We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

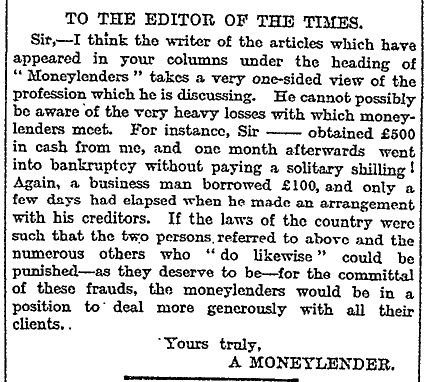

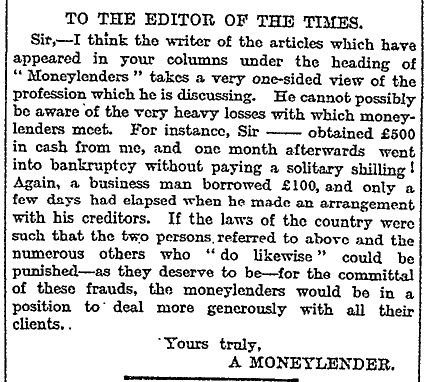

Moneylending: not as easy as you might think I see that the Church of England is about to go into the moneylending business. They appear to think that it is easy. If so, they might like to consider this moneylender’s words:

The Times, 11 July 1913 page 3. Or this one. (I liked the bit about even the Church having to lend out its money.)

The Liberty and Property Defence League also has a few things to say.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|

The greater the risk – the higher the rate of interest, the alternative is to NOT LEND. And that may be the correct policy – it is no good getting an agreement to pay a high rate of interest from someone who is going to default.

Money lending is a different business from banking.

Bankers (at least modern ones) lend out “money” that DOES NOT EXIST (I am NOT talking about gold – they do not even have the fiat notes and coins in their vaults).

However, some people (and I am one of them) do not regard bankers as the moral superiors of money lenders.

Rather the reverse.

I had an interesting chat over a drink a couple of months ago with a person who been involved in social lending to poor people from some semi-charitable organisation. Her job was risk management, basically, although she probably wouldn’t call it that. She described how she had discovered that ability to pay was not always a good indicator as to whether someone would pay a loan back, the importance of a borrower’s track record, how risk managers become captive to the interests of borrowers above sound risk management at times, and even how everything had been fouled up by introducing a computerised risk management model and over-relying on what it said rather than human knowledge of the borrower. It was interesting (and amusing) how the issues that came up were exactly the same as if you are a large bank making loans of hundreds of thousands (or even hundreds of millions) of pounds.

Payday lenders behave the way they do due to fairly straightforward market forces. If the CofE tries to compete with them, it will either find itself running or funding a business very like theirs, or it will get into a huge mess. These are the only two possibilities.(If it gets into a huge mess and the prospect of a government bailout then comes up, that would be funny in a sickish way).

I’m rather looking forward to seeing how the C of E does financially with its new venture. When one considers not just the default risk, but also the admin cost of making and collecting on a small loan for a short period, I can’t see how anyone could make a profit without charging stupendous interest rates, if you’re going to quote them in APRs. But if the Christians can make it pay – or even break even – good luck to them. I feel that this will be a good test of the power of prayer, as I rather doubt that arithmetic will cut the mustard on this one.

Yes Michael – the key indicator is MORAL CHARACTER.

No matter how unpopular that “judgemental” term is now.

Including with the Church of England.

This could get surreal. Does the C of E have the stomach for enforcing the repayment of a loan? I can’t see some Bishop bellowing through someones letterbox…Spanish Inquisition here, we’ve come for our money, can you?

Exactly what I was thinking, Michael.

I was under the impression that the C of E were intending a more on mutualised or

freindly society version, which were popular in days of old before governments and big commercial banks got an interest.

I was looking up in Wikipedia on the histories of the Hudson Bay Company when I came upon the references to the South Sea Company and the accompanying South Sea Bubble. And then I see the South Sea’s predecessor, The Hollow Blade Sword Company that was basically operating as an illegal public debt hedge fund of its day. Not too differently from today.

Paul Marks said Bankers (at least modern ones) lend out “money” that DOES NOT EXIST (I am NOT talking about gold – they do not even have the fiat notes and coins in their vaults).

And it’s true, in that there are no such notes and coins.

But it’s not relevant – “money” exists if it can be spent, not “if it exists in a physical token”.

Even if there were no notes or coins anywhere in the world, and all monetary transactions were electronic, the money would “exist” in the only important sense. And equally, if banks just printed off a ream of $1000 bills (or 5,000 pound notes or what-have-you) to cover their obligations, I don’t think it’d change anything important – or make Mr. Marks any happier about the situation.

(Equally, if notes and coins are repudiated they lose their value as “money” despite absolutely “existing” physically.

For that matter even commodity money – e.g. gold – stops being “money” if people stop deciding to accept it as a medium of exchange, either out of fear of legal consequence, or out of a preference for a money they prefer.

The problem with fractional reserve banking is the inflation of the money supply, not the lack of physical tokens.)

Sure, let the CofE set themselves up as moneylenders. It should be an interesting lessonf orthe divines in the realities of economics.

But they should take a leaf out of the book of their parent organization, which tried this many times in the C15 and came a cropper each time – until they set themselves up as not-for-profit pawnbrokers. This system flourished for 4 centuries and provided successful low-cost moneylending for poor people – which is the goal here, I thought. The CofE has underused premises everywhere, and underused staff to man them. I would have thought it would be the simplest start-up Ev-Er.

llater,

llamas

Ah, happy memories, the Hollow Blade Sword Company.

Trivia question – what tool in everyday use in the UK today can trace its history directly back to the Hollow Blade Sword Company? One of those little snippets of trivia that the lecturer used to keep us awake during boring Con Law lectures.

llater,

llamas

Too easy… Razor Blades, especially Wilkinson Sword. 😉

Sigivald – money is more than a medium of exchange, it is also a store-of-value.

It can come about in two ways – ether via a commodity being freely valued by buyers and sellers, or by government FORCE (legal tender laws and tax demands),

As for your “non physical money” – you are making a fundamental error.

The error of confusing money with CREDIT.

You remind me of the banker I once talked to (via the internet) who insisted that the “broad money” (bank credit) really existed, but “the deflation destroyed it”.

The “money” never existed in the first place – it is credit (magic pixie dust from the fairy castle in the air).

Credit bankers (and their defenders) believe that physical reality does not apply to them.

However, Kipling’s “Gods of the Copybook Headings” have the last (bitter) laugh.

Oh, by the way, that “gold” the City people (backed by the government Central Banks) have been selling…..

The buyers want physical delivery – and they want it NOW.

Tim Worstall linked to a piece a couple of years back about a not-for-profit organisation making payday loans. They too charged extremely high APR interest rates, for the same reason the profit-making companies do: it is a very expensive business with high rates of default.

But it’s better than going to loan sharks, something the Left seem not to understand.

My business is loans/rentals to the underclass (usualy) here in Oz.

I have over $400,000 of bad debts on my books which the courts will refuse to enforce. But i also have a government department which has been engaged in “cracking down” and vastly inflating the record keeping/budgeting and statutory requirements to stay in business.

If all my customers paid on time, in full I could halve my rates and still be in front.

It is a real failure of the courts which is at the heart of the problem, even if I obtain a judgement against someone (And I have been through this a few times now) the court will routinely set it aside as “causing hardship”.. And not a cent will be paid.

If a court wont enforce contract law then Im afraid any attempts at “reform” will lead to the Piranha brothers becoming the only source for short term loans.

Yes – whether it is “judge made law” or crazy Statutes – if the PRINCIPLES of law are lost then “law” becomes sick farce.

If, for example, repaying money will “cause hardship” and “hardship” means that one does not have to pay the money one has promised to pay – then what the legal system is really saying is “only lend money to rich people”.

The principles of jurisprudence (the philosophy of law) are just as real as physical laws (such as gravity) – the trouble is that the modern “legal system” has lost sight of them (even despises them).

Well someone can do that – but not without consequences.

A person may choose to walk off a cliff – but falling is not optional. “I want to walk off a cliff (without taking any measures to prevent falling) and not fall – because I do not want to fall” is not a sensible position.

The people of a legal system may choose to ignore sound principles of jurisprudence – but not without the consequence of harm to the basic functioning of civil society.

And people may choose to ignore the principles of a sound financial system (lending out “money” that does not really exist, lending to people who do not repay their loans – and then demanding government bailouts to protect their credit bubble “bank” and their own multi million Dollar bonus payments), but the CONSEQUENCES of choosing to do this, are not a matter of choice.

No, not razor blades.

One of the original workers at the HBSC was one Mohlle (sp?). When the HBSC went under as a sword-making company, he set up as a swordmaker and later a maker of all sorts of tools. The company Anglicized its name at some later time to Mole, and it is (among other things) the maker of the Mole over-centre locking wrench, aka ‘Mole Grip’.

So now you know.

llater,

llamas

Um, Wilkinson Sword bought the company in 1922, so why not razor blades? They also had a banking and Mortgage arm too. So why not mortgages?

When I was a lad in South Wales, you used to get letters where the envelope was franked with the legend… Newport, home of the Mole wrench. Their main factory was obviously situated there.

So now you know 🙂

It’s a well-known fact that money directly causes mental illness. You can prove this for yourself! Just lend a friend some money, and see how quickly he is stricken with amnesia!