We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

So we live in a society where head teachers make kids wear goggles to play conkers and policemen are forbidden from rescuing drowning people on health and safety grounds… and then they make you drive at 70mph in pitch darkness to save the polar bears?

– Mr Eugenides is not a happy baby concerning the latest environmentally motivated imposition.

I just did a posting about iScream at my personal blog, iScream being a type of ice cream which I tasted earlier this evening when I dined at Chateau Perry. And then I thought, why confine the news of this delicious dessert to such a tiny demographic? The whole world should be told about this superb dining experience.

I guess one reason why people make things like this, concentrating entirely on making them tasty rather than making stuff that tastes like cardboard, and spending all their time, money and tender loving care on a lot of ridiculous and expensive advertising, is that word of whatever it is will now spread far and wide at no cost, provided the product tastes good. In my opinion, this iScream ice cream tastes wonderful, and word of it will surely spread fast. I suspect that “iScream” may prove to be a rather silly name, but better a silly name for superbly tasty ice cream than superbly named frozen mediocrity.

The website is here, but is not that informative about iScream ice cream. So if you live in or near London, or if you are ever in London, why not visit the Artisan du Chocolat shop in Lower Sloane Street, just to the south of Sloane Square, where the above supply of iScream ice cream was purchased.

I’m told their chocolate is very good too.

One of the biggest eye-openers you can have is seeing a story in the press which you have personal knowledge of…

Of course, it could be that you just got unlucky and that all the other stories out there are 100% bang on, deadly accurate.

But that seems rather unlikely, doesn’t it?

– 6000 ruminates on false media prophesies of doom regarding the organisation of the soccer World Cup in his native South Africa.

Indeed. Bulletproof custard. Thank you Instapundit. The spirit of Q lives on.

This reminds me of a Winston Churchill story that Stephen Fry likes to tell. During Churchill’s last stint as Prime Minister, in the fifties, he was regretfully informed that one of his backbench MPs had been arrested the previous night for exposing himself on Hampstead Heath. After a pause, Churchill asked about the weather. Was it not very cold last night? Indeed sir, one of the coldest nights on record. Said Churchill after another thoughtful pause: “It makes you proud to be British.”

I try always to take my camera with me whenever I go out, because I never know what interesting thing I will encounter, and because I have a superstitious fear that on the one day when I don’t take my camera with me when I go out, that will be the day when an Airbus A380 flies over the middle of London, much too low, with one of its engines on fire, just when I have a perfect view of it.

Which means that when, on a recent late night visit to a local food and drink store that I don’t usually frequent, I spied the following mildly interesting collection of objects, I was able immediately to photograph them.

Okay, not an especially startling thing to see. A fizzy drink named after a murderous bolshevik who, because he died young just after being very well photographed, and because a lot of stupid and dishonest people worshipped him while concealing exactly why, is remembered as beautiful, and cool, and wise, and virtuous.

This peculiar cult of Che the Beautiful has been much discussed here, over the years, and not in a polite way. However, this fizzy drink does not by any means completely disgust me, by which I mean that the idea of it does not completely disgust me. I haven’t actually tasted Che and am in any case quite happy with the Tesco own brand version of such “energy” slop. Yes, these Che cans perpetuate a silly cult, but they also make it look, I think, rather ridiculous. For what we have here is not so much an anti-capitalist message as capitalism co-opting the iconography of anti-capitalism. Many of those seriously stupid people who not only love Che but who actually having a real inkling of what he stood for and of what he tried so ineptly to foist upon the world, well, they hate that. Their hero reduced by marketing opportunists to selling little cans of a generic fizzy drink to a target demographic of adolescent and agingly adolescent fools! Their precious revolution reduced to “the revolution of energy”, and it’s not even proper energy type energy, just stuff to keep kids awake for a few more hours. The horror. And I love that. This is the kind of thing that may eventually cut this beautiful, dead, deluded, murdering incompetent down to size.

Also, this is a photo-opportunity for the likes of us to remind ourselves, yet again, just what a bastard this particular bastard was, and just how stupid it is that so many people still worship him.

By the way, it was most gratifying how quickly google yielded up all those links. As one of the authors linked to above says, I forget which one, it is not at all hard to learn the ghastly truth about this ghastly man. Typing “Che Guevara” into google doubtless engulfs you in evil delusions. I don’t know. I didn’t do this. What I typed into google was: “truth about Che Guevara”, and most of what I very quickly found was very good and very anti-delusional.

According to one lady writer, when Che was a child he used to kill dogs for fun, a sure sign, she adds, of a psycho. Is that true? “Che Guevara killed dogs for fun” only got me back to the article I read this in. But if it is true, I think we might spread this around. Perhaps some little labels should be printed saying “When Che was a child he killed dogs for fun”, or maybe just “dog killer” because that’s quicker and simpler – and maybe tactically more effective because more cryptic and weird and disconcerting – and could then be stuck on Che tee-shirts, on Che posters, and on these little Che tins.

Readers may find it odd that students are being encouraged to express solidarity with totalitarian terrorist movements that set booby traps in schools and boast of using children as human shields, and whose stated goals include the Islamic “conquest” of the free world, the “obliteration” of Israel and the annihilation of the Jewish people. However, such statements achieve a facsimile of sense if one understands that the object is to be both politically radical and morally unobvious.

– David Thompson ruminates on the perverse intellectual incentives that face academics

The invasion by Austrian Economics of the Institute of Economic Affairs continues apace, and at lunchtime today I attended this IEA event on that very timely subject staged by the Cobden Centre. The weather today has been so hot that since this meeting I could hardly stay alive and then when I had staggered home, awake, so don’t expect a long and detailed report of what was said. All I really want to say here, now, is that I was greatly impressed by the two speakers, both of whom I photographed in action:

These two gentleman are, on the left, Jörg Guido Hülsmann, and on the right, Sean Corrigan. Watch out for those names. I’m fairly sure that quite a bit more is going to be heard of and from both.

The good news is that Cobden Centre Chairman Toby Baxendale asked both these two gentlemen if their performances could later be made available in written form to the Cobden Centre with a view to online publication, and both promised that they would cooperate fully with such plans.

I took other photos, including a couple of Tim Evans, the Cobden Centre’s Chief Executive. In one of these snaps, Tim poses next to the IEA’s evil monetarist Tim Congdon, who was present only as a picture on the wall.

Tim said that he also thought the speeches by the two gents above to be “superb”. He says that about any performances he has had any part in organising no matter how average, but this time I think he meant it. And as I say, I enthusiastically concur. Judging by the response at the end from a gratifyingly crowded room, everyone else present did too.

Allow me to put it another way, instead of scientists, these people were hedge managers, and they were found by an inquiry, run by fund managers and bankers, of not being involved in insider trading, but being part of a fan club. Moreover, though the figures they published for investors were misleading, the investors could have obtained the raw data and worked out that they were being sold a lemon on their own.

Would you be so forgiving?

– A commenter challenges George Monbiot on the subject of the Russell “Inquiry”, which found evidence of a failure to by communicate, but which didn’t find anything wrong with “climate science” on account of it not trying to. Recycled by “James P” in his comment here.

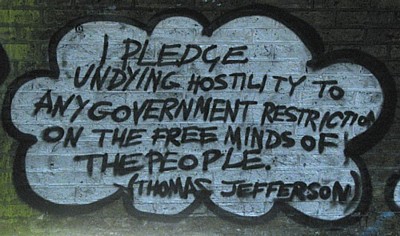

The words are mainstream anarcho-lefty stuff, but the name being quoted is a bit of a departure for the place where I spotted this. I took this photo in March, in Leake Street, which is a tunnel under Waterloo Station where graffiti artists do their best and their worst, with results that constantly change. Thank my Photoshop clone for how clear those words are. I went through the Leake Street tunnel again today and wondered if this sign had survived, but of course there was no sign of it. Here is how Leake Street mostly looks.

Contrary to what most people had assumed, banking in the United States had been highly stable in the decades before deposit insurance. Of course, depositors were concerned about their safety, but this made them cautious in whom they banked with. They demanded reassurance from their banks, and the banks gave it to them. Pressure from depositors forced the banks to be conservative, to lend carefully, to keep their leverage ratios low, and to disclose their broad positions. The bankers themselves were conservative even in their dress, but this was itself reassuring, and the solid architecture of the banks’ offices reinforced the notion that they were pillars of the community with solid roots in it. The key to banking was maintaining the confidence of depositors and not taking that confidence for granted.

Before deposit insurance, a bank that took too many risks would eventually undo itself. It would do well for a while, increasing market share and generating better shareholder returns than the fuddy-duddy banks, which would feel the pressure. However, come the inevitable downturn, the cowboy bank would experience heavy losses on its questionable lending, liquidity would tighten, and a point would come where the frightened depositors would run for their money: the cowboy would be literally run out of business. These occasional crises were unpleasant, but good for the long-term health and even stability of the system: the runs would expel the cowboys from the system and give a salutary reminder to those who survived. The system itself was rarely seriously at threat, because the depositors would redeposit their funds with the safe banks. There would typically be a flight to quality, a transferring of funds within the system, rather than a run on or threat to the system as a whole. Thus, it was the threat of a run that kept the bankers in line.

Once you introduce deposit insurance the situation changes profoundly. Deposit insurance allows the bankers to take their depositors’ confidence for granted. This takes the pressure off the bankers, who can now safely increase both their lending risks and their leverage ratios, thereby increasing returns to their shareholders (or, in modem Wall Street, to themselves). For their part, the depositors are no longer concerned with the risks their banks are taking, but only with the rates they get on their deposits. Consequently, deposit insurance subsidizes risk-taking, so leading to excess risk-taking with the deposit insurance agency and, ultimately, the taxpayer, picking up the tab.

Nor does the damage end there. With deposit insurance, there is no longer any run to fear and even the most insolvent banks following the most unsound “shoot to the moon” investments can now remain in business indefinitely, attracting more funds and staying in business by merely raising deposit interest rates. The process of competition then becomes utterly subverted: instead of allowing the conservative banks to drive out the cowboys, even if it takes a little time, the process of competition now rewards the cowboys and penalizes the good banks. It therefore pays to become a cowboy and, eventually, all banks do.

– From Alchemists of Loss by Kevin Dowd and Martin Hutchinson (pp. 271-2). Pictures of the two authors here, taken at the launch of the book last Wednesday evening at the Institute of Economic Affairs.

Michael Jennings just emailed me the link to this, “You may have seen this” being the title of his email. No, I hadn’t. “This” starts thus:

There was an unusual match between Barbados and Grenada.

I’ll say. Read the whole thing. Really, read the whole thing. It’s a classic of perverse incentives, showing how the wrong kind of rules can cause everyone to want to do badly. It’s about much more than football, in other words.

This posting is going to have to be of a more than usually interrogative sort, since I am more than usually ignorant of that whereof I blog, and which I will now copy and paste:

Certainly, on my travels, I’m going to be wary of accepting euro notes with serial numbers that are prefixed with the letters Y (coming from Greece) or M (from Portugal).

I shall also strongly steer clear of notes with the serial numbers starting G (Cyprus), S (Italy), V (Spain), T (Ireland) and F (Malta).

This might sound as if I’m being ridiculously alarmist, but you cannot be too careful.

However, other euro notes should be reasonably safe.

These include those marked Z (Belgium), U (France), l (Finland) and H (Slovenia). As for those with serial numbers beginning with X (Germany), P (the Netherlands) and N (Austria), they can all be used with total confidence.

Is this common knowledge? Am I the last person in Europe to hear about this? I shouldn’t be surprised. You can tell which country printed which Euro. Well, well. Who knew? Who, even now, knows?

The above quoted text is from a Daily Mail piece by Peter Oborne (linked to by Instapundit) about the various economic disasters the world faces. One of which is the melt-down of the Euro.

My big question, aside from wondering who else does or does not know this, is: supposing lots of people do know this, or get to know it, does it not provide a mechanism by means of which mere people might hasten the collapse of the more dubious EUrozone economies, by demanding, when being paid in actual money, to be paid only in Euros printed by the undubious countries?

Perhaps the answer might go: but making such judgments would be, in EUrope, illegal. Maybe so, but that won’t stop a black market making minute comparisons between differently lettered Euros, nor will it stop tourists in other parts of the world, planning their EUropean trips, demanding, once they hear such stories, to receive only the kinds of Euros that they would like. They could, for instance, refuse to accept the wrong kind of Euros, or, if given a mixture of good Euros and bad Euros, sort out the good from the bad and swap the bad ones back for pounds, or dollars, or whatever.

The wrong kinds of Euro notes, from the dubious countries, could soon be treated exactly as if they were forgeries, could they not? The big difference being that these forgeries will be easier to spot.

So, the much prophesied melt-down of the Euro can now be accelerated in a much more discriminating way than merely by people judging that the Euro as a whole will soon be disappearing down the toilet. We will all be able to decide – many may soon be forced to decide – which Euros will descend toilet-wards first. Won’t we? Can’t we? Now? I realise that there is more to money than mere bank notes. But if stories like those sketched above were to start circulating …

Has Oborne got his facts right about this? And if he has, do my supplementary questions also make any sense? As I say, this is all completely new to me, so I could soon, after the first few responses, be wishing that I’d never even asked.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|