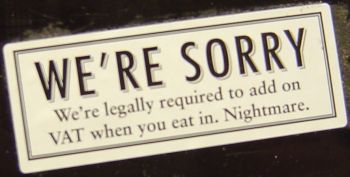

Way to go, Pret A Manger! The food is good, too.

|

|||||

|

We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people. Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house] Authors

Arts, Tech & CultureCivil LibertiesCommentary

EconomicsSamizdatistas |

The correct attitude towards taxationAugust 9th, 2005 |

16 comments to The correct attitude towards taxation |

Who Are We?The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling. We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe. CategoriesArchivesFeed This PageLink Icons |

|||

All content on this website (including text, photographs, audio files, and any other original works), unless otherwise noted, is licensed under a Creative Commons License. |

|||||

I like it.

How odd! I saw the same sticker in Pret a Manger yesterday and almost took a photo of it (the siren song of hot miso soup meant I skipped out without doing so). Quality.

Of course, one option is to buy a sandwich “to go”, and then sit down and eat in anyway. Of course, lying like that and then cheating the government of its 17.5% would be wrong, and obviously I don’t endorse this.

What do you mean: you don’t pay VAT if it is “to go”?

Alisa, that is correct. You pay VAT if you eat in.

That’s right, Alisa. If you eat it there and then it is a service, and VAT is charged at 17.5%; if you take it away it is food and the VAT rate is 0%. (Note VAT is still charged, just at a nil rate.)

It gets much much weirder than that. For example.

Ah yes, VAT and the chocolate biscuit. I well remember a VAT inspection during which the VATman was extraordinarily interested in our petty cash receipts for chocolate biscuits but quite unperturbed by the millions of pounds being spent in the UK and across Europe on advertising that was billed to us in numerous different currencies.

I seem to remember that when VAT was first charged on hot take-away food, like pies in an all-night garage, some people would serve their customers cold food, VAT-free, and point to the microwave that just happened to be next to the till. I think the Inland Revenue soon got stroppy about this ruse and slapped VAT on cold take-away food that the customer could microwave on the premises.

Surely some bureaucrat must define ‘hot’? Couldn’t some enterprising types avoid VAT by claiming to serve ‘cold coffee to go’?

Have they clamped down on that, ahem, practice, Ian? I’m surprised. I can’t think of anything else that explains the existence of Ginster’s pies.

Ian, Mary,

As far as I know those interpretative problems were removed when all takeaway food was zero-rated (I believe by John Major), the political pretext being that the poor eat takeaways, the rich visit resaurants.

Shame that we cannot get rid of VAT, but it is an EU tax and so the UK has no choice but to impose it. Some things may be 0 rated, but if they are ever moved at all it must be above the minimum level set by the EU. Not only is VAT overcomplicated it is also a fraud magnet, from the EU Referendum blog

chris writes:

“Shame that we cannot get rid of VAT, but it is an EU tax and so the UK has no choice but to impose it.”

VAT is many things – most of them too impolite to say on a public blog! One of the hidden horrors is the extent to which it inhibits the growth of small busineses.

Like over-complex and draconian employment laws, it encourages ‘off the books’ transactions and stops many self-employed people from expanding. They take one look at the rules they would have to abide by and decide not to bother.

Accountants and big businesses tend to like it, or claim they see no harm in it. The former because it earns them money, the latter because they don’t have to sit up on a Saturday night filling-in their VAT return when they’d rather be in bed, asleep.

Indeed the UK has no choice but to impose it, but the manner of imposition, the huge complexity, and fierce enforcement, are of HM Customs’ own stamp.

The only really stupid and disgusting part of our system that I’m not inclined to blame Whitehall for in detail is the Intrastat form.

John Howard based his first re-election campaign on one single issue – the introduction of a VAT-like tax (GST) in exchange for a reduction in income taxes.

He convinced a sceptical public and was re-elected.

Given that any tax is bad per se, id rather have consumption based taxes than income based taxes

pommygranate writes:

“Given that any tax is bad per se, id rather have consumption based taxes than income based taxes.”

We had one. It was called purchase tax. It was nice and simple.

In Canada the VAT is called GST, Goods and Service Tax. It’s based on the same idiocy as the UK VAT with even more stupidities. Salted peanuts are a snack, pay GST. Plain peanuts are a basic food pay NO GST. Buy 6 or more doughnuts , no GST it must be a basic food, buy 1-5 pay GST must be a snack.

Spend $5 for postage stamps for out of country mail, yes you guessed it right, no GST, but you must put the stamps on in the Post Office and mail them right there and then.

I say put VAT or GST or whatever you call it on everything and give the poor a refund cheque if you have to. Much simpler.