We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

But the kind of protectionism that Trump appears to crave creates even more – including the very people it is intended to help. Consumers pay more for goods. Less wealth is created. The arteries of exchange, of innovation, of prosperity, become choked.

To her great credit, Theresa May grasps these truths – hence her refashioning of Brexit this week as a chance for Britain to turn its face to the world. To his great discredit, Donald Trump does not. (Although there are any number of CapX articles that could enlighten him.)

In that farewell address, America’s first President expressed his faith “that the good sense of our countrymen will guard the public weal… and that, although we may be a little wrong now and then, we shall return to the right path with more avidity”.

On many issues, Donald Trump has yet to choose his path. But on trade, it is crystal clear that he is going down the wrong one.

– Robert Colvile

By definition, a customs union is an agreement between countries to embrace tariff-free trade between members but impose common tariffs on goods imported from non-members. At an EU-level, this means a Common External Tariff (CET), a dizzying array of over 12,651 different taxes (and some quotas to boot) imposed on goods from the rest of the world. The long and short of it is that the EU is internally trade liberating but outwardly protectionist.

– Ryan Bourne

Yesterday, at my personal blog, I expressed extreme gratitude to Christian Michel for letting me talk last Friday, at his home, on a subject which, when I first floated it to him, must have seemed very vague and vacuous, although judging by what he said about my talk afterwards, he was almost as pleased by it as I was.

Tonight, I will be attending another meeting organised by Christian Michel, partly out of gratitude for last Friday’s meeting. There is a London tube strike happening today, and I am pretty sure that Christian is now feeling a bit nervous about attendance, so I will make a point of being there.

The title of tonight’s talk is “The Collision of Fintech and Traditional Banking”. The speaker will be Sasha Karim. (I’m guessing that this is the Sasha Karim mentioned here.)

I am hoping that what Sasha Karim will say is, among other things, that, by radically lowering transaction costs and thereby making the life of a “financier” (formerly only available to ultra-clever (but not necessarily ultra-wise) people who had access to or who were attached by ultra-rich (but again, not always ultra-wise) employers to expensive machines in expensive buildings) “fintech”, aka the new world of financial transactions on mobile phones, now available to all people who are above dirt poor, is creating a world in which the old dream dreamed by the likes of Friedrich Hayek of denationalised money, can become a reality and rescue us all from the great catastrophe that has been governmentalised fiat paper currencies, of the sort denounced by another friend of mine, Detlev Schlichter. We shall see. But maybe I am being too optimistic, both about the talk and about the world. Concerning the talk, I will report further.

Hayek’s crucial little book on denationalised money has long been available on the www as a free .pdf download, but I only just found out that Detlev Schlichter’s book is now available as a free-to-download .pdf file also. Blog and learn.

The idea that an economist is an expert even in Economics is a dubious one. I would like to see two control groups shadowing every team of ‘expert’ economists – one making random predictions, the other a group of astrologers. After five years we compare their predictions for accuracy.

– Samizdata commenter Rob

The logical end-point in the reach of government is either state ownership of all private property, which is communism, or state control over what people do with their property, which is fascism. With communism discredited, the world is moving inexorably towards the latter. Every business is regulated in some way or other, and economic freedom is being progressively restricted with ever-tightening regulations.

– Alasdair Macleod

Recently a friend who works for the BBC asked if I knew of any good general interest but topical stories coming up any time soon, and I said that when they finally finish London Gateway, the new container port now being constructed and even already slightly used, on the north bank of the Thames Estuary, that will be made a big fuss of.

She then told me about a series that the BBC World Service is doing about 50 Things That Made the Modern Economy. I said that the Container certainly should be one of these Things. She later determined that the Shipping Container does indeed feature in this series, and she sent me that link. Amazing what a difference an email with a link makes to your willingness to attend to something.

This piece about the Shipping Container lasted under ten minutes, and, although I had heard most of the story before, I liked it. So I then sampled a couple of the other Things, about which I knew less and nothing, namely: the Barcode, and the Haber-Bosch Process. The latter is for turning the nitrogen in the air into fertiliser.

The next Thing I listen to will be Concrete. I already know what concrete is, but I expect to learn a lot more, about it, and about what it did to and does for the world. Made life a lot easier for farmers, apparently. Which, to a townee like me, is one of those many things which is obvious, but only if someone makes me think about it.

Recommended. An economist and economic historian by the name of Tim Harford has done a number of these Thing broadcasts, including the ones about the Container and about the Barcode. He is already very well known, but not so well known to me. But, I can already tell you that he also is to be recommended, going only by how he talks about these Things.

LATER: See also this earlier posting here, about similar Things.

I wanted to believe that Hillary Clinton would lose the recent US presidential election, so when I started reading Scott Adams saying that she was indeed going to lose, to Trump, I kept on reading him. Like so many others, I like to read within my bubble, as well as outside it. That means I also now read Scott Adams on every other subject he deals with in his blog. I am now digging back into his archives for more wise and witty verbiage. I am surely not the only one doing this now.

Scott Adams has a girlfriend called Kristina Basham, who, it would appear, is working and working at becoming one of those people who is famous for being famous. This is one of those labels that most people seem to assume is an insult. But being famous is a skill and a job, like any other skill and job. Your basic skill is that you know how to attract attention, and you basic job is that you sell this ability and live with the adverse consequences of it as well as the benefits. Scott Adams describes very well the sort of work that goes into becoming one of these F4BF people, as I will call them from now on. Kristina Basham is not, you see, outstandingly good at anything in particular. She is just pretty good at a whole “stack” of things, which, when you combine them, are making her into someone F4BF.

I say: good for her.

The claim that people who are F4BF contribute nothing to the world is the latest iteration of that very old and very bad idea that there is a “real” economy, consisting of work that people are used to doing and which their ancestors even did, like farming and then after that factory working; and then there is the “unreal” economy, consisting of silly things that add nothing to the “real” economy, but instead just leach off it, like financial services (which actually make farming and industry massively more productive by telling farmers what to farm and industrialists what to industrialise), and more recently jobs like being F4BF. (Even being a factory worker was once upon a time denounced as being unreal.)

Being a celeb, and in particular being nothing but a celeb, an F4BF, which is to say being good at attracting attention to oneself but for no single and obvious reason, but still being good at it, is a vital part of the modern economy. Celebs, including F4BFs, enable attention to be diverted away from major economic investments, while the work of creating or building them is being done and needs not to be disturbed, in the secure knowledge that when attention is finally demanded, and you need to attract a lot of business very quickly or else a lot of money will be lost while the word spreads by mere unassisted word of mouth. For that grand opening of whatever it is that you have been quietly working on for however long it has been, you hire a bunch of celebs. Including maybe some of that particular sort of celeb who are F4BF, pure and distilled celebs who are nothing but celebs.

Discuss.

Back in January of 1987, about thirty years ago, before it opposed economic theory on principle, The New York Times wrote an editorial against the minimum wage.

In a short piece provocatively entitled: “The Right Minimum Wage: $0.00”, they said, among other things:

[…]It’s no wonder then that Edward Kennedy, the new chairman of the Senate Labor Committee, is being pressed by organized labor to battle for an increase.

No wonder, but still a mistake. Anyone working in America surely deserves a better living standard than can be managed on $3.35 an hour. But there’s a virtual consensus among economists that the minimum wage is an idea whose time has passed. Raising the minimum wage by a substantial amount would price working poor people out of the job market.[…]

The newspaper was hardly expressing the sort of fully libertarian view I would prefer — the editorial suggests wage subsidies and state sponsored job training as an alternative to minimum wage laws. However, it is still noteworthy that thirty years ago, the New York Times’ editors still possessed the fundamental understanding that raising the price of something lowers demand, and that labor isn’t an exception.

It is worth reading, if you can, if only to remember how far the terms of the debate have slipped over the decades. Today, the editorial board of the same newspaper strongly favors doubling the minimum wage, to $15 an hour, which, in inflation adjusted dollars, vastly exceeds any level it has had in the past. No serious consideration is given in the more recent editorials to the notion that doubling the price of low skill labor might result in unemployment. This is quite a change, and not one for the better.

Said the Donald to the Salmon(d), erstwhile First Minister of Scotland, in a letter about the plans for windfarms off the Aberdeenshire coast, we know now from the Trump letters, obtained under the UK’s Freedom of Information Act.

A series of colourfully-written letters sent by Donald Trump to then-Scottish first minister Alex Salmond has been published in full for the first time.

The letters formed part of an intense lobbying campaign against plans for an offshore wind project near Mr Trump’s Aberdeenshire golf resort.

Some examples of Mr Trump’s forthright style:

On 12 March 2012 he asked Mr Salmond: “Do you want to be known for centuries to come as ‘Mad Alex – the man who destroyed Scotland’?”

He added: “If you pursue this craziness Scotland will go broke and forever lose whatever chance you currently have of making Scotland independent.”

he sent a one-sentence missive to the then first minister asking why Swedish energy firm Vattenfall was being allowed to “ruin” the Scottish coastline, adding: “Let them ruin the coastline of Sweden first.”

On 9 February 2012, Mr Trump told Mr Salmond: “With the reckless installation of these monsters, you will single-handedly have done more damage to Scotland than virtually any event in Scottish history.

I note that the letters indicate an appreciation of pragmatism by Mr Trump.

In one letter Mr Trump said: “History has proven conclusively that the world’s greatest leaders have always been those who have been able to change their minds for the good.”

He also said he would be “your greatest cheerleader if you can change or modify your stance on at least the inappropriately placed turbines.”

In the other letter he told Mr Salmond: “Your idea of independence is ‘Gone With the Wind’.”

Well, I am slightly puzzled by Mr Trump’s writings, if only by the use of the future tense in the reference to a third-world wasteland. And he surely meant to say ‘sh*thole’, which in Scots English I’m told is spelt ‘Cumbernauld‘.

I have to say that I am looking forward even more to 12 noon on 20th January 2017.

“The perceived ills of Anglo-American shareholder capitalism shown up in the bursting of the 1990 stock market bubble are not therefore a sign of some decrease in corporate morality – though there have been some clearly illegal practices which are rightly being dealt with by the courts – but due to the perverse incentives created for managerial `rent seeking’ by the regulations limiting hostile takeovers, and the unintended effects of fiscal policy through the double taxation of dividends. With the double taxation of dividends due to end, if all the regulations preventing hostile takeovers can also be repealed, the unregulated market for corporate governance would again provide checks on predatory managements. Executive compensation will begin to fall, accountants will have less pressure to cook the books, and the Anglo-American corporation would pursue the innovation, efficiency, and profitability that has till now been its hallmark.”

– Deepak Lal, from Reviving the Invisible Hand, page 202. (The book was first published in 2006.)

Why you should feel cynical about government projects, part umpteen thousand.

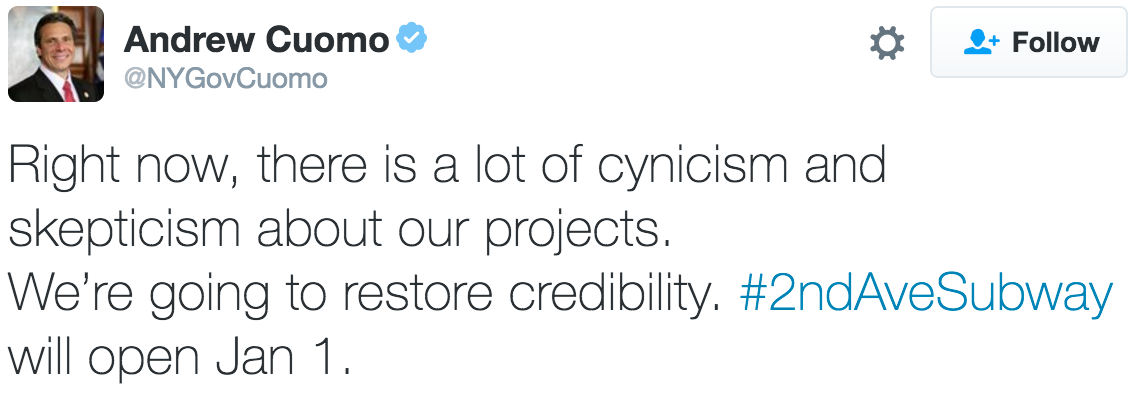

New York State’s Governor, Andrew Cuomo, proudly tweeted this today:

“Right now, there is a lot of cynicism and skepticism about our projects. We’re going to restore credibility. #2ndAveSubway will open Jan 1.”

He is referring, of course, to the imminent opening of a small segment of New York City’s long planned Second Avenue Subway.

Let us recall that planning for the Second Avenue subway began in 1919. That’s quite literally just short of a century ago.

Let us recall that construction began in 1972. That’s 44 years ago.

Let us recall that what is opening on January 1 is not even remotely a full Second Avenue subway. It is just three stations, at 96th, 86th and 72nd streets.

Let us recall that to get just these three stations, and just since the latest phase of work resumed in 2007, $4.5 billion, that’s billion-with-a-b, have been spent. That’s $1.5 billion per station. That’s $3.75 billion per mile for the 1.5 miles built to date, by far the world’s most expensive subway line.

The line has about 13 other stations to construct according to current maps, so completing this single subway line would cost about another $20 billion dollars. If we judge on the basis of the per-mile cost of Phase 1, the seven miles still remaining would cost another $26 billion. However, for projects like this, costs generally go up with time, not down, so the price may even be far worse.

No, Andrew Cuomo, this minor expansion of the transportation network, which is not yet remotely complete after a century of work, which has cost an astonishing sum and will cost vastly more if it is to ever be complete, has only reinforced cynicism, and has done nothing to restore credibility in government projects whatsoever.

The New York City subway system was mostly built privately, until the government forcibly took it over. Since the takeover, the system has stagnated, leaving a major metropolis with a public transportation network that has barely been improved since the First World War.

The system is grotesquely filthy, so noisy that scientific studies say routine users suffer hearing loss, is slow, is unreliable, is vastly overcrowded, often reeks of human excrement, is a sweat-box throughout the summer months, and yet, in spite of huge numbers of passengers, loses money year after year.

So what would I do to fix it? That should be obvious.

We’re living longer lives these days, we’re working for fewer decades of them and thus people are rationally saving for their expected golden years. Thus capital as a percentage of GDP rises – not to produce inheritances, but to produce incomes in retirement. And rises by potentially at least more than 100% of GDP.

We can’t see that this is a problem and we most certainly cannot see that this is an argument for greater taxation of capital. Quite the reverse in fact, people saving for their old age should be encouraged, not specifically taxed.

– Tim Worstall

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|