We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

The only other thing I would add is that I am in the advertising industry and most of the ads for sub-prime loans had dried up before the recent bail-out bill. As soon as that went through the volume for these ads went up 10 times. Whatever the government did to “fix” the problem ain’t working because all they did was just give everyone who didn’t make money the first time around another shot at the craps table.

– from a comment by “Ben Franklin” on this Belmont Club posting spotted by David Farrer

Poor naive George W. Bush! For all his shambolic presidency, his dreadful mistakes, and the horrors of aggressive imperialism, his last couple of months in office could end up being the most disastrous for the world.

Bloomberg reports:

The leaders of the U.S., France and the European Commission will ask other world leaders to join in a series of summits on the global financial crisis beginning in the U.S. soon after the Nov. 4 presidential election.

President George W. Bush, French President Nicolas Sarkozy and European Commission President Jose Barroso said in a joint statement after meeting yesterday that they will continue pressing for coordination to address “the challenges facing the global economy.”

The initial summit will seek “agreement on principles of reform needed to avoid a repetition and assure global prosperity in the future,” and later meetings “would be designed to implement agreement on specific steps to be taken to meet those principles,” the statement said.

Just how bad this could be is already showing. The report continues:

Sarkozy and Barraso are pressing Bush for a G8 agenda that includes stiffer regulation and supervision for cross-border banks, a global “early warning” system and an overhaul of the International Monetary Fund. Talks may also encompass tougher regulations on hedge funds, new rules for credit-rating companies, limits on executive pay and changing the treatment of tax havens such as the Cayman Islands and Monaco.

Just what has the continuation of the OECD nations’ campaign to plunder smaller states and institute globally uniform (high) taxation got to do with the market crash? Nothing. Executive pay? Irrelevant, too, save in the politics of envy. Mainstream banks, not hedgies, were the ones that crashed after playing iffy games with CDOs, and governments helped pump-up house prices – with enthusiasm. Where this agenda comes in is as an opportunity to kick the resented “Anglo-Saxon” model of capitalism while it is down – even, and especially, in those places where it is not down yet. (Are we missing Commissioner Mandelson yet?)

Mr Bush has lost the thread entirely if he really thinks a transnational “reform” of the financial system can do other than damage “free markets, free enterprise and free trade”. He may have a patchy record on liberty, and a bad record on limited government. His guests in November will have no interest in either. They will tempt him (have tempted him) with the mantle of world saviour, and will try to get him to bind his successors. We shall have to hope that his successor, either one of whom would be well to the economic right of the self-selected ‘international community’, depressingly enough, is more wily and far-sighted.

Meanwhile, where is there left to run?

…They would make Guido Fawkes an advisor on how to fight the next election. Of course Guido (aka Paul Staines), whom I know and like, prefers, as I and many other bloggers do, to give party politics a wide berth in professional terms. He is far more effective doing what he is doing now and obviously has a great time doing it. But as his example shows, the guy has more sense on how the Tories should go after the absurd notion of Gordon ‘off-balance-sheet’ Brown than any number of folk working in Tory HQ.

Think about it: the Tories should put up posters with the Brown comment on “no return to boom and bust” over, and over, and over. That this man, who has presided over deteriorating public finances during a relatively strong period of growth, sold our gold reserves at a fraction of their current value, raided pension funds and shafted taxpayers should be able to pose as some sort of economic Winston Churchill is a joke.

Jesse Walker at Reason magazine points out something very inconvenient for Naomi Klein, whom I discussed recently at this blog:

Let’s just zero in on the contrast Klein draws between utopian theories and real-world practice. It’s a fair argument if you apply it properly: that is, if you look at the consequences of Friedman’s policy prescriptions where they are put in place. It makes sense, for example, to look at how Friedman’s ideas about denationalization and free trade fared in Chile after they were put into effect. It doesn’t make much sense to look at Blackwater’s contracts in occupied Iraq, because — try as Klein might to pretend otherwise — they don’t have anything to do with Friedman. (And of course, it’s important to examine the ways Pinochet’s Chile deviated from Friedman’s economic ideas as well as the ways it embraced them.)

Exactly.

At the same time, you have to consider how Friedmanism fared everywhere some portion of it was applied, not just cherry-pick the most unappealing regimes that experimented with it. If the only place that adopted any of Friedman’s economic ideas was Chile, then Klein might be onto something when she suggests there’s a connection between libertarian economic policies and deeply un-libertarian ideas about torture, censorship, surveillance, and state-sanctioned murder. But the most sweeping free-market reforms of the last 40 years were not adopted in Pinochet’s Chile, Thatcher’s UK, or anyplace else addressed in Klein’s book. They were enacted by the New Zealand Labour Party in the 1980s. Far from fusing economic liberalization with political repression, the Labour government expanded civil liberties: It adopted a bill of rights, decriminalized homosexuality, improved the treatment of the native Maori. And while Pinochet signed on to the CIA’s war against the Latin American left, New Zealand strained its relations with Washington by making itself a nuclear-free zone, a policy that effectively barred the U.S. Navy from New Zealand ports. By Klein’s logic, these are all effects of Friedmanomics.

One would not expect Ms Klein to respond to this other than with smears. It turns out that she more or less ignored the devastating review of her book by Johan Norberg at CATO recently, did not address his very serious accusations of widespread inaccuracy or misrepesentation. To repeat: it is not just her views that are a problem – I am sure some leftists argue in good faith – but her actual, repeated lying, fabrications and errors that are so easily corrected and yet she cannot be bothered to do so. That is one reason why I loathe so much of this sort of writer. It is a sort of contemptuous attitude towards simple fact-checking that I cannot abide. So Friedman did not support the Iraq war after all? Well, whatever, he might as well have done, seems to be her attitude.

The point that Jesse Walker makes about the varied effects of free market ideas is important. Yes, some repressive regimes around the world may have found it convenient, for whatever reason, to claim they had signed on to the package, as Chile did. But then remember that even former London mayor Ken “friend of Hugo Chavez” Livingstone once argued that he had borrowed the idea of road-charging from the great Chicago professor. In different times, very different types of political leader, such as Richard Nixon, claimed to be Keynesians, just as, right now, a lot of people are scurrying to claim to be in favour of tougher regulations (see Guy Herbert’s comment immediately below this one).

Klein tries to draw an equivalence, in a muddied way, between those leftists who deny that Marx can be blamed for the horrors done in his name and those of us who point out it is absurd to try to blame free market thinkers from what is happening now. Well the reason, Ms Klein, why Friedman et al cannot be so blamed is that what is happening now is not an example of laissez faire capitalism. Re-read that slowly, Ms Klein: what is happening now is not a case of laissez faire. Just to spell it out for those who have not been following this debate: the central banks responsible for setting interest rates are state bodies; the US home loan agencies such as Freddie Mac that underwrote risky mortages are ultimately state bodies; the legislation forcing banks to lend to risky groups is state activity; the Basel and other bank capital rules that have arguably encouraged the irresponsible use of credit derivatives are state rules, and so on. With the exception of Lehman Brothers and some of the Icelandic banks, not a single large financial institution has been allowed to go bust, as a private company would in a free market. Not one.

Corporate industrialists are frequently not keen on free markets. They are fond of order, safety, and “fairness” or “a level playing-field” – which means everybody doing things the same way they do. They like a managed world, because management is what they do. So no good comes of appointing them as regulators. Technocracy joins with bureaucracy.

Here is Adair Turner interviewed by The Guardian (perhaps in itself a significant choice of forum):

There will be more people asking more questions and getting more information than we were getting before… . There is no doubt the touch will be heavier. We have to make sure it is intelligent and focused on where the risks really are.

Translation: “We have to destroy The City in order to save it.” This is ‘risk’ as understood by a safety fanatic – one-sided, and totally unrelated to choice or to return.

We will have more people than before looking at the high-impact, systemically important firms with major knock-on effects than we did before. We will pay more than necessary to attract the correct quality of people from outside.

More than necessary? And who will pay for such artificial premiums? Whoever the FSA decides to tax or fine. It is a predatory organisation: a Self-Financing Regulatory Agency. So it wil have to find more occasions to punish and to license in order to fund more intervention, licensing and punishment.

There is no chance of a 1929-33 Depression. We know the lessons and we know how to stop it happening again.

A prime lesson of the Great Depression for most commentators has been that shutting down free trade in goods in order to protect industrial markets made the depression deeper and longer than anyone could have imagined. It stopped trade and industry recovering from the shock. That our Government is looking to blame foreign investors for our problems and is taking measures to frighten them off, and that Lord Adair is advocating, as the cure for a financial market crash, tight supervision of the surviving free markets in finance and commercial instruments, suggests the lessons have been rather badly understood. They risk stopping the financial markets recovering from the shock.

Thanks to the eagle-eyed Samizdata commentariat (Ian B), I read this article by Dominic Lawson, son of the former Chancellor of the Exchequer, Nigel Lawson. Lawson Jnr argues that the much-mocked notion of gold-backed currencies, which finally fell out of favour in the early 1970s during the Presidency of that economic ignoramus, Richard Nixon, is due for a comeback. He gives a rather quaint example of what is happening in Lewes, Sussex.

As an admirer of the writings of the Austrian economics school, I have a great deal of sympathy with this argument, although I do not think that gold per se needs to be the anchor of a currency. Given the vast gyrations in the price of gold in recent years, I do not see it as a very practical option for many, if not some, countries. What I do think, however, is that the idea that we can go on regarding money as a sort of metaphysical abstraction to be manipulated at will by Godlike central bankers needs serious reappraisal.

But remember that in times of massive stress – and inflation – gold, like silver and other relatively scarce substances of universally-recognised value, can win new friends. I will be keeping an eye out for stories of such “parallel currencies” in the next few weeks and months. If readers have examples, let me know. Surely this is an area for an enterprising economics PhD student to work on. Why not?

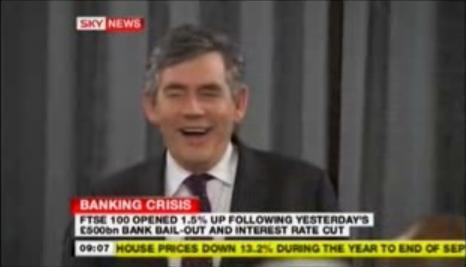

In the meantime, I see that Gordon Brown is now regarded as “statesmanlike” by spending gigantic sums of other folks’ money. I’d be more impressed if he came out and urged a big reduction in UK public spending. He’s also probably got some beachfront property in Arizona he wants to sell………..

The ‘Paul Marks Plan’ to save the world economy is inspired by President Bush and Tim Congdon. I can save the world economy on my own, all I need is the cooperation of the public authorities!

First interest rates must be reduced to a negative level (quite a moderate level, say -0.5% although I would settle for -0.1%) then I will borrow huge sums of money and use some of it to “buy cars” as President Bush has suggested. I will also “buy up every decent security in sight” every time the banks get into trouble – as Tim Congdon has pointed out must be done. But it is the “buy cars” suggestion that has really inspired me, and for a special reason. You see I can not drive – and so I would smash up the cars I bought in car crashes, thus meaning not only would I buy more cars, but the drivers of the cars I smashed into would buy more as well.

It would be a wonderful example of stimulating the economy via consumption. A point that the school of thought led by the late Lord Keynes and the school of thought led by the “monetarist” Tim Congdon are in full agreement upon. And whilst such Chicago School people as the late Milton Friedman might not be wildly happy with the direction of ever greater subsidies for the banks that Tim Congdon has taken “monetarism”, the great Tim would be quick to point out that Milton Friedman would not be able to present clear economic principles showing any error in his conception of money and banking – so it must be okay then.

In case anyone think the above is, er, insane… I would point out that it is more moderate than what the British government has already announced, such as one third of the entire British economy (not the government budget – the entire economy) being pledged to back up the banks.

This goes beyond even what President Bush and Congress have done in the United States. Surely we are moving towards the glorious day, worked for so hard by Tim Congdon, when the entire economy (not just the government budget, but everything) is devoted to subsidising the financial services industry. Let us reject such reactionary nonsense as the principle that every Pound of lending must be from a Pound of real savings. And let us also reject the reactionary principle that if a business goes bust it goes bust – and that a bank is no more entitled to protection from “bankruptcy” than a coal mine is. And, most important of all, let us reject the rigid dogma that once money is lent out the lender does not have it any more – till when, and if, it is paid back.

With ‘advanced banking methods’, backed by government of course, one hundred Pounds of physical savings can be multiplied to vastly more than that in loans. One plus one need not equal two – it can equal any number clever people want it to. And with credit money expansion by the public authorities any problem can be overcome. Credit money expansion, under the control of wise and well paid ‘experts’ of course, can achieve anything and no petty thing like either logic or physical reality can stand in its way.

We can achieve a perpetual motion machine – accept that it will speed up.

Of course scientists might claim both that such a thing was ‘impossible’, and that even if it was not that it would destroy the universe. But so what? If we destroy the universe we can create other universes – by an act of will. After all the physical distance between Chicago and Cambridge already seems to have collapsed.

As President Bush and Tim Congdon have explained – prosperity will return, as long as we pump out enough credit money!

“In addition, one should not minimize the great economic achievements of the past 25 years in the form of rapid growth in world GDP, low world inflation, and low unemployment in most countries. Perhaps these achievements will be overshadowed by a deep world recession, but that remains to be seen. If the impact of this financial crisis on the real economy is not both very severe and very prolonged, and time will answer that question, the combination of the past 21/2 decades of remarkable achievement, and the economic turbulence that followed, may still look good when placed in full historical perspective.”

– Gary Becker.

Like Professor Becker, I think fears of a repeat of a 1930s-style depression are unwarranted. What is a serious concern in my mind is the likely explosion of poorly thought-out regulation by politicians who seem to have forgotten how it was often such regulations, as well as lax monetary policy, that is at the crux of the current turmoil.

This, by Charles Spencer in the latest Spectator, made me smile:

“This is a time for making the most of small mercies. One of the greatest of these, as the financial system collapses around us, is the splendid joke that is Robert Peston of the BBC. His extraordinarily camp, over-emphatic delivery would be perfect for reporting glitzy Broadway first nights but seems hilariously at odds with worldwide economic catastrophe. Peston has all the glee of the callow cub reporter rejoicing in the size of his scoop while lacking the imagination to understand the anxiety his excitable tales of doom-and-gloom might be causing others.”

I admire the scoop-getting skills of Mr Peston, if not always his analytical skills. Anyway, as Mr Spencer continues:

“Like poor Mr and Mrs Spencer of Claygate, Surrey, for instance, who somehow managed to commit themselves to £40,000 worth of home improvements (double glazing and a new kitchen) just before the current crisis went big time. As I do my lengths at the swimming pool, I sometimes experience a knot of fear forming in my guts. Mercifully, thinking of Peston, an egregious character both Jane Austen and P.G. Wodehouse would have been proud to have invented, makes me laugh and my panic disperses.”

On a nicer note to Robert Peston, however, he has put economics at the top of the BBC news agenda in a way that would have been unthinkable a decade ago. Part of this is down to simple events, but part of it is due to Peston’s skills in ferreting out the news, not to mention his status as a friendly journalist to NuLab. Whether this continues if the current bunch get kicked out of Westminster is a moot point.

Last night I attended a Libertarian Alliance talk/discussion evening at the Evans household, the talk being given by Antoine Clarke. Here is what Antoine said in an email about his talk beforehand. I learned several interesting things which smarter people than me doubtless already realised but which were new to me. The most interesting thing I learned, assuming Antoine was right about it, was that after the first mega-billion dollar bale-out package failed to be agreed by the politicians of the USA, the market immediately went up. But then, as soon as a revised bale-out package, containing more bribes, was agreed, the market went down. “We should do nothing” is a tough political sell, but the smart move, said Antoine. And McCain should have gone with what, according to Antoine, were apparently his instincts and torpedoed the whole damn bale-out operation, and thereby clung onto a chance of being the next President of the USA.

My take on this is that there is a crowding out effect going on here, big time. I trust we are all familiar with this idea. It says that big government plans of any kind not only do harm because the government plans fail and all the wealth it wastes on them is wasted, but, and arguably even worse, because people with better plans in the same line of business are frightened into inactivity. In this spirit, I recall the disgraced former Tory MP Neil Hamilton once saying at a meeting I attended long ago that the money that an earlier Labour government had spent on buying up and ruining the British motor industry would have done a great deal less harm if it had just been put into several thousand suitcases and chucked into the sea (I daresay this would have been good for inflation also). That way, saner motor car entrepreneurs could have gone to work making cars and car stuff in better ways than then prevailed, unimpeded by the fear of great walls of government “investment” screwing up their plans, bidding up the prices of all the people and all the things they wanted to hire and buy and put to good use.

Well, now, exactly the same thing seems to be happening in the banking industry. Were I one of the immensely rich and immensely sensible banking people who had (a) seen this crash coming and cashed out at roughly the right time, and who now (b) has plans to gobble up failed banks and reorganise them along more sensible lines, I would now, despite all my hopes of profitable new business, be sitting on my hands, waiting for all the government plans to do their immense damage before I went wading in and god chewed up too. Only when these government plans had become an obvious failure, and the politicians had just totally given up, would I be ready to move in and sort things out. Only when the politicians lapse into inactivity, which for a brief shining moment looked as if it might happen straight away, does economic optimism, among the people willing to back their optimism with money, reassert itself.

But, as I like to say from time to time when blogging, what do I know? I am no expert on the banking business, and as I say, I only realised this thing about the ups and downs of the world’s stock exchanges when Antoine Clarke pointed it out to me last night. So, did Antoine get this story right? And have I explained this phenomenon, even part of it, even approximately right? Tomorrow afternoon, Antoine, I, and fellow Samizdatista Michael Jennings will be getting together to record a conversation about all this, so comments now would be especially welcome.

Economic historian Robert Higgs makes some interesting observations at the Liberty & Power group blog. I often disagree with some of its foreign policy views – it verges on outright pacifism – but its economics I like.

At least someone is enjoying themselves. The taxpayer has always paid his bills, except in his childhood, when God did. And now he gets to use unlimited power to seize whatever he likes and congratulate himself that he is punishing bad people for taking risks in the hope of making money for themselves.

pic hat-tip: Guido

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|