We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

The headline says ‘Europe declares war on rating agencies‘:

Wolfgang Schauble, German finance minister, said there was no justification for the four-notch downgrade or for warnings that Portugal might need a second bail-out. “We must break the oligopoly of the rating agencies,” he said.

Heiner Flassbeck, director of the UN Office for World Trade and Development, said the agencies should be “dissolved” before they can do any more damage, or at least banned from rating countries.

Now ponder that for a moment… what is a ‘rating agency’? It is a company that states an opinion regarding credit worthiness. And those opinions are only significant if people who make investment decisions think the opinions in question actually reflect reality, i.e. the opinion has some credibility.

So what these quoted members of the political class are calling for is banning credible opinions about the consequences of decisions by, er, people like themselves.

Astonishing. And in reality rating agencies have a history of excessive optimism, only downgrading ratings long after the dots were joined by anyone who has been paying attention.

Yesterday, there was a mini-rebellion in Parliament, to be precise in one of its Committee Rooms. Britain’s (increased) IMF subscription was being discussed, and although it got through, there was a little flurry of excitement, as Guido reported:

Something very rare happened in what is usually the dullest of committees. A dozen or so Tory non-members of the committee came and spoke against affirming the instrument. Government whips cajoled the pliant Tory and LibDem members of the committee to vote to affirm the instrument while Tory MPs spoke from the floor against it. Promising new boy Steve Baker and backbench eurosceptic Douglas Carswell were among those who spoke against affirming the instrument.

You can now read what was said in Hansard.

When these kinds of things are argued about, everything depends on whether the contrariness on show is a genuine argument that we should switch to an alternative and better policy, or merely grumbling. If all that is happening is that people don’t like whatever it is, what with them not having created the problems (or so they say) with their decisions, and what with all the cuts they are having to put up with now, well, frankly, that doesn’t count for very much. If the powers that be are able to say: Well, what would you do that would be any better? – and if you don’t then have an answer, you might as well not have bothered. All you are saying is: This hurts. And all that the government has to say in reply is: Yes, we hear you, we feel your pain, but we are going to do it anyway, because despite all the pain, we remain convinced that this is the best thing to do.

Scroll down at Hansard and you can read, in particular, what Steve Baker MP had to say. The thing about Baker is that he really is arguing for a paradigm shift in economic policy thinking. He even quoted a chunk out of Human Action, which I think I will quote here, again:

The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion.

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” (Human Action, p. 572)

Baker is not just saying: this is a crisis. Everyone knows that. He is also saying: and we need to have the crisis, now, all of it and get it over with as soon as we can.

Hayek also got a mention, as did Jesus Huerta de Soto, who gave the Hayek Memorial Lecture last October.

This is the kind of politicking that is capable of having actual impact. Not now, and certainly not right away, but … in the longer run. In the longer run, ideas can change.

LATER: The Cobden Centre blog now has a more user friendly version of Steve Baker’s words, here.

Sport, especially when it gets big and successful and financially significant, is incurably political. This is because, when it gets big and successful and financially significant, it can’t be run like the car industry or the computer chip industry. If you think the current range of cars or computer chips on sale are rubbish, you can go into business on your own, and make better cars or computer chips, or you can import better cars or computer chips, or you can make what you reckon to be better car components or better chip designs and then try to sell them to the various car or chip companies, and if one car or chip company won’t buy them, you can try the others.

Car and computer chip companies can also get very political, but at least there is a decent chance that they will be run approximately like real businesses, competing with each other, and in a form which allows malcontents to express their discontents commercially rather than politically.

But, if you don’t like how your sport is run, you and your friends walking out of the AGM in a huff and starting your own version of that same sport is not any sort of solution. That, actually, is a pretty good one line description of the fundamental problem. (Consider what happened to rugby, when it split into rugby league and rugby “union” (hah!). Think what rugby, league and union, now is. Think what it might have been.)

Everyone who wants to be part of running their favourite sport is stuck with each other. All must somehow agree on the same set of detailed rules. All must cooperate to contrive competitions of the kind they all want, or at least are all ready to live with. All must submit to the same “governing” body. When a car company competes with another car company, they don’t need to communicate at all. When a sports team competes, in the sporting sense, with a rival sports team, there has to be a minimum of civility involved, otherwise they’d never be able to fix a time, a place, or officials to adjudicate. Sporting fixtures need fixing, cooperatively.

Sports only compete in the purely commercial sense, uncontaminated by the need for any “politics”, in that an entire sport competes with other entire sports. In new and small sports, everyone is in a very basic sense on the same side. But when things start to go really well, there start to be fights within the sport, about the rules and for the spoils. Small sports tend to be run well and amicably. It’s only when they get big that the trouble starts.

My particular favourite sport happens to be cricket, and cricket, now as always, is riddled with political problems.

In the course of giving a lecture recently at Lord’s, the highly respected former captain and still current Sri Lankan player Kumar Sangakkara, identified the moment when things started to go wrong for cricket administration in his country:

Sangakkara pinpointed the country’s most powerful moment of national unity – the World Cup final victory over Australia in 1996 – as the moment the sport’s administration changed “from a volunteer-led organisation run by well-meaning men of integrity into a multimillion-dollar organisation that has been in turmoil ever since”.

Precisely.

The other way that sports administration can go horribly wrong is when the politics of the country itself goes so horribly wrong that it screws up everything in the country, sport included. This happened in recent years in Zimbabwe, and Pakistan cricket is a constant source of worry to cricket people everywhere for those kinds of reasons.

It would be tempting, then, for a devotedly anti-politics libertarian like me to crow with joy at a report like this, which is about how the world governing body of cricket is telling national governing bodies of cricket that they must be free from political interference.

However, in this report, we read this:

The change is something the ICC has been keen on for some time, to try and bring governance of cricket in line with other global sporting bodies such as FIFA and the IOC.

The ICC is the cricket governing body, FIFA the soccer governing body, and the IOC the Olympic Games governing body. The latter two are constantly in the news because of political turmoil and because of thoroughly well-founded allegations of corruption. And yet here are cricket administrators, without any apparent sense of irony, putting these two bodies forward as models to be emulated, to create a cricket world free from “politics”. Where, as a Samizdata commenter might say, do you start?

I’ll start with that horrible word “governance”, a euphemism regularly perpetrated nowadays by politicians to describe politics, but without calling it “politics” because politics sounds too sordid and nasty. Talk of “governance” at once tells us that global cricket administration remains what it has always been, a zone of political bullshit rather than any kind of new nirvana of enitrely prudent and totally stress-free sports administration. Only the nature of the bullshit changes. It used to be imperial and British-flavoured; now, as the new money of the Indian middle classes floods into cricket, the bullshit is more Indian-flavoured and commercialised. (See, for instance, what another former international cricket captain, Ian Chappell, has to say about the ICC.)

The truth is that this is not an argument about whether cricket should be political, merely about what sort of politics, national or global, should make the running, in the running of cricket.

In this respect, cricket resembles the world, I think.

As briefly mentioned in a post below, people – a lot of them who seemed to be classical liberal stirrers like yours truly – gathered in the sun-lit gardens in front of the US Embassy, Grosvenor Square, to witness the unveiling of a statue of Ronald Reagan. I like this editorial in CityAM by Allister Heath, who signs off with these two paragraphs. His comment about JF Kennedy is very much on point:

“In fact, Reagan wasn’t even that original. The best exposition of how tax cuts can reinvigorate an economy remains Democratic president John F Kennedy’s spectacular 1964 reforms, which reduced the top rate from 94 per cent to 70 per cent (Kennedy was assassinated in 1963, of course, but his tax cuts were agreed prior to his death). Two years later, the federal tax haul was 11 per cent higher than forecast: more people made more money and their taxable efforts more than compensated for the reduced tax rate. Kennedy had been proved spectacularly right when he had argued that “an economy hampered by restrictive tax rates will never produce enough revenues to balance our budget just as it will never produce enough jobs or enough profits… In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now.”

“In 1981, Reagan reduced the top rate of income tax to 50 per cent. In 1986, he cut it again to 28 per cent. Of course, this benefited the richest disproportionately – but they nevertheless ended up shouldering a greater tax burden and paying for a greater proportion of public spending. The share of tax raised from the best-paid 1 per cent jumped from 19 per cent in 1980 to 25.6 per cent in 1990. The moral: to squeeze more tax out of the rich, lower the top tax thresholds. We learnt that in Britain starting in 1979 – but with top earners now taxed at 52 per cent and millions paying 42 per cent, the lessons have been forgotten again. Britain needs to discover its very own Ronald Reagan, a hopeful, optimistic, pro-individual liberty, pro-growth politician with an uncanny ability to communicate. Any takers?”

Well said. In a spirit of fairness, though, I link to an interview with Reagan’s former budget director, David Stockman, who is a fierce critic of the deficits (he also strikes me as somewhat embittered). I am not sure if his call for tax rises in the absence of any serious spending cuts is going to find any welcoming audience. I also think Stockman is far too dismissive of the fact that because of the Reagan supply-side tax cuts, revenues boomed.

As Heath says, hero-worship is something any genuine liberal should avoid. The list of heroes in public affairs is, as far as I can judge, short. Reagan is one of them.

“Will militant unions derail big fat Greek sell-offs on the rocky route to recovery?” sayeth the Telegraph.

Well anyone buying Greek infrastructures with private money deserves everything they will get… it would be easier and probably less stressful to just flush the money down the toilet and call it ‘performance art’.

Leave Greece to circle the drain as a prime example of Mencken’s observation:

“Democracy is the theory that the common people know what they want and deserve to get it good and hard”.

Greece will just be the first of many as the vast ponzi scheme that is the ‘welfare state’ reaches its climax set to Bouzouki music playing faster and faster…

An interesting item about how economists influenced by the teachings of the late JM Keynes are falling out with one another.

Here is a quote worth pondering from Henry Hazlitt: “Keynes constantly deplored saving while praising investment, persistently forgetting that the second was impossible without the first.” Page 203, The Wisdom of Henry Hazlitt.

Too many of our internet dreams depend on the internet being far less vulnerable to governments than it actually is.

– August, commenting on a posting at my place about Bitcoin.

I suggest comments about what August says about the internet: here. Bitcoin comments: there.

I see that my fourth (approximately, I think) cousin John Micklethwait, Editor of the Economist, whom our own Paul Marks disapproves of so severely, is this weekend attending a meeting of the Bilderberg Group.

I learned about this list of potentates thanks to a link to it from Guido Fawkes, and I consider it rather significant that such an august media personage as Guido should be positively drawing our attention to this gathering.

When the internet got seriously into its stride, and particularly blogging, at or around the year 2000, you would have thought that observation and analysis of the global elite would have exploded. After all, detailed analysis of these persons and their thinkings and their doings was the quintessential Story They Don’t Want Us To Know, in other words, a story that was ready-made for the internet.

Yet, actually, very little was said about these persons and their meetings and their secret thinkings aloud, by regular people as opposed to the people who were already fascinated by such things. Oh, I’m sure that the people who had been banging on about the evil Bilderbergers for the previous quarter of a century immediately started publishing vast screeds about these persons on the internet. But, or so it seems to me, very few other people paid such talk very much attention. And so, pretty much, it has continued.

Why? Was it because bloggers who dipped their toes into these hitherto forbidden waters were visited by sinister people in sinister raincoats at sinister times of the night? Did those who mentioned the Bilderberg Group on the internet suffer mysteriously fatal road accidents?

I can’t speak for others, but the thing that kept me away from talking about Bilderberg meetings and similar things was not the fear of Them, but the desire not to be thought completely mad, by people generally. → Continue reading: Is the globe now ready to start thinking seriously about its elite?

Newspaper headlines photoed by me today, in London:

For a more considered view of the economic picture, try Detlev Schlichter, who now seems to be the unofficial Samizdata economics correspondent, who has another posting up today, about, ah yes, inflation.

But the good news is that not all prices are rising.

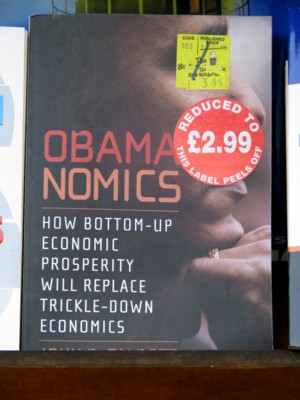

Photoed by me yesterday, in London:

The original price of this book was £10.99. I guess people now realise that it didn’t have a happy ending.

Perhaps the answer is going to be to keep warm by burning books.

“Auction houses and auction websites make markets out of common objects that would be trash except for a celebrity having owned or used or once touched it. A set of golf clubs or a box of golf balls is worth far more in a pro shop if the brand name “Tiger Woods” is on the label, because by affixing the name of the golf legend the buyer is being told that Tiger Woods had personal input into the quality of the products. Anyone who copies that box of golf balls with the Tiger Woods label on it — without proper authorization — is committing an act of forgery.”

J. Neil Schulman.

He certainly has an unusual way of looking at IP. This issue is messing with my head. A few weeks ago, I read Tim Sandefur’s lucid take on the matter, and took the view that whatever else can be said about it, it is hard to see how I could make a “natural rights” claim for IP in the same way as some classical liberals can do with physical property. But a few days later, talking to an old friend who is a professional arbitrator, my view swung more favourably to this sort of argument, as presented in favour by the late, great Lysander Spooner.

I fear that with IP, this is going to be one of those “I haven’t really made up my mind yet” positions. I suspect I am not alone.

My favourite bit in the Eagleton piece that Natalie links to below is this:

British universities, plundered of resources by the bankers and financiers they educated, …

Does it not occur to Eagleton that perhaps the British universities that all these wicked bankers and financiers attended educated them rather badly? While at university, Britain’s future financial elite were taught to accept a false view of the economic world. Now this elite “plunders” (as in “cuts the government grants of”) its educators.

The educators educated the elite. The elite screwed up horribly, and now the educators are getting screwed themselves. The educators are appalled at this terrible ingratitude, this horrible injustice. What have they done to deserve this? I say: quite a lot. You teach financially ruinous ideas. The people you taught them to turn round and ruin you. I say: it serves you right. I say: that’s just about the most perfect punishment there could be for what you have been doing.

My only worry is that things are actually not as bad as Eagleton says, and that Britain’s universities are in fact not being punished nearly enough for the financial ruin that they did so much to unleash upon the rest of us.

Never mind he is debasing the currency and starting us on the road to runaway inflation, is functionally indistinguishable from Tony Blair and his ‘savage cuts’ are a fiction simply parroted by a mainstream media seeming unable to do simple math… he has ‘Ease and authority’

Well, phew, good to know! I guess we’ll be ok then!

– Perry de Havilland commenting on a Telegraph blog article claiming that “Ease and authority make David Cameron hard to beat“

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|