We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

Instapundit, whom I revere for his relentless, industrial strength linkage (happy tenth anniversary Professor), has been in the habit, in recent times, of linking to pieces about how Americans are getting ever more disappointed by President Obama. But, as I am sure that Instapundit himself appreciates, the disappointment with Obama coming from Obama’s own former supporters is not because Obama’s preferred economic policies are now correctly understood by those ex-supporters to be disastrously destructive, but rather because Obama seems insufficiently determined and skilful in imposing these policies upon Americans who would prefer relatively sensible economic policies.

Obama’s leftist critics are not disappointed with Obama because they have come, reluctantly and through bitter experience, to share the opinion of his policies held by the Tea Party. Rather are such critics disappointed with Obama because he is not crushing the Tea Party, but instead haggling with them, and doing so, as these critics see it, with insufficient skill and nastiness.

Yes, Obama still seems to believe in the same daft policies that these leftist critics favour. But where is the passionate commitment to folly that he persuaded them he felt when he was getting elected, and that they still yearn for? Perhaps someone else (Hillary Clinton?), with greater energy, industriousness and human warmth, could lead America over the cliff with the proper amount of dash and determination, instead of Obama just leading the herd from somewhere in among it.

One should not, in short, confuse the fact – if fact it be – that President Obama is now being thought by ever more Americans to be doing a bad job, with the claim that all of America is coming to its senses in the matter of what it should do about its current economic woes, or what will happen to it, and to the world, if it does not do what it should do.

Today I learned, from someone who was involved in the making of it, that:

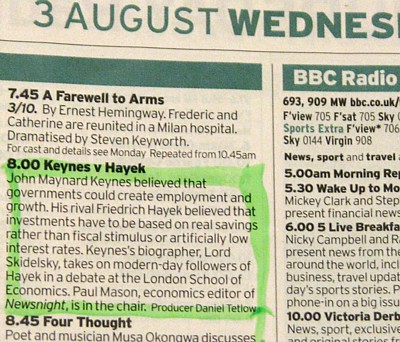

The Radio 4 bosses liked the Keynes v Hayek debate so much that they are going to repeat it at 9 am on Wednesday 24th August. This sort of thing is very very unusual. This is probably going to add around 1.5 million listeners to the estimated 1 million radio listeners the programme has already had. (I haven’t looked at the podcast stats yet but it was in the iTunes News and Politics top 5 in the UK.)

My own personal reaction to the debate was that a true clash of archetypes was too often, for my taste, dragged off into nitpicking about who said what, when, and just what Keynes would have made of Q(antitative) E(asing), when the real point is that he wouldn’t have started from there. But then again, the show was flagged up as “Keynes v Hayek”, rather than as “Mainstream Economics v Austrian Economics”, so I probably shouldn’t grumble but should instead be counting blessings.

Which are numerous. Far more to the point, the above news makes me think, again, more so, this, which said that we are at least, at last, having this argument, beyond the confines of the Austrian Economics tribe and of the tiny few others who had until recently actually heard of it. Austrianism is now emerging from the great gaggle of alternatives to the present disastrous economic policies to take pride of place, at least in the heads of a great many of those who think seriously about economic policy, as The Leading Contender.

This is, in short, very good news, which puts an interesting slant on the ever ongoing argument about whether and how the BBC is biased.

Taking a break from life in riot-torn London, I came across this item at the FT about some of the implications of longer lifespans. It is a mixed situation. Excerpt:

“Maxmin admits there are no miraculous solutions to the problems of a fast-ageing society. We will all have to work longer, save more and pay more in tax to cover the costs of a world with a greyer population. Even so, he thinks models like Elder Power can have a much wider application. Perhaps moments like the collapse of Southern Cross, he tells me, could (in the right hands) become moments of opportunity. More generally, models like Beacon Hill Village, ITNAmerica and Elder Power show glimpses of a future in which more elderly people can stay in their homes for longer. All three use innovative technology, make use of assets in their local community and bring together the resources of local businesses, volunteers and the state to solve problems none could have solved individually, at reasonable cost.”

How we deal with ageing, and the issue of longer lifespans, is of course intertwined with the current fiscal breakdown of many developed economies. Healthcare costs are skyrocketing. And in that Greg Lindsay and John Kasarda book I have been linking to lately, about the impact of mass aviation, there is a segment on how said aviation can be used to dramatically reshape healthcare, such as by flying people with problems to cheaper, but arguably better run, hospitals in Asia. It struck me while reading this book that while automobiles and consumer electronics have been propelled by their Henry Fords, Michael Dells and Steve Jobses, we haven’t really had, in healthcare, a similar set of individuals to drive innovation and push things sharply down the price curve. The dynamics of Silicon Valley, allied with cheap Chinese manufacturing and just-in-time stock inventory systems, hardly touches healthcare at all, although this is starting to change, perhaps. Of course, much of this is caused by how healthcare is seen, wrongly in my view, as somehow “different” from such vulgar things as selling flatscreen TVs or cars. Healthcare is political. That’s the problem.

“The US government has to come to terms with the painful fact that the good old days when it could just borrow its way out of messes of its own making are finally gone” […] In the Xinhua commentary, China scorned the United States for its “debt addiction” and “short sighted” political wrangling. “China, the largest creditor of the world’s sole superpower, has every right now to demand the United States address its structural debt problems and ensure the safety of China’s dollar assets,” it said. It urged the United States to cut military and social welfare expenditure.

– Xinhua News Agency.

No kidding but hey, when a state run by a communist party tells the USA to spend less on… welfare, you start to get some idea just how strange the world has become and just how screwed the US actually is.

“Flowers begin arriving past night and bidding starts before dawn. To ensure their lilies and hyacinths are ready for the auction block, growers move them from cold storage onto carts in the early morning, or else rush them from Schiphol after overnight flights from Quito, Nairobi, and Tel Aviv. It’s impossible to see, much less make sense of, the Aalsmeer at eye level, as the floor of its central warehouse is a thicket of carts bearing blooms, all waiting their turn. This is the world’s largest commercial building at ten million square feet, more than twice the size of Chicago’s Willis Tower or Merchandise Mart….” (Page213).

“From a catwalk running above, you can study the crazy quilt of tulips, sunflowers, azaleas and hydrangeas bleeding into daubs of orange or pink on the horizon. The quilt constantly changes colors and patterns as burly Dutchmen at the wheel of one-man tugs trail daisy chains behind them.” (Page 213)

What is interesting about these passages, concerning the marvels of the vast flower-auction market in Holland, and the global reach of this business made possible now due to aviation and refrigeration, is that the author does not fall into the usual stale bromides about how all this aviation-led trade is killing the planet. I liked this passage, on page 232-3:

“Food miles cannot begin to compare in toxicity with flatulent cattle. Anyone who’s read the Omnivore’s Dilemma can recite chapter and verse on the perils of force-feeding corn to livestock in feedlots. Cows produce methane, a greenhouse gas thirty times more potent than carbon, as a by-product of digestion…..A breakdown of the Big Mac revealed that nearly a third of its [carbon] footprint stems from feed production, another third from storage, and much of the rest from slaughtering, frying, and baking. Food miles contribute 3 per cent.”

Aerotropolis: The Way We’ll Live Next, Greg Lindsay and John Kasarda. 2011.

Tonight,BBC Radio 4, 8pm:

I’m told that it will sound a lot more coherent than it did on the night it was recorded.

More pre-publicity from the BBC here.

American government spending will be higher in 2011 than it was in 2010.

Government spending will be higher in 2012 than it was in 2011 – much higher.

The above is all that matters – everything else is piss and wind.

The deal is one great big shining lie.

– Paul Marks

The first match fixture to be drawn for the 2014 soccer world cup. One of the manifestations of globalization that will go largely unnoticed for a couple of years.

UPDATE: With North Korea and Syria in the same qualifying group of four teams, it looked like we could have a different sort of “Group of Death” than usual, but FIFA chickened out and put Iran and China in other groups.

MORE: Guatemala and Belize. The former’s government claims ownership of the latter. Football correspondent with war zone reporting experience required?

On a more pleasant note, the job I want is covering CONCACAF Group B: Trinidad & Tobago, Guyana, Barbados and the Bahamas. Well, someone has got to go there and report on the beaches, I mean football matches…

EVEN MORE: “In consideration of the delicate political situation between Russia and Georgia, FIFA has agreed to a UEFA request that these two teams not be drawn together.” [From the news feed here]

The good news: those polars bears killed by “global warming,” were not.

From the AP:

Charles Monnett, an Anchorage-based scientist with the U.S. Bureau of Ocean Energy Management, Regulation and Enforcement, or BOEMRE, was told July 18 that he was being put on leave, pending results of an investigation into “integrity issues.”

… observations suggested the bears drowned in rough seas and high winds and “suggest that drowning-related deaths of polar bears may increase in the future if the observed trend of regression of pack ice and/or longer open water periods continues.”

Bad news for some, I reckon.

A few years back, I proposed an alternative budget for the UK. IIRC, it involved cutting taxes by a quarter, spending by a third. Even assuming no increase in economic growth (that would boost sales tax revenue), this would have created a massive budget surplus that could have cut the UK national debt by over 10%.

I opposed default then for what I still think were good reasons: first, many private individuals and institutions bought bonds in good faith; but second, because the UK nearly had to surrender to Nazi Germany in 1940, and had refused to confront Hitler when war was still not necessary partly because of the consequences of a partial default on war bonds from the First World War. In essence, appeasement was the necessary policy of 1930s British governments because they could not expect to borrow so had to pay in gold and whatever the British public could be persuade/forced to raise (yes I know pacifism was big too, but the financial imperative meant that it was the only option).

Whether we take an interventionist view or not, the re-militarization of the Rhineland in 1936 was the moment when, without firing a shot, Hitler could have been stopped.

What does this have to with events in Europe and the USA today? In short, I think the financial situation is so dire, and the political solutions on offer so inadequate, that default is now the only credible outcome. I therefore conclude that it needs to happen very soon, rather than after wasting more resources on more “bail-outs.”

We will just have to take our chances that no one decides to, invade the Falklands, or grab Gibraltar, or build nuclear weapons and give them to terrorists, or blow up US embassies. I explain why below. → Continue reading: The debt ceiling should be cut not raised

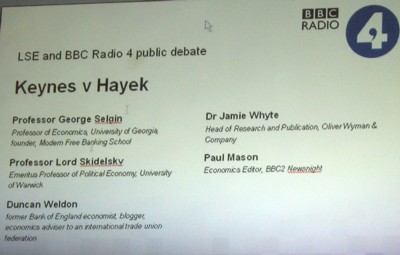

I see that, no doubt under the influence of the same editorial prodding as I received this afternoon, Johnathan Pearce has already done a posting here (see below) about the debate last night (also attended by John Phelan) at the London School of Economics. What I have to say is really just an expanded version of what Johnathan Pearce has already said, but I’ll say it anyway, partly because I do have one distinct advantage over him in this matter. Unlike Johnathan but like John Phelan, I was actually there.

I took photos, including one that does quite a bit of further event describing, which saves me having to:

Click to make that more legible.

Here are the two bad guys, Skidelsky and Weldon:

And here are the two guys on our side, Selgin and Whyte:

Click on the good guys to get them bigger. (The bad guys are quite big enough already.) As you can probably deduce from my pictures, the lighting on the stage was what you might call excellent for radio.

As for what was said, my overriding impression was that the Hayekians won, but not in quite the sense that John Phelan means when he says that they won, i.e. (a) that the Hayekians were more numerous and shouted louder and (b) that the Hayekians included John Phelan. They were, they did and they do. The “Hayekians” included me as well, for whatever difference that makes to anything. No, this was a more significant victory for Austrianism in the broader sense than merely that some Keynesians were, in the opinion of one of the anti-Keynesians who attended, out-argued on the radio. The really important point is that Austrianism is being put up there beside the broadly Keynesian macro-economics orthodoxy, as the alternative. The alternative.

I recall in my youth reading a book by someone called Robert Townsend. Townsend was the boss of a car hire company called Avis, and it was on his watch that a go-ahead new advertising agency (a bit like the ones in Mad Men), urged on and applauded by Townsend and his underlings, coined the Avis advertising slogan: “We’re Number Two and We Try Harder”. Number One being the car rental company Hertz.

The point of the slogan wasn’t that it caused very much immediate hurt to Hertz. On the contrary, it acknowledged Hertz as Number One, which got everyone’s attention. Who are these guys calling themselves Number Two? Wow. The regular advertising thing in those days would have been for Number Two to scratch around until it had found some more or less implausible excuse to call itself Number One. Most of the hurts (pardon the pun) unleashed by this slogan were inflicted upon car hire companies Number Three, Four, Five and the rest of them. What the slogan about Avis being Number Two but trying harder did was separate Avis from the huge pack of “other” car hire companies. It turned Avis from nothing into Pepsi-Cola, you might say. Hertz continued to be Coke (whether Coke itself is still Coke is another argument), but Avis itself lept ahead, patronised by anyone who fancied trying a try-harder, less smug alternative to Hertz. The others, who were presumably trying just as hard as Avis, fell away.

That, I believe, is the significance of events like that debate last night. It puts Austrianism on the map as the “other” way of looking at all that financial turmoil we’ve been having lately. No Keynesians present at this debate will have been very discomforted by anything that was said during it. They had their guys up there on the platform and they clapped and laughed and cheered when their guys spoke with any eloquence, just as we (John Phelan, I and the rest of our team in the audience) clapped when our guys waxed eloquent.

For you see, this was a classic BBC event. Built into the DNA of the BBC is that in order to “do” anything that is opinion rather than mere news, you have to argue about it, and to argue about it, you have to have two sides. Not three sides or five sides. Two.

And the big trick, if you aren’t Number One in a BBC debate is somehow to wangle yourself the Number Two spot, and what’s more to get that spot entirely for your team. Austrianism, judging by last night’s show, is well on the way to accomplishing precisely that status. And this despite, as Lord Skidelsky himself quite rightly said, having a numerically tiny academic presence compared to the (approximately speaking) Keynesian orthodoxy.

The big point here is not, e.g., whether Lord Skidelsky said nice things about how the Chinese government goes about its Keynesian business (although he did), or whether Selgin spoke eloquently (he did in my biased opinion, eventually, and despite his rather comical reliance on waving minute and totally illegible graphs around, which don’t exactly go over a storm on the radio, as everyone except him seemed to realise). The point is that this debate was “Keynes v Hayek”, rather than “Keynes and his critics”. The speakers were two Keynesians and two Hayekians, rather than merely two Keynesians and then a pathetic queue of anti-Keynesian pygmies of about ten different varieties (several of them complaining that the Keynesian headliner acts weren’t being Keynesian enough) taking it in turns to be humiliated.

I agree with Phelan that Skidelsky’s open admiration for Chinese “investment” in “infrastructure”, in answer to a question about China from the floor (and huge kudos to whoever it was who asked it), was both an illustration of the inherently bossy nature of Keynesianism, just as Hayek said, and that this might have been seized on more eagerly by Whyte or Selgin than it was, which was hardly at all. Skidelsky’s answer was also a horrendous hostage to fortune. If Chinese infrastructure “investment” in recent years becomes famous for being as wasteful as some here already suspect, Skidelsky should be reminded of this pronouncement.

Speaking very much for myself, I was delighted when Skidelsky spelt out, with admirable clarity, that we Austrianists believe that President Roosevelt prolonged the Great Depression. At this point I shouted out words to effect of “quite right” and “he did”. Skidelsky then said, glancing contemptuously in the general direction of my heckling, that anyone who thought that was living in cloud cuckoo land. Fine. He was on the platform and was entitled to the last word on the matter. On the night.

The point being not to win arguments like this, but to have them, to let everyone listening know that, when it comes to things like whether Roosevelt had a good Great Depression or a bad Great Depression, there is an argument.

When it turns out (this was not really talked about last night) that actually, far from having calmed down, our new version of the Great Depression is still at the you-ain’t-seen-nothin’-yet stage, arguments like that one in particular about Roosevelt making the Great Depression worse, and in general about Keynes versus Hayek, could result in the Number One team in this bunfight being deposed. Guess who I think might – just might – be invited to step forward to replace that Number One team. I agree with Johnathan Pearce that “wallowing in despair” (see below) is, in times like these, a cop-out.

A final point, concerning the BBC master of ceremonies, Paul Mason. Mason had a lot to contend with, what with urging speakers to cool it with the paper flapping, organising the re-recording of bits when microphones fell off or when there was a big noise interrupting things or when the audience wasn’t quiet enough during the first attempt at a re-run, or when he himself had some intros to do but fluffed his lines, for instance by giggling. Also, from time to time, it was Mason’s rather undignified duty to get us all to yell either “Yo Keynes!” or “Yo Hayek!”, according to taste. Nevertheless, in among all that, I got the distinct impression that, if not actually on our side, Paul Mason is highly sympathetic to the case that the Hayek team were making. At the very least, he has taken the time to become thoroughly acquainted with what that case is.

An edited version of all this intellectual mud-slinging will be broadcast by Radio Four on August 3rd.

See also the latest Keynes v Hayek rap video. They played that at the beginning, to get everyone in the mood. Genius. If you want to know why I think it’s genius, you must be one of those people who skips to the end of blog postings without actually reading them. Which is fine, but: see all of the above.

I have been reading this book, Aerotropolis: The Way We’ll Live Next, by Greg Lindsay and John Kasarda, and it is full of gems. We take the ability to order a book or other item online and have it delivered in days for granted, and perhaps tend to forget how much we have got used to this unless, that is, such services are disrupted by things such as security clampdowns or Icelandic volcanic eruptions.

Here’s a couple of paragraphs:

“Despite its handicaps, LAX has been the catalyst for the city’s metamorphosis into America’s premier trade entrepôt over the last 30 years. It was during those decades that the industrial fulcrum of California first shifted north – out of the hangars of Hughes Aircraft and into Silicon Valley – and then west, all the way to China. We have LAX to thank for our iPhones and iPods being `designed by Apple in California, assembled in China,’ as they advertise on their backs. Not just Apple, but every Valley company that began life combining transistors there – think Intel, Hewlett Packard, Sun, and Cisco – long ago began outsourcing work from its messy, depreciating factories to ones across the Pacific. Now they wait for airborne freighers to land in Los Angeles with the first samples of their latest holiday smash in the hold.”

(Page 29)

“Anyone lucky enough to have hitched a ride aboard a freighter or been taken under the wings of the `freight dogs’ who pilot them could tell ou enough stories to pass the eighteen hours to LA from Singapore. At any given moment, there are aloft `incomprehensible quantities of the mundane,’ in the words of one such witness: 160,000 pounds of roses leaving Amsterdam, 25,000 wiring harnesses bound for auto plants around the Detroit, or 5,000 pounds of Grand Theft Auto games inbound for LAX. Another writer babysat a stableful of horses in transit between O’Hare and Tokyo, including a dozen Appaloosas bound for a Hokkaido ranch. One pilot recounted the tale of a mysterious ice chest, insured for millions, which he later learned was the vessel for the first HIV drug cocktail.”

(page 33).

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|