We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

Paul Marks casts a jaundiced eye at real voodoo economics.

The latest crackbrained theory to hit the media is the “Brazil must win for Wall Street” argument.

This argument holds that if Brazil wins the world cup “confidence” in Brazil will improve, an Argentina style collapse will be avoided, the ‘Right’ will win the election – and the money lent to Brazil by various ‘Wall Street’ institutions will be safe.

Of course if the term ‘Right’ means anti-statist the argument is out of touch with reality – as the government of Brazil are a bunch of social democrats and the opposition ‘Workers Party’ are worse.

However. the problem with the argument is rather more basic than this. The argument is really anther example of J.M. Keynes’ theory that a change in ‘confidence’ (‘animal spirits’) creates slumps.

Actually government credit money expansions create the boom-bust cycle.

This may have been explained a long time ago (David Hume stated it in a basic way – and Mises explained it in detail many decades ago), but ‘Wall Street’ and the media do not have a clue.

Everyone reading this blog may be saying to themselves “why is Paul Marks telling us things we already know” – but the problem is that the powers that be in our world do NOT know these things. They are not evil – they are ignorant. Ignorant of the basic principles of political economy.

Of course if Brazil wins the World Cup its economy will still collapse, but will that lead the people of power in our world to do some real thinking? I doubt it.

Paul Marks

The World Cup is a positive image of globalisation: it isn’t a government project, it’s racism free, it’s about as capitalist as it gets and celebrates individual and team efforts. It also allows national hatreds to be acted out without anyone getting killed. Even the refereeing is generally better than some previous shockers.

Especially wonderful has been the willingness of Japanese spectators to ‘adopt’ teams and players regardless of national origin. The sight of Japanese supporters of Belgium against Brazil was surreal.

Actually, GBRI stands for Global Business Research Initiative, and to call it the brainchild of my good friend Syed Kamall somewhat exaggerates its current level of development. The enterprise is now hardly more than a strand of intellectual DNA.

Mission

– The GBRI exists to promote a greater public understanding of the role of business in spreading prosperity across the globe.

The GBRI’s Work

– Our initial work will concentrate on barriers to free trade.

– We will identify and expose human and cultural barriers to trade, as well as traditional barriers such as tariffs.

– We aim to educate people about different business cultures across the world.

– We will publish the work of leading businessmen, economists and policy thinkers from across the globe.

– We will also seek to promote new, young intellectual talent and fresh perspectives.

And so on. A few more bullet points follow. If all I knew of the GBRI was the small amount of verbiage currently on offer at its website, I’d be saying: could mean anything and probably means nothing. However, I had supper with Syed yesterday evening at his home and it all sounded decidedly promising. The Internet has massively reduced the costs in cash, office space, time and emotional wear-and-tear of running something like the GBRI, and Syed is not merely enthusiastic; he is also capable and not given to exaggeration. So I too am optimistic, and will keep you posted of developments, as and when.

Brian remarks that no one posts him advice about what to say about Third World poverty, but that he was relatively flooded with info about the US soccer team. This is a good sign. Worrying about the US soccer team is a relatively harmless past-time. (Revelling in their defeat of Mexico might be dangerous in some places however). The libertarian answer to what radio listeners should do about the Third World is basically “do nothing”. The three main obstacles to enrichment of people in the Third World fifteen years ago were:

1) the skirmishing of the Cold War (which I think was justified by anti-Soviet forces)

2) the absence of the rule of law

3) trade barriers and a belief that socialism was better than capitalism for developing economies

The first is redundant.

The second can only come about by internal pressures or by the imposition of direct colonial rule from the only country whose constitution I would trust: Switzerland. Realistically this means, the Africans are going to have to sort it out for themselves.

The third is very simple. We oppose Bush’s trade tarriffs. We want the European Union Common Agricultural Policy abolished immediately. We should also try to stop the IMF and the World Bank from financing welfare state programmes in countries that can’t afford them (and never will afford them, if they try to leap from pre-industrial to welfare-underclass in one go).

BRING ON BRAZIL!!!!!!!!!

Doesn’t sound like such a big deal does it? Portugal out? What’s new? So are France. So are Argentina. No, the big story is that the USA are through to the last 16, despite being beaten 3-1 by Poland. Weird weird world (cup) or what?

On a more serious note, I’m doing a broadcast for BBC Radio Scotland this Sunday morning (at about 9.15 am) on the subject of what the Trade Justice Movement hopes will be a big demo by the Trade Justice Movement. What should I say? Their campaign seems to be big on waffle and weak on specifics, which I think is probably good because any specifics they favour would probably be bad. So what specifics (a particular identified tarriff barrier – a particular WTO procedure or rule or programme) should I talk about?

Please don’t email me with why free market economics in general is better than statism in general for getting rid of world poverty. I already know that.

A few days ago, I received through the post one of those half-book half-pamphlet things (only 85 pages long but with a readable spine) that have so abounded ever since the Institute of Economic Affairs got into its stride, this one being from the Social Affairs Unit. It is called Marketing The Revolution: The New Anti-Capitalism and The Attack Upon Corporate Brands. It’s by Michael Mosbacher, who is a longish standing friend/acquaintance of mine. It’s good.

There’s a biographical note at the back which tells us that Mike, who is now the Deputy Director of the Social Affairs Unit, once upon a time “studied politics at Exeter University, writing his Master’s dissertation on the impact of the collapse of communism in Eastern Europe and the Soviet Union upon the British Communist movement”. This, or something pretty like it, was published by the Libertarian Alliance as Political Notes No. 127. This new piece is the logical successor of that earlier one. It describes some of the new globalised groups and campaigning methods and ideological themes that have elbowed their way forward to fill the void once occupied by those pathetic old Bolsheviks and all their massed ranks of useful and not so useful idiots.

Here’s a chunk, not from the piece itself, but from the press release that arrived with it:

The broader message is an old, and rather tired one, hatred of capitalism, the belief that the world is diametrically and permanently divided between the exploiting corporate fat cat few and the exploited masses. What’s changed is the way that message is now being marketed to a new, wider audience by piggy-backing on the corporations’ own publicity. The activists do this, often via websites, by cleverly parodying corporate ads, organising media-friendly stunts at AGMs and launching boycotts.

That you can play games with a famous brand and get your joke bounced around the world at virtually no cost to yourself is a fact that Samizdata readers have several times also been invited to enjoy. Think of the logo adaptations we’ve featured of London Underground (“take a taxi”), and of Intel (“Big Brother inside”).

Would that Mike Mosbacher’s work was making equally clever use of the Internet. Alas, the Social Affairs Unit website makes that of my dear old Libertarian Alliance look downright advanced. That it doesn’t refer in any way to this publication is peculiar (although technical difficulties have also prevented any reference to the LA’s latest batch of paper yet finding its way onto our site). But far worse than that, the SAU website commits the basic old-school sin of using the internet only to try to sell paper, instead of also to distribute text free of charge. There’s nowhere on the site from which you can download anything “published” by the SAU, other than short bits of sales blurb. If you actually want to read anything substantial that they’ve “published”, you have to order it through the post. You have to pay money. (For all the difference it can make me saying it here, you can buy Marketing the Revolution by sending GBP9.95p plus GBP1 for postage and packing (blogspotbollocks won’t do pound signs so please decypher that as best you can) to: Social Affairs Unit, 314-322 Regent Street, London, W1B 3BB. Or ring Mike Mosbacher himself on 020 7637 4356.)

You’ve got to make a living, and if you are in politics, “public affairs” etc., that tends to involve doing things that ignorant old people think will influence the young, rather than doing things that actually will influence them. I don’t blame Mike Mosbacher for the foolishness of writing interesting things about the internet but then publishing them in an internet-hostile manner. Well, maybe I do, because like I say he doesn’t just write for the SAU; he is its Deputy Director. Whatever. But let’s be clear what the next step is: an internet presentation of Mike’s stuff which actually deploys some of the good work that he’s been doing in an internet-usable form.

Because it is good work. Mike is not overwhelmingly strong, for my taste, on analysis. His big picture is somewhat unpersuasive. He makes much, for example, of the fact that anti-capitalists make a living within the world of actually existing capitalism by having capitalist money of their own, and by accepting great lashings of it from others who do if they don’t. So what? This is like moaning about Soviet dissidents who also had jobs as government scientists. What were they supposed to do? Starve? The case against these anti-capitalists isn’t that they are taking money from capitalism to trash capitalism; it is that they are trashing capitalism.

But if the big picture is somewhat blurred, the small pictures are in exact focus again and again. Just as with PN127, Mike digs into just how this campaign operates, and what that bunch of lefty-capitalist self-haters actually say and do and ill-spend their well-gotten gains. Waffle it is not. And again as with PN127 (communists who reviewed that said it was very accurate), those it describes would recognise the details as accurate rather than the polemical and inaccurate waffle that is often presented as anti-anti-capitalist “analysis”.

Mike is good on the way that capitalism appropriates the imagery of youthful rebellion and uses it to sell things to those same youths when they get a bit older. (While doing this I also noted a TV advert featuring the late Jimmy Hendricks emitting all manner of anti-establishmentarian vibrations via the latest psychedelic computer-graphical trickeries, in honour of the latest Audi.)

But one of the better bits of analysis comes not from the text itself, but from that same press release which I’ve already referred to. Just after the bit quoted above, it goes on to say:

Because its impulse is anti-capitalism rather than ameliorating the practice of corporations, the anti-corporate movement views progressive corporate policies as simply an attempt to mask the true nature of capitalism; which it is their mission to unmask. The harder an individual corporation seeks to show that it is doing good, the more important it becomes for these activists to seek to show that it is not. Progressive companies are attacked not in spite of, but because of their progressiveness.

I don’t remember anything as bang-on-the-nail as that in the thing itself, although of course in Marketing the Revolution itself there’s much more detail:

The TV stations of Turner and the skin care products and lotions of the Roddicks are, of course, themselves identified by the anti-branders with all the alleged sins of branding. They are, in fact, seen as especially heinous offenders by some: the mainstream media represented by Ted Turner is seen as the engine behind the construction of the branded world and Anita Roddick is the champion of what they see as the blind alley of ‘ethical consumerism’. Hence, The Body Shop was a prominent target on the web-based hit list of corporations to be subject to ‘anti-capitalist actions on Tuesday 1st May 2001’.

Here we have a principle that might enable the pro-capitalist movement to start making some waves of its own, by piggy-backing on the anti-capitalists. We can note which corporations are trying to be seriously “progressive” to the point of being actually anti- any capitalism but their own, and especially if they are doing this not just with their messages but with their money. We can point out to them not only that they are asking for trouble, but that, if they don’t stop letting the capitalist side down, we will set the anti-capitalist dogs on them.

It’s no use blaming anti-capitalists from getting money from whoever they can, but you damn well can blame capitalists for giving it to them.

Hard-line socialist journalist Paul Foot Paul Foot waxes indignant in the Guardian newspaper on Wednesday about what he sees as the systemic sickness of capitalism, as demonstrated in his view by the demise of such U.S. corporate behemoths as Enron Corp and conglomerate Tyco. Foot quotes the Goldman Sachs chief executive Hank Paulson, who warned last week that “Business has never been under so much scrutiny. To be blunt, much of it is deserved.”

These words, which will hardly strike readers of this blog as controversial, come in for the following Foot broadside. Let’s quote the man in full: “The problem with this argument is that it overlooks the central feature of capitalism: the division of the human race into those who profit from human endeavour and those who don’t. This division demands freedom for employers, and discipline for workers; high pay and perks for bosses, low pay for the masses; riches for the few, poverty for the many.”

In other words, life is a zero-sum game. If I profit from selling you a pair of shoes, a newspaper or a motor car, then you have “lost”. If you are poor, your poverty must be caused by my wealth, and vice versa. No-where in Foot’s mental universe is the idea entertained that both sides in a trade gain, since why else would they trade in the first place? In his world, no wealth is really ever created, just redistributed or grabbed by one group from another. His world is essentially closed. It is not surprising that a world fashioned according to such beliefs will be marked by stasis and decline. If we were to accept Foot’s take on capitalism, the history of mankind and its staggering increase in wealth at all levels would be incomprehensible.

I have no quarrel with the many commentators who have blasted the U.S. financial system for the bad lapses in recent months. The demise of Enron, the faltering faith in the quality of corporate accounting and the shenanigans of analysts secretly trashing stocks while plugging them in public have damaged the U.S. economy. But surely what these sagas show is that capitalism, often with brutal power, punishes malefactors and ultimately puts a premium on honesty and fair dealing, and at the same time educates the masses into investing carefully. In short, capitalism works because it embraces a form of feedback, as mis-judgements and crooked behaviour get punished. This is something one won’t readily find in the socialist world of which Paul Foot dreams.

In the recent Samizdata article American Perfidy it is claimed that “apart from the tax cut” Mr Bush has allowed his agenda to collapse.

Actually (as I and others have pointed out) “apart from the tax cut” Mr Bush did not have an agenda worth talking about (just a lot of waffle about being “compassionate” by handing out tax payers’ money to religious charities). To be fair if Mr Bush had gone into the 2000 election with a decent agenda he would have lost. The “window of opportunity” that existed in Britain in 1979 and the United States in 1981 has gone. Just over 20 years ago most people would have accepted real budget cuts and deregulation, but this mood has past. The public (in both the Britain and the United States) are now obsessed with the “public services” and see new regulations as the correct response to any problem from Enron to hay fever.

Sadly the judgement on Mr Reagan and Mrs Thatcher must be that they had a chance but failed (in terms of regulations and welfare state programs government is bigger than ever now) – although in both cases one can produce a case for the defence (Mr Reagan faced a House of Reps controlled by the Democrats, Mrs Thatcher was surrounded by traitors from day one…). As for Mr Bush – he never had a chance. The media were against him, the “intellectuals” and their universities were against him, the Republicans did not have firm control of the Senate – all these things might have been overcome. However, Mr Bush faces a general public the majority of whom are statist – and against that what can he do?

Oh by the way – no Mr Clinton did not favour free trade. Mr Clinton liked trade agreements if they led to regulations being imposed on countries (especially “pro labour” union type regulations) and he especially liked trade deals if they helped build up the old dream of a world government (replacing G.A.T.T. with the W.T.O. was a fifty year old dream in certain circles in the U.S.) – one step at a time was Mr Clinton’s way (after the health care defeat early on in his administration). However an actual free trade deal – no, Mr Clinton never very keen on them.

Paul Marks

The recent massive U.S. government increase in subsidy to its domestic farmers comes in for a deserved and amusing mauling from Daily Telegraph journalist and Tory MP Boris Johnson. He is right to point out that by signing off the vast increase in aid to American farmers, Bush has compounded the damage to international free markets made when he agreed to steel and lumber tariffs earlier in the year.

On a broader point, this makes me wonder whether Bush is headed for going down in history as one of the most protectionist Presidents since the Second World War. On the domestic front his pre-election agenda seems to fallen apart with the exception of the tax cut. Instead, Bush is resorting to pork-barrel politics to shore up support in supposed key states for the Republicans ahead of the Congressional elections this autumn. Of course, we libertarians hold no illusions about politicians as a group, so I suppose Bush’s slide into cynicism should not surprise us. But I never thought I could write the following words – I am beginning to miss Bill Clinton. At least he believed in free trade, if nothing else.

As everyone knows by now, US Treasury Secretary Paul O’Neill and U2 frontman Paul “Bono” Hewson just completed a week-long tour of Africa. While the unlikely pair seem to play off each each other well on stage, and seem to be getting along well offstage, it is not entirely clear how Mr. Bono has suddenly emerged as a power-broker. Several news sources attributed this quote to the man with the wraparound shades:

“[O’Neill] is the man in charge of America’s wallet … and it’s true, I want to open that wallet.”

None of the news sources I saw chose to elaborate on this comment’s obvious falseness. The treasury cannot release any funds until the proper appropriation and authorization bills have made their way through Congress. (I will cut Mr. Hewson some slack because he is not an American; but if certain members of the press need a refresher course in this area, I would recommend that they review their Schoolhouse Rock.) At any rate, it makes you wonder why we should take anything else the guy says seriously.

Bono’s cause is third-world debt relief. He argues that the heavy external debts of foreign governments are the principal obstacle to their emergence from poverty. We shall examine those claims briefly. How effective are official debt-relief programs in improving economic performance? Well, we can let history be the judge, since we have tried this before. In the late 1980s, the US treasury department began a debt-relief program called the Brady Plan, in which creditor banks were encouraged (through the stick / carrot of the federal tax code) to refinance debt at subsidized rates and reduce principal levels by allowing banks to replace severely discounted loans with new debt at levels closer to par value.

Was the Brady Plan a success? It depends on how you define success. If the objective was debt reduction as an end in itself, then the Brady Plan looked good — more than $60 billion in foreign debt was forgiven, by one estimate. But did the Brady Plan succeed on a larger scale, i.e. did it promote economic growth and encourage more responsible borrowing by third world governments? Sorry, Bono, but the track record there is not so good.

In his book International Debt Reexamined (unfortunately no longer in print, though I have a copy from my grad-school days), economist William R. Cline demonstrates that the economies of Brady Plan participants did not outperform those of nonparticipants with similar debt levels in the 1990s. So much for the argument that debt relief is a sine qua non of future economic growth.

Moreover, there is evidence that the Brady Plan (and other official debt relief programs) merely crowded out private debt relief efforts such as debt-for-equity and debt-for-nature swaps, which had commendably been on the rise throughout the mid to late 1980s. The announcement of the Plan itself had the effect of encouraging further profligacy — if your mortgage banker announced that it might be forgiving or substantially reducing your mortgage debt in the near future, wouldn’t you think twice before mailing in your next payment?

Bono’s line of reasoning on third-world debt would have found a favorable audience with economists a generation ago, but has long since fallen out of respectability. The new generation of development economists, spearheaded by the Peruvian economist and think-tank chairman Hernando de Soto, argues that the people of the third world already hold the solution to their poverty. This makes things difficult for would-be celebrity messiahs like Bono. Sorry, pal, but the world is ready to move on, with or without you.

… Paul Staines does not think so!

British Chancellor Gordon Brown’s recent splurge on the National Health Service was supposed to be supported by a bouyant economy, but first quarter figures (just released) are terrible.

Manufacturing output tumbled by 1.5 per cent, leaving it 6.5 per cent down on the same time last year ÷ the biggest annual decline since the recession of the early Eighties. A further slump in exports, by nearly 7 per cent, also took a heavy toll.

On the plus side that means mortgage rates are very unlikely to rise near term, but taxes may be more likely to rise as the economy stagnates – unless you think New Labour would actually consider reducing state spending?

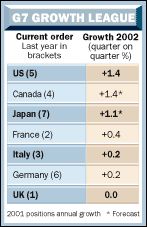

As the graphic shows we have slipped from first to last in the G7 growth league – as the other G7 countries voters all shifted rightwards.

Things are going to get more difficult for Brown, sooner rather than later.

Paul Staines

World trade could be a powerful motor to reduce poverty, and support economic growth, but that potential is being lost. The problem is not that international trade is inherently opposed to the needs and interests of the poor, but that the rules that govern it are rigged in favour of the rich.

-Oxfam, from the Introduction to their Report Rigged Rules and Double Standards: Trade, Globalisation, and the Fight Against Poverty. See their Make Trade Fair campaign website (but don’t expect the rules to be any less rigged by the time they’ve finished with them).

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|