Canada has, there is still substantial resistance from the provinces (you would think Canada would be in favour of some climate warming). Which leaves Europe left holding the UN’s baby, valiantly trying to save the world by implementing Kyoto, and in the process impoverishing its citizens. As usual!

Phil Bradley

Cobden Bright posted a comment in an earlier article that deserves the prominence of full posting, slightly edited. This follows on from The Anglosphere and Economic Freedom

The fact that a country taxing over 40% of GDP from its populace can be considered the 5th most “economically free” country in the world is rather depressing. Let’s face it, most countries on that list are not economically free at all – they are just slightly less bad than most of the others.

The people at Cato also seem to have forgotten about tax rates. A person paying 0% tax is in most respects an economically free man – someone paying 50% per year is a slave for half their working life. So they should have included tax havens like Monaco, Bermuda, the Bahamas, Cayman Islands etc, and low tax larger countries like Russia.

Also, as noted by a previous poster, it is actions, not written laws or words, which achieve freedom. A backward country with repressive laws may be freer for you personally if those laws are not enforced, or avoidable at low cost via bribes or cunning. So a corrupt backwater may be relatively free in real terms, whereas a “free” country like America will tax you ruthlessly even if you move to live on the other side of the world, and will exact severe penalties for certain voluntary economic exchanges (e.g. buying a joint or a Cuban cigar).

Which raises the final question – is there any meaningful distinction between economic and personal liberty? I would say no. How free are Hong Kong, Singaporean, UK or US citizens to buy and sell firearms, narcotics, or sexual entertainment?

Finally, there is a bizarre tendency for everyone to take GDP figures at face value. Remember who makes these up? Yes, that’s right folks, it’s our old friend the government. So take GDP figures with a pinch of salt. Firstly, much government spending, most of which is highly wasteful, is regarded as a positive contribution to GDP. So employing someone on $30k per annum to build bridges to nowhere is seen as economically just as “good” in GDP terms as paying someone $30k per year to build a house, or work as a doctor or shopkeeper. Yet obviously the latter activities are productive, and the former destructive or at best worthless. This focus on production per se, rather than useful production, means utterly worthless projects drive a country up the GDP ranks. Thus countries with large amounts of state spending get an artificially high GDP rating.

The only real way to measure economic prosperity is to visit a place for a while and see what kind of real living standards prevail. What kind of cars do people drive, what clothes do they wear, how nice are their houses, are the streets clean, how good are the restaurants, how long does it take to get from A to B?

Cobden Bright

I’ve just watched the film Wall Street for the very first time. I know I’m a few years late, but c’est la vie. The movie subjects viewers to the economic fallacy that asset stripping does not create wealth.

When financiers asset strip a company, they do something very useful. They take assets that are not being used efficiently, and change their use to something more valuable. It may not be nice for those employed by the company, but the country as a whole is better off as a result.

“But it may be that I shall leave a name sometimes remembered with expressions of goodwill in the abodes of those whose lot it is to labour, and to earn their daily bread by the sweat of their brow, when they shall recuit their exhausted strength with abundant and untaxed food, the sweeter because it is no longer leavened by a sense of injustice”.

– Sir Robert Peel, British statesman (1788-1850)

The quote by Peel above, coming as it does from one of the greatest of British statesmen and a free-trader who paid a high political price for his convictions, ought to be remembered as we contemplate the recent trip by President George W. Bush to Africa, and indeed the trips by numerous western leaders to the poorer parts of the world.

We live in times when we are constantly told that it is the duty of the prosperous industrial nations to help lift their poorer peers, such as in Africa, to a wealthier state. And yet nothing could be more useful in that aim than if governments, such as those which support the EU and U.S. farm subsidies, chose the path of genuine laissez faire.

Sir Robert Peel may not be a name familiar to many people today – more’s the pity. He may be mainly known as the man who established London’s Metropolitan Police (which is why our police are still sometimes called “bobbies”).

When one considers how he put the industrial future and prosperity of the masses before the vested interests of the land by embracing free trade, the dimwits who inhabit our government today look very small indeed.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|