We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

So many economists today spend more and more time mastering higher-level mathematics and econometric techniques that they simply never master basic microeconomics. These economists (from my reading of him, I judge Piketty to be among them) take their fluency in statistics and their skill at quantitative-data gathering for being a fluency in, and skill at doing, economics. They are mistaken. And while their error is too-often masked to the general public by their formal credentials as professional economists, their error is never hidden from genuinely skilled economists such as Deirdre McCloskey.

– Don Boudreaux, of Cafe Hayek. The whole item is worth a read, as is the McCloskey item at the Cato Institute to which he links. And let’s not forget Samizdata’s own Perry Metzger’s marvellous “shoe event horizon” takedown of Piketty a few months ago.

While it is perfectly reasonable to expect companies to obey the law in the countries in which they operate, the rage against Uber highlights how stifling regulation of economic life can be. Prior to the emergence of Uber, complaints of never being able to get a cab during peak times were common in every major city in the world. Uber’s sidestepping of licensing laws and other regulations that limit enterprise has enabled it to increase supply and meet demand.

What’s more, Uber’s cheaper fares have saved customers money, expanded our transport options and provided a source of income for a whole new sector of drivers. While the debate about Uber drivers’ pay and employment rights rumbles on, it is clear that banning the service, and forcing these drivers to go through the same costly licensing systems as everyone else, does no one any favours.

It is the competition that Uber provides that is driving its popularity with drivers and customers. But this is precisely what is enraging licensed taxi drivers.

– Rob Harries

From the “it’s just a temporary emergency created by the need to suppress vicious anti-social elements, and we will restore things to normal after the crisis has ended” department:

Venezuelan farmers ordered to hand over produce to state.

I’m certain this new measure will finally end the reign of terror of the hoarders and restore food to Venezuelan homes.

Meanwhile, a word about toilet paper. The capitalist propaganda machine outside of the Bolivarist Paradise has been telling people that toilet paper is now largely unavailable for purchase in the country. But, does man really require toilet paper to be happy? A few centuries ago there was no toilet paper at all – indeed, mankind survived for most its history without toilet paper. The desire for toilet paper is simply a form of manufactured desire created by capitalist marketing and advertising – the production of a want in people for a product they don’t actually have a real use for. The creation of toilet paper despoils forests and the landscape, is unsustainable, and it is only to the good that Venezuela now leads the world in eliminating this scourge from our midst.

(See also: What Socialism Has Done To A Supermarket in Venezuela.)

Paul Johnson, writing in the Times about the minimum wage (“Why it’s a gamble to follow Ikea on higher pay”) talks some sense but puts the cart before the horse:

It is a bet that forcing companies to increase wages will force them to increase productivity. If you have to pay £9 an hour then you’ll be forced to invest in the training and the machinery to ensure you get your money’s worth. Indeed this could be one of the reasons why productivity in France is so much higher than in the UK. With high minimum wages and extensive labour market regulation French companies can only survive by being highly productive. On the other hand that same regulation probably partly explains higher French unemployment.

Of course French workers are productive. The people who would have been the least productive French workers aren’t workers at all. Thanks to the minimum wage they’re unemployed, except for a little light rioting.

However Mr Johnson’s penultimate sentence cannot be faulted:

The minimum wage as it stands is widely seen to have been a success.

Everyone loves a feelgood story, and to increase the minimum wage feels so good. How vividly one imagines the joy of the hardworking night cleaner as he counts the extra in his meagre pay packet! In contrast, how dim and watery is the mental picture of the, um, potentially-but-not-actually hardworking unemployed person who might theoretically have benefited from a job at the till at a supermarket but now there’s an automated checkout machine instead. She’ll never know. The supermarket chain are not such fools as to announce that the reason for them scaling back their hiring plans is that they would rather not pay their employees any more. They will present automation purely as a benefit to the customer. The customers will continue to curse at the words “unexpected item in the bagging area” and moan about what a pity it is that they don’t have real human beings at the till like they used to, especially since that nice Mr Osborne put up their wages.

An afterthought: Oh, and about that hardworking night cleaner… six months after he was interviewed by the BBC saying what a wonderful difference the extra pay would make to his life, he was let go. Nothing personal, but what with the rising wage bill, the only way for his employers to keep within budget was to cut the frequency of cleaning. The BBC were long gone. Warmhearted people continued to feel good about how companies were finally being made to pay a “decent living wage”.

If the project itself would add value then it should be built, recession or no. And if it doesn’t add value then it shouldn’t be built, recession or no. There is no room left for the argument that it should be built because recession.

– Tim Worstall, on the ASI blog writing “Keynesian infrastructure spending might not be the answer you know“

Obama collecting personal data for a secret race database, reports the New York Post.

A key part of President Obama’s legacy will be the fed’s unprecedented collection of sensitive data on Americans by race. The government is prying into our most personal information at the most local levels, all for the purpose of “racial and economic justice.”

Unbeknown to most Americans, Obama’s racial bean counters are furiously mining data on their health, home loans, credit cards, places of work, neighborhoods, even how their kids are disciplined in school — all to document “inequalities” between minorities and whites.

This Orwellian-style stockpile of statistics includes a vast and permanent network of discrimination databases, which Obama already is using to make “disparate impact” cases against: banks that don’t make enough prime loans to minorities; schools that suspend too many blacks; cities that don’t offer enough Section 8 and other low-income housing for minorities; and employers who turn down African-Americans for jobs due to criminal backgrounds.

So they want to push banks into making more loans to minorities who tend to lack good credit histories. What could possibly go wrong? When companies like Wonga encourage poor people to take out loans they cannot afford, it’s called loan sharking.

As with my previous post, I first learned of this story via the Drudge Report, which seems particularly good at sniffing out and really making public stories of this type in which momentous developments were previously “made public” in a purely technical sense by bland official reports. “You will be assimilated” was the catchphrase of the Borg, a “collection of species that have been turned into cybernetic organisms functioning as drones in a hive mind called the Collective”, formerly thought to be fictional.

I have been reading Derek Wilson’s book about The Plantagenets, which is a succinct, blow-by-blow history of England’s monarchs from the beginning of the reign of Henry II in 1154 to the death of Richard III at Bosworth in 1485 at the hands of Henry Tudor. It’s good. All the various blows are briskly and engagingly described. If that’s the sort of book you are looking for, look no further.

In 1471, it seemed at the time as if the fighting had ended. The chapter covering 1471-1485 begins thus (on page 259 of my paperback edition):

After half a century of governmental breakdown, baronial strife and dynastic uncertainty the country needed internal and external peace and a firm hand on the tiller, and Edward IV certainly settled things down for a dozen years. …

But as anyone familiar with Medieval English history knows, and as Wilson then of course immediately relates, the fighting wasn’t quite done. This same paragraph then continues:

… However, following his death at the age of 41 his family managed to tear itself apart, provoke fresh conflicts and pave the way for a challenge from a minor branch of the Lancastrian dynasty, something which had up to that moment seemed inconceivable.

But then, Wilson switches in his immediately following paragraph to a different story:

Beyond central politics profound changes were taking place in these years. Commerce – especially the trade in woollen cloth – flourished, and a wealthy capitalist, mercantile class emerged. Renaissance influences from the continent began to affect cultural life and provoke new patterns of thought. But most revolutionary of all was the appearance of cheap books from the new print shops, which brought the world of ideas within the reach of many more people.

Now I want to make it clear that I have no major complaint to make about Derek Wilson, or his book. His aim with it was to tell the story of the Plantagenet kings, and he succeeds very satisfactorily. What I am here regretting is the absence of a point which he might have made here, maybe in a mere couple of phrases. I am not accusing Wilson of failing to understand the point I am about to make. I am merely noting that, for whatever reason, this is a point that he does not, at this highly relevant moment in his story, make himself.

Wilson could have connected the two paragraphs above, with half a sentence which added something along the lines of: “Perhaps partly because the aristocracy were consuming their energies fighting each other rather by meddling with commerce …”, and then noted that commerce at this time flourished.

For my point is that this royal “hand on the tiller” that Wilson says the country so much needed can sometimes be rather too firm.

→ Continue reading: An infirm hand on the tiller has its advantages

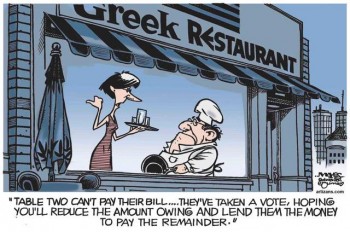

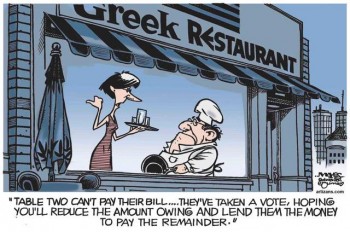

People in Greece are rioting against ‘austerity’ (which is the term used to describe the state spending less of other people’s money).

Troika. IMF. Democracy. blah blah blah…

Yet what is all really boils down to is this…

Hardly surprising so many Latvians, Lithuanians and Slovaks are utterly unmoved by the ‘plight’ of Greece.

“A good economist is one who can understand both the “seen” and the “unseen” consequences of policy. It is the proponents of this policy who are ignoring the complexities of the issue. `Britain deserves a pay rise, let’s give it one’ is hardly the height of sophistication when it comes to economic and political analysis.”

Philip Booth, who was unimpressed by how Iain Martin, of the “popular capitalist” blog CapX, wrote in defence of George Osborne’s atrociously-conceived “living wage” idea.

When you have a writer of an allegedly pro-free market blog such as Martin arguing for state fiat control of wage levels, and who belittles those who argue against such things as ideological nit-pickers, there is a problem. What also gets me is that this foolish idea was introduced by a government that does not need to pander to leftist economic illiteracy. The Tories don’t even have the feeble excuse of having to placate coalition partners after having won power outright in May.

There may be some good features of Osborne’s recent Budget (the upward rise in inheritance tax thresholds was welcome, although the system remains unnecessarily complicated) but there is far too much political gamesmanship from Osborne for anyone who supports free markets to take him all that seriously as a friend of capitalism and freedom. If or when the costs of a far higher statutory minimum wage start to really hit small and medium-sized firms – as they will – will he have the balls to admit this has been a foolish mistake? I am not betting on it – he’ll probably have moved on by then.

Greece became what it is today through the tireless efforts of Andreas Papandreou, the anti-Pinochet, who helped create a second Greek lost decade, ran up the national debt, raised the natural rate of unemployment, and kept inflation sky-high. Today, Greece, relative to the E.U. 15, is in the same place in RGDP per capita terms as it was in the early 1960s, before the economic boom under the Junta. Greek convergence with the rest of Europe ended in the late 1970s, and it actively fell behind in the 1980s. Clearly, as Andreas was the anti-Pinochet, blaming neoliberalism for the post-1980 economic stagnation in various countries (including Communist ones!) is simply being unconscionable.

– E. Harding, commenting here. The main article itself by Scott Sumner is also well worth reading.

A notionally free-market party is endorsing a policy which will see a fifth of the wage distribution’s hourly rates determined by a government QUANGO – targeting not a basic wage floor to alleviate exploitation, but a measure of inequality.

– Ryan Bourne.

The key word in that sentence is “notionally”.

Interestingly, Mussolini found much of John Maynard Keynes’s economic theories consistent with fascism, writing: “Fascism entirely agrees with Mr. Maynard Keynes, despite the latter’s prominent position as a Liberal. In fact, Mr. Keynes’ excellent little book, The End of Laissez-Faire (l926) might, so far as it goes, serve as a useful introduction to fascist economics. There is scarcely anything to object to in it and there is much to applaud.”

After the worldwide Great Depression, Mussolini became more vocal in his claims that fascism explicitly rejected the capitalist elements of economic individualism and laissez-faire liberalism. In his “Doctrine of Fascism,” Mussolini wrote: “The Fascist conception of life accepts the individual only in so far as his interests coincide with the State. . . . Fascism reasserts the rights of the state. If classical liberalism spells individualism, Fascism spells government.” In his 1928 autobiography, Mussolini made clear his dislike for liberal capitalism: “The citizen in the Fascist State is no longer a selfish individual who has the anti-social right of rebelling against any law of the Collectivity.”

– Lawrence K. Samuels, The Socialist Economics of Italian Fascism

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|