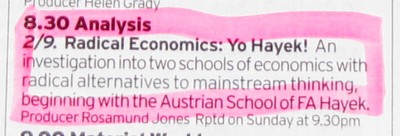

As in BBC Radio 4, this coming Monday, January 31st, 8.30 pm:

That’s from the current Radio Times. As you can tell from the pink, I will be paying close attention. My thanks to fellow Samizdatista Chris Cooper for alerting me to this radio programme.

But will it be an attempt at a hatchet job? It seems not:

This week, Jamie Whyte looks at the free market Austrian School of F A Hayek. The global recession has revived interest in this area of economics which many experts and politicians had believed dead and gone. “Austrian” economists focus not on the bust but on the boom that came before it. At the heart of their argument is that low interest rates sent out the wrong signals to investors, causing them to borrow to spend on “malinvestments”, such as overpriced housing. The solution is not for government to fill the gap which private money has now left. Markets work better, Austrians believe, if left alone. Analysis asks how these libertarian economists interpret the state we’re in and why they’re back in fashion. Is it time to reassess one of the defining periods of economic history? Consensus would have it that the Great Depression of the 1930s was brought to an end by Franklin D Roosevelt’s Keynesian policies. But is that right? Jamie Whyte asks whether we’d all have got better quicker with a strong dose of Austrian medicine and whether the same applies now?

I think I first encountered Jamie Whyte at a Cobden Centre dinner.

I was disappointed with the recent Robert Peston TV show about the banking crisis, despite appearances on it by Toby Baxendale, the founder of and Chairman of the Cobden Centre. All the fault of the banks was the basic message, with governments looking on helplessly. No mention (that I can now recall) of those same governments monopolising the supply of money and relentlessly determining the price of borrowing it, all day and every day, all the time.

But, my understanding of Baxendale and of the Cobden Centre is that he (it) is playing a long game, giving broadcasters whatever they ask for (in Peston’s case Baxendale messing about with fish), while all the time asking them to give the Cobden Centre’s ideas at least something resembling a decent hearing. Don’t compromise on the ideas, but be endlessly mellow and accommodating at the personal level, intellectual steel in velvet glove, and so on and so forth. If that’s right, then it may be starting to work.

8.30 PM Monday, BBC Radio Four.

Right I can listen to that – so I will.

Just to be pedantic, Roosevelt wasn’t a Keynsian. The General Theory wasn’t even published until 1936! His policies were more fascist corporatism than anything, based on the widepsread admiration for Il Duce at the time.

Hayek was another economist who agreed that Land Value Tax was the least bad tax 🙂

” . . . radical alternatives to mainstream thinking.” [emphasis added]

And not a peep from the Samizdatocracy!

“Don’t compromise on the ideas, but be endlessly mellow and accommodating at the personal level, intellectual steel in velvet glove, and so on and so forth. If that’s right, then it may be starting to work.”

Do you really believe this!?

Mark Wadsworth.

I will not ask where you got that Hayek thing from – because I am not interested.

However, I am interested in one thing in relation to your proposed tax.

HOW BIG WOULD IT BE.

Say the rentable value of a bit of land was ten thousand Pounds per year.

Or the sale price was two hundred thousand Pounds (which ever way you want to do it).

HOW MUCH MONEY WOULD YOUR TAX BE?

I am NOT asking for you to justify your tax – or explain to me how it is the “least bad” (or whatever).

I just want to know how BIG this “Single Tax” would be.

Please tell me.

It was a good programme – I would recommend it.

However, there should been more of an attack on the idea that Roosevelt cured the Great Depression.

And the (leftist) biographer of Keynes should not have been given a large parts of the show.

There will be a collectivist show on next week – same time, same station.

Will large parts of the show be taken up with imput from a free market person?

I doubt it.

You have a limited amount of time – do not waste it giveing a platform for the left (they have all the rest of the time anyway).

Well worth hearing. Pulled its punches a bit, and ended with gloomy prognostications of the “we haven’t much chance of persuading people” variety. Andy Murray would never say that. Not even Tim Henman ever said that.

Must check out that Keynesians-v-Austrians rap on YouTube – it sounded surprisingly good.

The worst bit of the programme came at the end.

The bit about America has gone in for “stimulus” but Britain has not – so we will be able to compare……

Actually the British budget deficit is at least as big (if not bigger) as a proportion of the economy as the American one.

The economy was already in decline last year – even BEFORE the tax increases came in.

No doubt the left will say the failure of Britain shows the failure of the “free market”.

“But Paul, if tax increases are free market you might as well call Herbert Hoover a free market person”.

That is exactly what the left do – and have done for decades.

False – but it is what is taught in the schools and universities, and presented in the media.

By the way – even Germany had a budget deficit of 3% of G.D.P. and is linked in to the insane Euro system (the bailouts are often to protect German banks who have lent money in markets like Ireland).

Still Germany is miles better than the vile line of policy followed in Britain and the United States.

The only good thing about Britain is that the labour market has not been as inflexible as I feared it might be.

Real wages have dropped – thus meaning truly mass unemployment has (so far) been avoided.

Not all of Mrs Thatcher’s labour market reforms were reversed – although (it should be remembered) that these reforms were really those of Norman Tebbit.

Before N.T. became Employment Secretary the government did basically nothing to reform the labour market – thus allowing MASS UNEMPLOYMENT because of the pro unionj laws that were in place.

The inaction of James Prior (and so on) was a terrible thing – truly terrible.

Some free market people attacked Tebbit (on Friedman grounds – that he was adding new laws not repealing old ones), but if the old statutes could not be repealed there were two choices.

Add new statutes to artificially weaken the unions (to counter balance the artficial strengthening of the unions by the old statutes) or do nothing.

And doing nothing (the policy of James Prior and so) meant leaving millions of people to decay in unemployment.

As a belated response to Paul Marks, if I were in charge I would replace absolutely ALL taxes (income tax, VAT, NIC, corp tax, council tax, the lot) except booze fags and fuel duties with LVT of very approximately 8% of the current market value of land and buildings. Pensioners would be exempt (because I can’t be bothered with that argument) and LVT on farm land would be so low as to be not worth collecting.

This of course would mean an overall reduction in the tax take, but there would be a corresponding reduction in corporatist spending and state sector non-jobs.

Thank you Sir.

I did not (I must confess) think you would reply.

So the tax would be 8% of the sale price (not the rentable value) – every year.

But in return there would no income tax and so on.

What about people like me – who own neither land nor buildings.

Would the council pay 8% of the sale price of this house every year?

Of course the sale price would tend to drop – once people understood they would have to pay 8% of the value of a house every year in tax.

But, on the other hand, you say income tax and VAT (and so on) would be gone.

So I am not going to just denounce you – you have a point of view, and it might be no worse (or even less worse) than the current system.

How irritating – Paul does not get to rant.

I can not rant – because I got a reasonable response.

“What about people like me – who own neither land nor buildings. Would the council pay 8% of the sale price of this house every year?”

Everybody has to live somewhere – whether as tenant or owner-ocupier. So everybody gets his (modest) Citizen’s Income (about £70 a week in my manifesto) plus he keeps the whole of his earned income (however much or little that is).

The LVT is a tax on the ‘consumption of’ i.e. the exclusive possession of land. So whether you are tenant or owner-occupier, you will end up paying or bearing the LVT bill for where you live (or the premises that you need for your business) – it’s about taxing substance over form. Whether the landlord ‘passes on’ the LVT to the tenant or whether the LVT is included in the total rent that a tenant pays anyway is neither here nor there.

You could argue that a tenant pays his landlord’s income tax bill under current rules, for example, because by definition, part of the rent goes towards the landlord’s income tax. So what?