We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

Incoming from Sam Bowman of the Cobden Centre (and also the Research Manager and Blogmeister at the Adam Smith Institute – most recent blog posting here):

This Thursday 28th October, the world’s leading economist of the Austrian school – Jésus Huerta de Soto – will be giving the first annual Hayek Lecture on the topic “Financial Crisis and Economic Recession”. The lecture is a great chance to hear about the Austrian Business Cycle Theory from its leading living theorist. It’s free, no advance tickets are needed. It starts at 6:30pm and full details are available here.

That event has already been flagged up (although somewhat imperfectly!) here. The Cobden Centre head honchos are hoping for a good-to-bursting type turnout, to keep the buzz they are already creating buzzing along and buzzier. So if you can just show up, do. No compelling need to listen to everything that carefully, or not first time around, because unless things go badly wrong the event will be recorded. I will be going, and I expect to learn a lot.

And there’s more:

A conference is being put on in London on Saturday 13th and Sunday 14th of November by the Positive Money campaign. The conference is not Austrian – there will be speakers from a range of intellectual viewpoints – but it will focus on the issues of money and banking and will have lectures from several Cobden Centre board members, including Toby Baxendale, James Tyler and Steve Baker MP. Full details are available here.

One of the things I most like about the Cobden Centre is how they cooperate so enthusiastically and helpfully with other groups which have broadly (rather than merely narrowly) similar agendas, that latter event being typical of this mind-fix.

This article by one of the Home Depot founders has been out for a few days, but I thought it would be good to put it up as it communicates, with a sort of barely suppressed rage, how businessfolk in the US feel patronised and insulted by the sort of policymakers in Washington, obviously starting with Obama.

And I would happily wager that there are a lot of business people who feel pretty much the same way about the UK, as well. I just wish we would have more entrepreneurs making these kind of comments.

Probably the most devastating take-down yet of the economist and leftist news columnist I have ever read. The man’s credibility is in total ruins. The stuff at the end about the housing bubble is the killer. Read the whole thing.

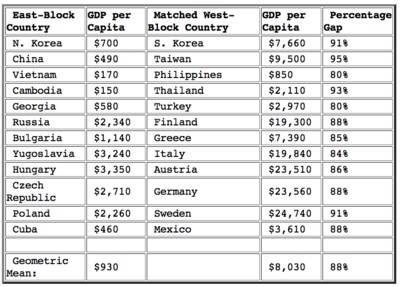

When in my teens, in the 1960s, I wondered what rules were best for governing the world, and the nations in the world. Comparisons like this (featured by Tim Worstall at the ASI blog today, he having come upon it here) helped me to decide:

As Tim Worstall notes:

[T]he countries are matched as to rough starting point before the communist armies marched, matched roughly as to culture and so on, and yet after that series of communist experiments we see the same result everywhere.

Exactly. It was the matching of like (to start with) with like that was most telling. And before 1990, we also had the damning comparison between East and West Germany (very near to my English home) to contemplate.

So, said contemporaries who were drawing more nearly opposite conclusions, you want sweatshops like they have in South East Asia? With growing confidence, I learned to say: yes. If people in South East Asia now have sweatshops, that’s a pity. They must be very poor. But how will shutting down those sweatshops make them any less poor? You’re saying poor with hope of escape is worse than poor with no hope at all. That sounds downright wicked to me.

That time proved me, and all who argued as I did, right was one of the big reasons for communism collapsing where it did collapse, and trying to insert capitalism into itself where it did not.

Some libertarians now live in dread of a time when such comparisons will no longer be possible, because the entire world will be equally stagnant, and nobody except them will be able to see this. Some people are determined to be miserable.

El socialismo es contra la prosperidad.

– Instapundit flags up an aspect of the Tea Party that doesn’t fit the one party media narrative.

In the UK edition of Wired magazine is an article on the use of environmental markets in which, for instance, property developers or industrial users of water pay others, such as owners of wetlands or somesuch, if they want to make a development. The way the article is written gives the impression – at least in my eyes – of this being a great example of how capitalism and the Greens can work together. I am not so sure.

For instance, take the idea of “banks” of wetlands. Typically, what happens is that a government, such as the US one acting under legislation, will decree that there can be no net loss of wetland in given geographical area A, so if any area of wetland is destroyed, then the destroyers must offset this by paying to create another area of wetland somewhere. I immediately see a problem here: someone in authority has decreed that whatever happens to be the area of wetland at the time the new system is introduced is the area that must be maintained ad infinitum; but why not say that the area should be twice as big, or three times, or four times, or half as big? Also, the supposed “market” for such development permit trading depends on the existence of government regulations of certain areas, like wetlands, which might clearly go against the property rights of the folk who have owned those wetlands in the past and might have wanted to turn them into golf courses or whatever.

To be fair, though, the article does address the fact that property rights or markets of some sort represent a smarter way of addressing issues such as conservation, pollution and so on than traditional “lets just ban it” approaches used in the past. The article contains a great example of how the French mineral water industry did a deal with farmers over the latters’ use of fertilizer and pesticides in order to protect the water and keep the farmers happy. That is the kind of market transaction that works, and probably could have worked without government getting involved. My worry, though, is that a lot of such artificial markets in things such as environmental resources can become prey to corruption and mission creep of all kinds. Nigel Lawson, for instance, wrote dammingly about carbon trading in his recent book on the global warming controversy.

I would love to hear from AEP, or from Prof Congdon, exactly how creating money is supposed to create wealth.

If the Central Banks of the world buy private sector bank debt, they create new demand-deposit money that the private sector banking system can then lend. So more money units chase the same goods and services? Where is the new wealth?

– Toby Baxendale

With apologies to all for whom this is stale news, I want to report on Ezra Levant’s latest book. Remember Ezra Levant? Yes, the guy who put his head way above the parapet to defend freedom of speech against the ridiculous ‘Alberta Human Rights Commission’, which had been busy trying to stamp it out.

I have not been paying much attention to Ezra Levant lately, but last night I happened to re-visit his blog, and I soon struck gold. Or rather: black gold. Oil. Shale oil, to be more precise.

A commenter on this later posting by me here about Levant mentioned Canadian shale oil, and now Levant has written a whole book about this.

Canadian shale oil is taking a huge bite out of the market share of those Middle Eastern terror paymasters who have been such pestilential opponents of free speech in the West in general and of Ezra Levant’s free speech in particular, which could just be how Levant got interested. The Greenies hate Canadian shale oil, probably for that same reason. The Mainstream Media … well, that bit’s obvious. What’s not to love about a book saying hurrah for Canadian shale oil?

As I say, lots of Samizdata readers will have seen these bits of video, of Levant talking about this book, Ethical Oil (brilliant title, yes?), at least a week ago. I’ve only had time to watch and hear half of the first bit of video, but already I know that any Samizdata readers who do not yet know about this book will likely be very glad to hear about it now.

Many bad things have happened during the last decade. One of the best things to have happened during that same time is that books like this one of Ezra Levant’s – thanks to all of, you know, this – can now become as widely read as they deserve to be.

Lord (Robert) Skidelsky is the biographer of JM Keynes. Keynes is, as regulars here know, a man generally regarded as the “dark knight” of economics, a man who made intellectually respectable notions that had been often regarded as little more than the ploys of quacks and charlatans. Books by Henry Hazlitt and William Hutt, for example, have in my view pretty much demolished his central idea: that the way to get out of a recession is for governments to print money in large amounts and hopefully, when the sun comes out from behind the clouds, to turn on the monetary and fiscal brakes later on. It is an approach that was destroyed by the stagflation of the 1970s, when a combination of high unemployment, out-of-control trade union power, low growth and skyrocketing prices forced policymakers to seek alternative sources of wisdom, in the forms of Friedman, Hayek and the rest. However, the attempts by governments to revive their economies in the past few years have given what I consider to be a spurious impression that Keynes’ ideas are still appropriate to our time. I disagree.

Skidelsky argues that the current Tory/LibDem coaltion government is making a fearful error in trying to reduce debt and spending. He also argues that what the world needs right now is a new sort of Bretton Woods agreement, moving on from the original deal as signed in the 1940s at the end of WW2. That agreement achieved, among other things, strict controls on capital flows between nations. It is hard for younger people to realise that it was not all that long ago that it was illegal, for example, for Britons travelling abroad to take more than a small amount of money out of the country without explicit consent. This is serfdom: if people are banned from taking money from place A to B even if they have earned it, then what is the difference between that and a serf seeking the consent of his lord before moving to another village down the road?

And in any event, as Lord Skidelsky knows only too well, the BW agreement eventually failed because of a combination of forces: rising government deficits, rigid, unionised labour markets and inflation (caused by things such as Vietnam War, the Great Society welfare policies in the US and UK); the oil crisis of the early 1970s, and developments such as the offshore Eurodollar market, which encouraged a relatively unregulated, vibrant financial market that made BW increasingly hard to operate. The stresses proved too great; the US finally severed any link between the dollar and gold during the Nixon presidency, and Bretton Woods was dead. A good summary of how it all went wrong can be seen in this recent book by Deepak Lal.

Keynes was not completely wrong on all the topics of the day, and to his great credit, the post-war settlement did include attempts to foster free trade and reduce protectionism, which policymakers realised had been such a disaster in the 1930s. But the idea of governments spending vast sums of central bank funny money as a way to deal with the results of previous monetary excess looks less and less wise with every day that passes. Keynes still has his devotees, such as Paul Krugman, but his ideas are not, by and large, what are needed to get us out of our current predicament.

In case you missed it, Apple is already the second biggest corporation in the world in terms of capitalization and is poised to pass Exxon as number one, possibly this winter with the iPad this year’s most coveted Xmas gift. The Silicon Valley company is sitting on some 50 billion in cash, pretty well positioned to do whatever it takes to maintain their technological/aesthetic edge. That’s one helluva long way from two young guys in a garage, tinkering with a computer. It’s close to the most extraordinary business story of all time.

– Roger L. Simon. Today I wrote out a cheque for a new super-fast computer, but not an Apple Mac, a PC. But, what kind of purgatory would the PC be in now, without the Mac keeping it semi-honest and semi-friendly and semi-nice-to look-at? Thank you Bill Gates, but thank you even more: Steve Jobs.

“It is true that individual financial institutions made bad decisions. In my opinion, they should have been allowed to go out of business—that would have been the proper way for them to be handled. However, their decisions were secondary to government policy. It should be remembered that the Federal Reserve owns the monetary system in the United States; we do not have a private monetary system. In 1913, our monetary system was nationalized. If you’re having problems in the monetary system—which is where the problems in the economy began—they are, by definition, government problems. This is analogous to interstate highway bridges falling down: If interstate highway bridges were falling down, everyone would recognize that the government owns the highways and conclude that this is a government-caused problem. Well, the government owns the monetary system, and the errors by the Federal Reserve are the foundations of the financial problems we’ve experienced.”

John Allison, former CEO of BB&T, who is that rarity in financial services, a genuine free marketer who knows what the prime cause of the credit disaster has been.

(The quote is taken from an interview of Allison by The Objective Standard, a fine magazine. Most of the articles are behind the subscriber firewall.)

This is a headline in the leftist New Republic magazine, over an article lauding any kind of US government spending, by Jonathan Cohn:

“Wanted: More Fraud, Abuse in Government Spending”

Here’s a paragraph to show just how far down the Keynesian rabbit-hole parts of the pro-stimulus crowd have gone:

“But efficiency isn’t the Recovery Act’s primary purpose. Reviving the economy is. And that’s required spending a vast amount of money very quickly–a goal that, inevitably, is at odds with spending the money carefully. Or, to put it another way, a stimulus that threw a little more money away might have created more jobs.”

So “throwing away” money – which is ultimately not the government’s to “throw away” but belongs, or is claimed, from individual citizens – “creates” jobs, does it? So if the US unemployment rate is stubbornly holding just below 10 per cent – a miserable result – then what is needed is yet even more spending, more money printing. These guys remind me of what was said, not always fairly I might add, of WW1 generals, who, when faced with the failure of their latest mass infantry assaults against the German army in Flanders, were urged for one more push, one more bout of bloodletting and hence on to victory.

Einstein once defined madness, I recall, as the repeating of an error and failing to learn from such errors over, and over again. By that measure, parts of the media and commentariat in the US are out of their conceited, Keynesian minds.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|